Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.53% higher at 18,141, signalling that Dalal Street was headed for a positive start on Monday.

Japanese stocks were trading higher, tracking Wall Street overnight, after Federal Reserve officials hinted at slower interest rate hikes. The Nikkei 225 index rose 1.13% and the Topix gained 0.91%.

Indian rupee gained 24 paise to 81.12 against the US dollar on Friday.

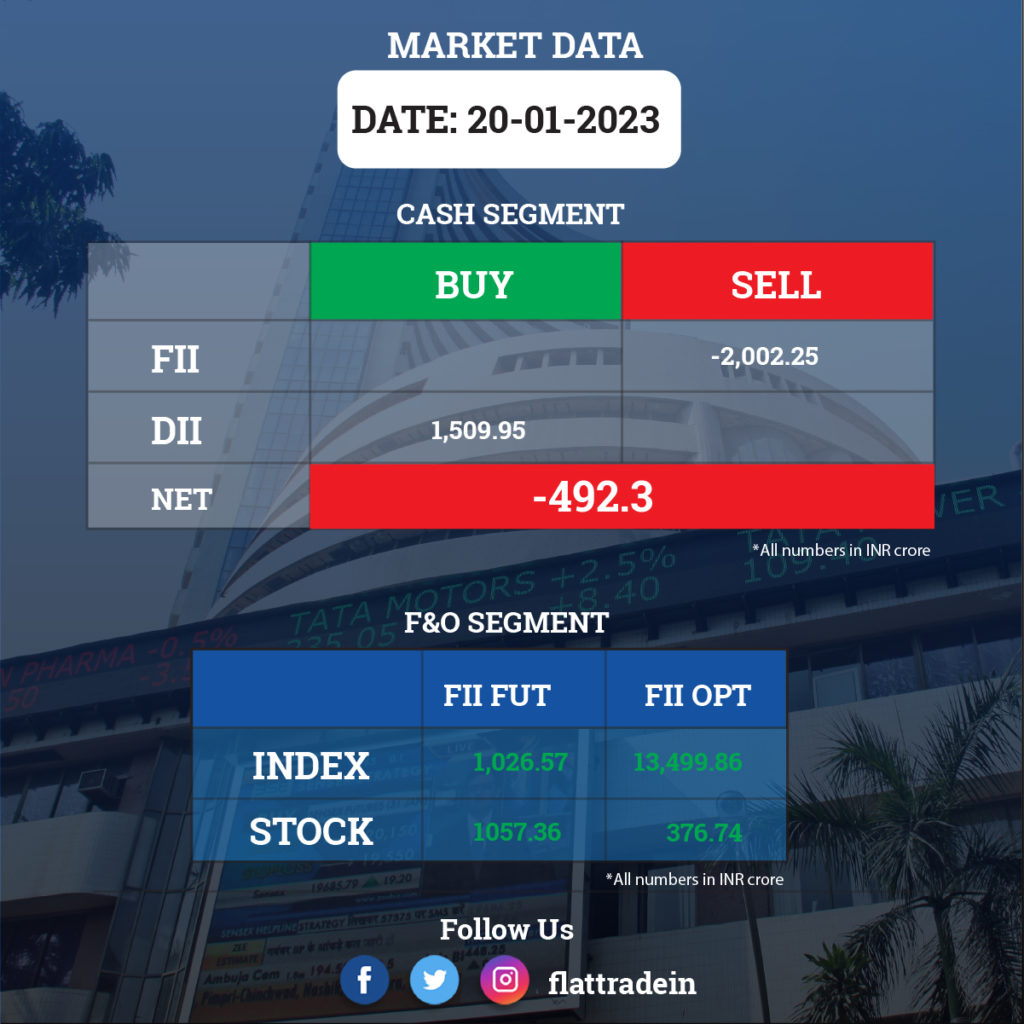

FII/DII Trading Data

Upcoming Results

Axis Bank, IDBI Bank, Canara Bank, Container Corporation of India, Amber Enterprises India, Craftsman Automation, Butterfly Gandhimathi Appliances, Gland Pharma, Gravita India, HFCL, Jammu & Kashmir Bank, Jindal Stainless, Poonawalla Fincorp, Route Mobile, Shoppers Stop, Syngene International, Tata Communications, Tamilnad Mercantile Bank, and Zensar Technologies will be in focus ahead of quarterly earnings on January 23.

Stocks in News Today

Reliance Industries (RIL): The conglomerate’s consolidated net profit of Rs 15,792 crore in October-December 2022 compared with Rs 18,549 crore in the same period a year back, according to company’s stock exchange filing. Gross revenue at Rs 2.4 lakh crore increased by 14.8% YoY, supported by continuing growth momentum in consumer businesses. The company’s EBITDA stood at Rs 38,460 crore, was up 13.5% year-on-year led by consumer businesses and higher oil and gas prices aiding the upstream segment.

