Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.89% higher at 18,119, signalling that Dalal Street was headed for a positive start on Monday.

Asian shares rallied on Monday, helped by positive sentiments driven by hopes for less aggressive US rate hikes and China’s reopening of borders. The Nikkei 225 index rose 0.59%, the Topix was up 0.37%. China’s CSI 300 index advanced 0.84% and the Hang Seng jumped 1.49%.

Indian rupee fell 16 paise 82.72 against the US dollar on Friday.

Corporate India will kick-start its earnings season with Tata Consultancy Services reporting their quarterly results on Monday after market hours.

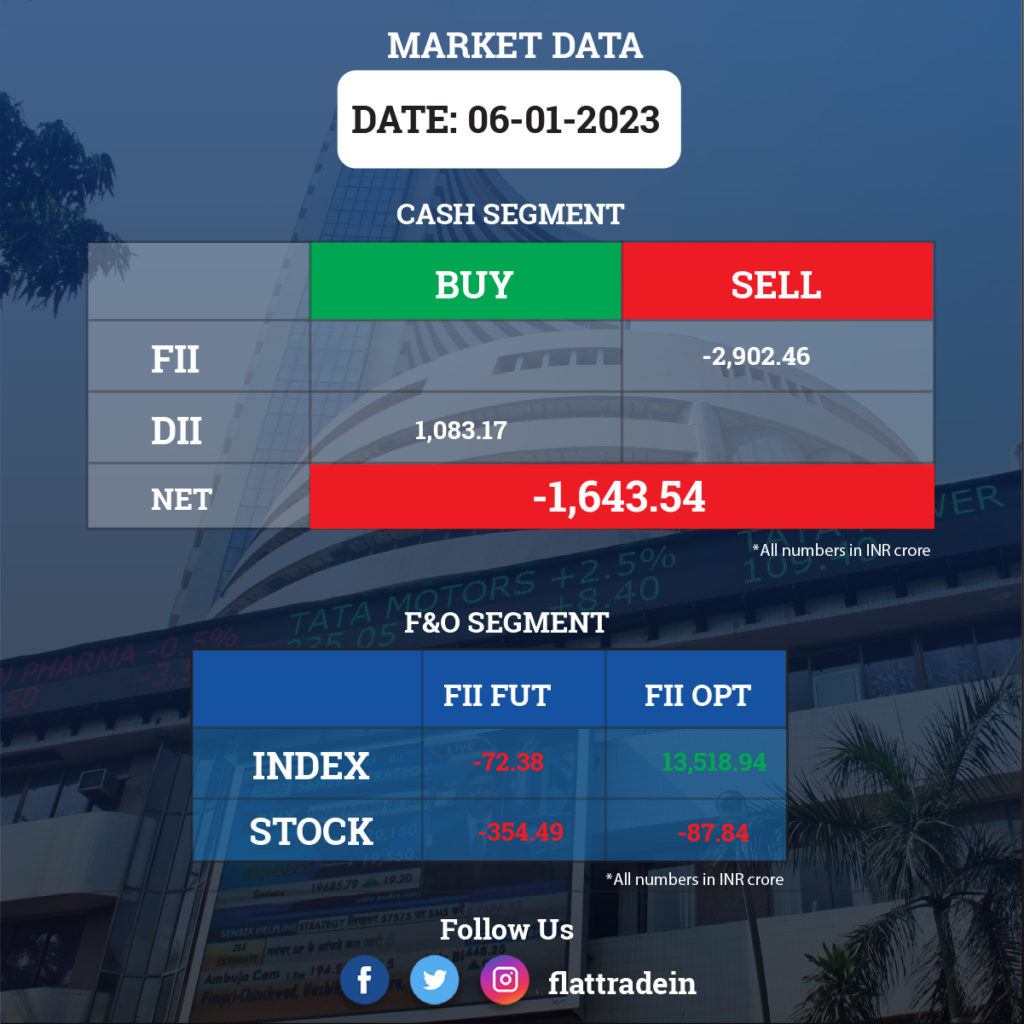

FII/DII Trading Data

Stocks in News Today

Titan Company: Total sales climbed by around 12% YoY during the third quarter of FY23. The company added a total of 111 new retail outlets in the third quarter of FY23 and jewellery business grew 11%, while watches and wearables segment grew 14%. Eyecare vertical registered 10% growth and fashion, fragrances and apparel businesses grew 75%. Its subsidiaries TEAL and CaratLane grew 58% and 50%, respectively.

