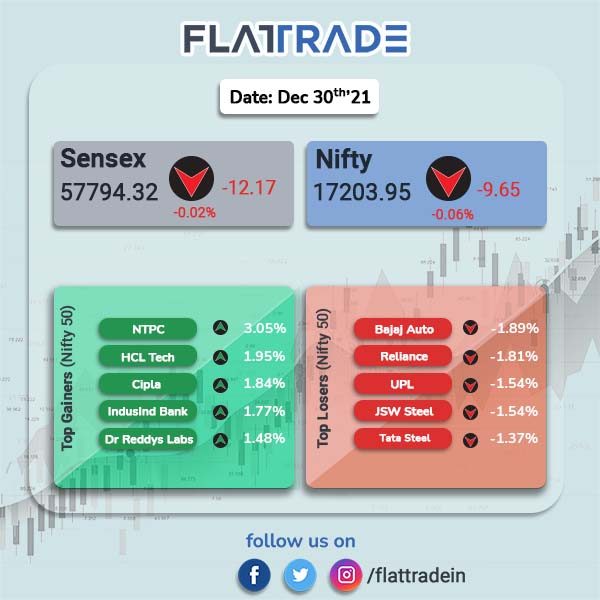

Domestic indices closed nearly flat as gains in IT and healthcare stocks were offset by losses in metal, energy and public-sector banks. The Sensex closed 0.02% lower at 57794.32 and Nifty slipped 0.06% to 17203.95.

Top losers were in Nifty sectoral indices were Metal [-1.17%], Energy [-1.14%], PSU Bank [-0.75%]. Top gainers were IT [1%] and Pharma [0.44%].

Indian rupee rose 33 paise to 74.41 against the US dollar.

Stock in News Today

RBL Bank: The lender wrote off Rs 300 crore loan within seven months of being sanctioned that led to an intervention by the central bank, according to Mint newspaper, citing two people directly aware of the matter. RBL Bank made the loan to a company as part of a consortium of lenders in 2018 and RBI has been seeking details about the bank’s loan portfolio for the past few months. Shares of the company closed 9.42% lower. Meanwhile, RBI approved the appointment of Rajeev Ahuja as interim MD & CEO.

HCL Technologies Ltd: The company’s wholly-owned step-down subsidiary, HCL America, has acquired the remaining 19.6% stake in HCL Technologies SEP Holdings. The cost of acquisition is $100.2 million. HCL Technologies SEP Holdings is the sole parent entity of Actian Corporation.

NTPC: The state-owned power giant’s arm NTPC Renewable Energy Ltd (NREL) will float a global engineering procurement and construction tender to set up a 3GW renewable energy project with a battery storage system worth around Rs 15,000 crore by February 2022, according to a senior official. It has also planned to bring strategic investors for NREL to bring its share of equity below 50 per cent before its listing on bourses in October 2022.

Kalpataru Power Transmission Ltd: The utility company has bagged new orders worth Rs 1,560 crore from India, Africa, CIS and South America in the power transmission business. The company’s international subsidiary also secured new power transmission projects in Europe.

Meanwhile, in a separate exchange filing, the company said it is scheduled to meet on Tuesday (January 4, 2022) to consider and approve the proposal for raising of funds by way of issuance of Non-Convertible Debentures on private placement basis.

Firstsource Solutions Ltd: The company announced that it has entered into an agreement to acquire American Recovery Services which is a legal collections network headquartered in Southern California. The acquisition is likely to enhance Firstsource’s leadership in consumer debt management services.

Delta Corp Ltd: Shares of the company fell over 4% after Goa government announced new restrictions to limit the spread of omicron strain of covid-19 infection. Delta owns and operates three offshore live casinos and one land based casino in Goa.

Deep Industries Ltd: Shares of company rose over 12% in intraday trade but pared some gains to close at 7.85% higher after the company received a letter of award for order worth Rs 44.4 crore from GSPC LNG Ltd. The order includes the hiring of gas compression services at GSPC LNG Terminal, Mundra, Gujarat for a period of five years.

Granules India Ltd: The drugmaker said that it has received an approval from the US health regulator for its generic Amphetamine mixed salts for the treatment of Attention Deficit Hyperactivity Disorder (ADHD) and narcolepsy. The company said that the product would be manufactured at Granules manufacturing facility in Chantilly, Virginia and is expected to be launched shortly.

Bajaj Finance Ltd: The company is joining hands with Cars24, a leading e-commerce platform for pre-owned vehicles, to venture into the used car financing business and facilitate a quick, frictionless and streamlined shopping experience.