Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.25% higher at 18,122, signalling that Dalal Street was headed for a positive start on Wednesday.

Most Asian shares were trading higer on Wednesday. The Nikkei 225 index was up 0.62%, the Topix index rose 0.37%. The Hang Seng index was 0.47% higher, while the CSI 300 index fell 0.12%.

Indian rupee depreciated 15 paise to 81.77 against the US dollar on Tuesday.

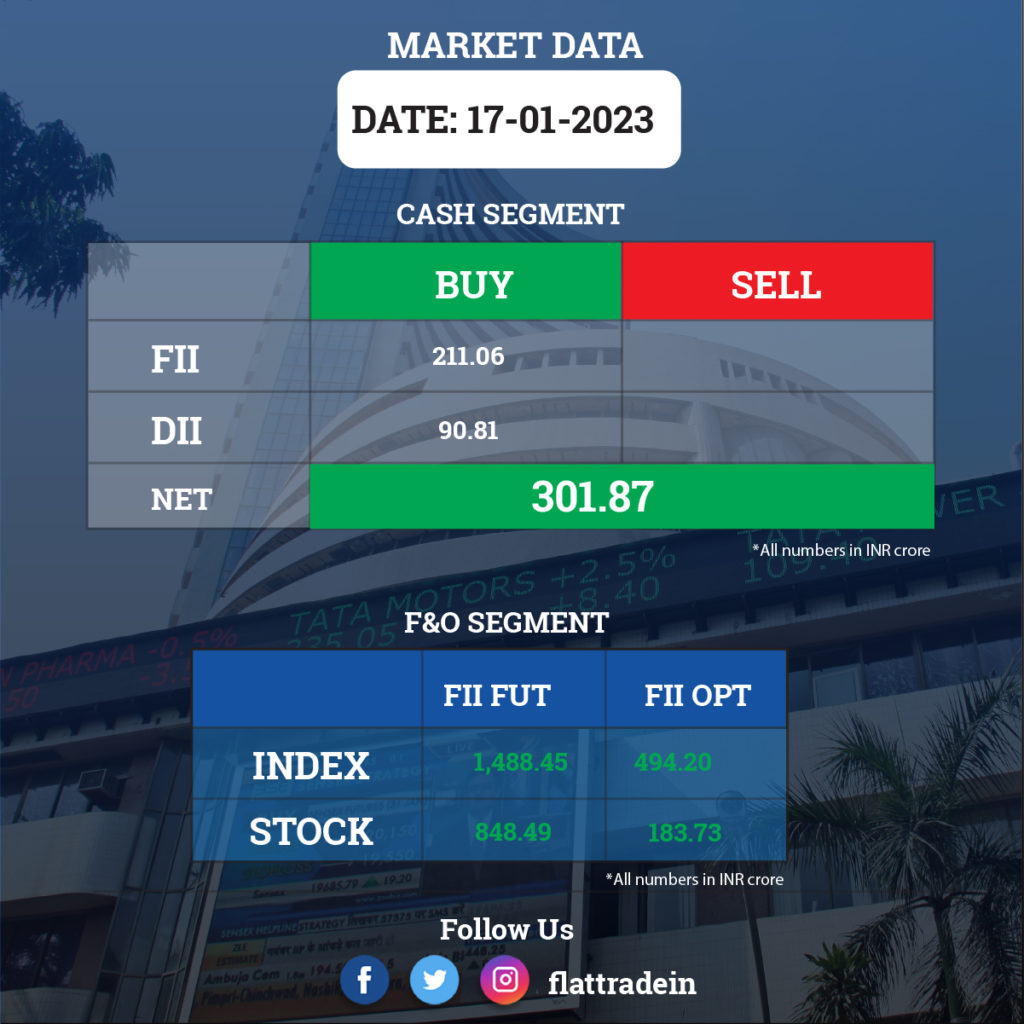

FII/DII Trading Data

Upcoming Results

IndusInd Bank, Central Bank of India, Persistent Systems, PSP Projects, Rallis India, Shemaroo Entertainment, Oracle Financial Services Software, Aashka Hospitals, Alok Industries, Amal, Anubhav Infrastructure, Aurum PropTech, CCL Products (India), Cosyn, Elegant Floriculture and Agrotech (India), Goa Carbon, Orosil Smiths India, Stylam Industries, Supreme Holdings and Hospitality (India), Surya Roshni, Toyam Sports, Umiya Tubes, Vinyl Chemicals (India), Vivanta Industries, Welspun Investments and Commercials, and Wendt (India) are expected to report their Q3FY23 results today.

Stocks in News Today

ICICI Lombard General Insurance Company: The insurance company has reported a 11% year-on-year growth in profit at Rs 352.53 crore for quarter ended December 2022. The company’s premium earned stood at Rs 3,792 crore for the quarter grew by 14.5% YoY and total income grew by 13.2% to Rs 4,362 crore in Q3FY23.