Tata Steel: India business production was up 4.2% at 5 million tonne and delivery volumes down 3.6% at 4.73 million tonne on a quarterly basis. Europe business production fell 6.25% at 2.25 million tonne and Europe business delivery volumes rose 4.8% to 1.96 million tonne QoQ.

HCL Technologies: The ODP Corporation has selected HCL Technologies as its primary IT partner. HCL will provide end-to-end IT operations and enterprise-wide digital transformation to support ODP’s business strategy in its Office Depot, ODP Business Solutions and Veyer business units.

Aditya Birla Fashion & Retail: The company proposes to raise funds by issuing 5,000 listed, unsecured, rated, redeemable non-convertible debentures of face value of Rs 10 lakh each issued at par aggregating to Rs 500 crore on private placement basis, on or after January 13.

Asian Paints: The board approved setting up a new water-based paint manufacturing facility with a capacity of 4 lakhs kilolitre per annum at an approximate investment of Rs 2,000 crore, to be commissioned within three years after acquisition of land.

IDBI Bank: The government received several expressions of interest (EoIs) for the strategic sale of stake in the lender held by the centre and state-owned Life Insurance Corporation of India (LIC). A consortium, two foreign banks and a private equity firm are said to be among those that have submitted the paperwork.

Bandhan Bank: The lender’s loans and advances grew 14% to Rs 1.01 lakh crore. CASA deposits declined 3% to Rs 37,194 crore, while CASA ratio stood at 36.4% as against 45.6%. Total deposits grew 21% to to Rs 1.02 lakh crore.

Kalyan Jewellers: The jewellery retailer recorded sequential consolidated revenue growth of approximately 13%. Its Middle East business grew 24% growth sequentially on the back of improved customer sentiment.

Vodafone Idea: The telecom operator has dialled a host of lenders — State Bank of India, Punjab National Bank, HDFC Bank and IDFC First, among others — to line up loans aggregating upward of Rs 7,000 crore. The bulk of the loans will be used to clear a portion of its dues to Indus Towers, three people aware of the matter said.

Gland Pharma: The company’s subsidiary, Gland Pharma International PTE, has entered into a share purchase agreement with FPCI Sino French Midcap Fund and others to acquire 100% stake in Cenexi and the Cenexi Holding Entities.

JK Cement: The company’s wholly owned subsidiary JK Paints & Coatings invested Rs 153 crore and completed the acquisition of 60% equity shares of Acro Paints.

National Fertilizers: The company clocked 27 percent growth in total fertilizer sale during April-December 2022 as compared to corresponding period last year. The company reported total fertilizer sales of 49.71 lakh MT compared to 39.25 lakh MT in corresponding period last year.

Mahindra and Mahindra Financial Services: CRISIL Ratings has upgraded its rating on the long-term bank facilities, subordinated debt and NCDs of the company to ‘CRISIL AAA/Stable’ from ‘CRISIL AA+/Stable’.

Keystone Realtors: The company has been selected to redevelop the plot and premises of Basant Park Co-operative Housing Society Limited on a plot spanning 16,896.40 square meters in Chembur, Mumbai. This redevelopment will lead to a sale potential of approximately 2.75 lakh square feet of RERA carpet area.

Jindal Steel and Power (JSPL): The company will invest up to Rs 1,500 crore to make recently-acquired Monnet Power operational, Managing Director Bimlendra Jha said. The investment will be made over the period of the next 12 to 18 months, he said.

Electronics Mart India: The lock-in period for shares allotted to anchor investors will partially end this week. The lock-in ends for only half of these shares; the other half will remain under freeze for 60 days.