ICICI Prudential Life Insurance Co: The financial services company reported a 29% YoY fall in net profit for the quarter ended December 2022 to Rs 220.63 crore. The net premium income for the quarter rose 4.3% on year to Rs 9,465 crore. The net income from investments surged multi-fold year-on-year to Rs 7,722 crore.

Adani Enterprises: The company has signed an agreement with Ashok Leyland Ltd and Canada-based Ballard Power to jointly develop hydrogen fuel cell electric trucks for mining, logistics and transportation sectors. The three companies are working on a pilot project and they expect to launch the truck in India in 2023.

Adani Transmission: The company reported 4.2% YoY rise in electricity units sold in the December 2022 quarter. The company had sold 2.17 billion units in the reproted period compared with 2.08 billion in the same period a year ago, and 2.23 million in the preceding quarter. The company has bought the entire stake in special purpose vehicle WRSR Power Transmission Ltd, held by REC Power Development and Consultancy Ltd.

ITC: The company on Tuesday signed an agreement to acquire direct-to-consumer start-up Sproutlife Foods that owns ‘Yoga Bar’ with the aim to strengthen its presence in the fast-growing nutrition health foods space. It will buyout the company in tranches over a period of 3-4 years. It will buy a 47.5% stake by March 2025.

Reliance Jio Infocomm: The telecom arm of Reliance Industries has launched 5G wireless services in 16 cities across seven states in the country. With this, the total count of cities having Reliance Jio’s 5G services has touched 134.

Bank of India: The lender reported 12% rise in its profit at Rs 1,151 crore for the third quarter ended December 2022. The bank had posted a net profit of Rs 1,027 crore in the same quarter a year ago. Total income increased to Rs 14,159.60 crore in the December 2022 quarter from Rs 11,211.14 crore in the year-ago period. Net interest income rose by 64% to Rs 5,596 crore against Rs 3,408 crore in Q3FY22, it said. The lender’s net NPAs eased to 1.61 per cent as against 2.66 per cent in the same period a year ago.

Tata Metaliks: The company has reported a profit of Rs 9.48 crore for the quarter ended December 2022, a drop of 74% YoY, due to weak operating performance. Higher input cost and finance cost weighed on the company’s net profit. However, revenue from operations grew by 14.5% YoY to Rs 790.23 crore for the quarter.

Dishman Carbogen Amcis: The company has received its board approval for allotment of market-linked non-convertible debentures worth Rs 100 crore on a private placement basis in one or more tranche(s). These NCDs will be listed on Wholesale Debt Market Segment of BSE.

Glenmark Pharmaceuticals: The drugmaker entered into an agreement with Eris Oaknet Healthcare, a wholly-owned subsidiary of Eris Lifesciences, to divest the tail brands from its dermatology segment, for India and Nepal territories. The transaction cost is Rs 340.48 crore. The divested tail brands include Onabet, Halovate, Sorvate, Luligee, Demelan, Aceret, Dosetil, Revize, and Powercort, and their sub-brands. This divestment is in line with Glenmark’s strategy of focusing on its leading brands in the dermatology segment.

Sundram Fasteners: The company has bagged a contract worth $250 million from a leading global automobile manufacturer to supply sub-assemblies for its electric vehicle platform.

Rail Vikas Nigam: The company’s consortium with Siemens India has emerged the lowest bidder for two metro projects in Gujarat. The projects include Rs 673 crore Surat Metro Rail Project Phase-1 and Rs 380 crore Ahmedabad Metro Rail Project Phase-II.

Tata Investment Corp: The company’s net profit for the December quarter declined 59.5% YoY to Rs 14.8 crore, and revenue dropped 53% to Rs 24.8 crore.

Delta Corp: The company’s consolidated net profit for the December quarter rose 20.5% YoY to Rs 84.8 crore, while revenue increased by nearly 11% to Rs 273.4 crore.

EID Parry (India): The new 120 KLPD distillery of the company at sugar unit, Sankili in Andhra Pradesh, has commenced commercial operations. The said sugar unit has the flexibility to operate with multiple feedstocks molasses/cane juice & syrup/grain based.

Landmark Cars: The company’s consolidated revenue rose 41% YoY in the nine months ended December to Rs 3,380 crore. The luxury automotive retailer’s car sales rose 44% YoY, and revenue from after-sales service, spare parts and others increased 30%.

Hathway Cable and Datacom: The company reported a 15.3% YoY decline in consolidated net profit for the quarter ended December 2022 to Rs 28.74 crore. The company’s consolidated revenue rose by 5% YoY to Rs 478.45 crore in the reported quarter.

Samvardhana Motherson International: Japan-based Sojitz Corporation on Tuesday sold 2.35% stake in the company through a bulk deal for Rs 770 crore. Sojitz Corp sold over 10.6 crore shares at Rs 73.11 a share.

Shalby: The multispeciality hospitals operator has registered 17% year-on-year decline in consolidated profit at Rs 15.3 crore for quarter ended December 2022, due to tepid sales and weak operating performance. Revenue from operations grew by 0.3% to Rs 202.5 crore in the reported quarter compared to corresponding period last fiscal.