Its telecom arm Reliance Jio reported a 28.6% jump in net profit to Rs 4,881 crore on customer base swelling to 43.3 crore and a 17.5% increase in per-user earnings. Retail business net profit was up 6.2% to Rs 2,400 crore on the addition of 789 more stores, growth across consumption baskets, and rising contribution from digital channels led to a rise in retail segment profits. The firm plans to raise Rs 20,000 crore more to fund expansion across the business – from building Giga factories for a new energy ecosystem to 5G telecom service rollout and retail expansion.

ICICI Bank: The private sector lender recorded a 34.2% year-on-year increase in standalone profit at Rs 8,312 crore for the quarter ended December FY23. The rise was attributed to strong NII and and improvement in asset quality. Net interest income surged 34.6% YoY to Rs 16,465 crore in the reported period with net interest margin expanding 69 bps YoY to 4.65% for the quarter. The bank’s total capital adequacy ratio in Q3 was 18.33%

Kotak Mahindra Bank: The private sector lender reported a 31% year-on-year growth in standalone profit at Rs 2,792 crore for the quarter ended December 31, 2022 despite higher provisions. The lender posted healthy operating profit, other income and NII growth, along with an improvement in asset quality. Net interest income for the quarter jumped 30.4% to Rs 5,653 crore, with 85 bps YoY expansion in net interest margin at 5.47%. Deposits for the quarter grew by 13% and advances increased by 23% from the year-ago period.

UltraTech Cement: The Aditya Birla Group-owned cement company reported a 38% year-on-year decline in consolidated profit at Rs 1,058.2 crore for the December quarter, hit by weak operating margin. It reported an increase in raw material cost, power & fuel cost and freight & forwarding expenses YoY. Consolidated revenue from operations increased 19.5% to Rs 15,521 crore for the quarter YoY.

IDFC First Bank: The bank clocked a 115% year-on-year growth in standalone profit at Rs 604.6 crore for the December FY23 quarter despite higher provisions, supported by strong other income, operating profit and NII and asset quality improvement. Net interest income at Rs 3,285.3 crore grew 27.3% compared to the year-ago quarter.

Yes Bank: The private sector lender saw an 80.7% year-on-year decline in standalone profit at Rs 51.5 crore for the quarter impacted by ageing related provisions but supported by higher other income and operating profit with improvement in asset quality. Net interest income grew 11.7% to Rs 1,970.6 crore for the quarter YoY, with net interest margin rising 10 bps YoY (down 10 bps QoQ) to 2.5%. Advances for the quarter grew by 10% and deposits growth stood at 16% compared to the corresponding period of the last fiscal.

RBL Bank: The bank reported a 34% year-on-year increase in profit at Rs 209 crore for the December quarter on fall in provisions with an improvement in asset quality. Net interest income at Rs 1,148 crore rose 13.6% from the year-ago period, with the net interest margin expanding 40 bps YoY to 4.74%. Advances for the quarter at Rs 66,684 crore were up 15% and deposits grew by 11% with CASA deposits rising 18%.

Bandhan Bank: The lender’s profit declined 66% year-on-year to Rs 290.6 crore in the December quarter, dented by higher provisions and lower growth in net interest income. Net interest income fell 2% YoY to Rs 2,080.4 crore, with 130 bps drop in net interest margin at 6.5%. The loan book grew by 11.1% and deposits rose by 21% YoY.

LTIMindtree: The IT services company recorded a 16% sequential fall in profit at Rs 1,001 crore for the December quarter, with EBITDA at Rs 1,374.8 crore declining 16% QoQ and margin dropping nearly 4 percentage points QoQ to 15.95%. Revenue grew by 4.8% sequentially to Rs 8,620 crore, with dollar revenue growth at 2.4% and constant currency revenue growth at 1.9% for the quarter.

SBI Life Ltd: The insurance company has reported a net profit of Rs 304 crore for the three months ended December 2022, which is down about 16% from Rs 364 reported in the same period of last year. Net premium income during the quarter stood at Rs 19,170 crore, up about 6% year-on-year. The company had posted a net premium income of Rs 18,025 crore in the last year period. Assets under management (AuM) during the quarter grew by 17% to 2.99 trillion as on December 2022, with debt-equity mix of 71:29. Over 95% of the debt investments are in AAA and Sovereign instruments.

JSW Energy: The power company has reported a 42% year-on-year decline in consolidated profit at Rs 187 crore for quarter ended December FY23 impacted by higher fuel cost. Consolidated revenue from operations grew by 18% YoY to Rs 2,248 crore for the quarter due to higher realisation. Overall net generation was at 4.3 billion units, a decline pf 5% YoY due to lower merchant market sales in the quarter.

JSW Steel: The steel company has reported a 89.5% year-on-year decline in profit at Rs 474 crore for quarter ended December FY23, impacted by higher raw material cost and power & fuel expenses. Revenue grew by 2.8% YoY to Rs 39,134 crore for the quarter.

Tanla Platforms: The cloud communications company recorded a 26.3% year-on-year decline in profit at Rs 116.5 crore in the December quarter, dented by lower top line and weak operating performance. Revenue at Rs 869.6 crore fell by 1.7% and EBITDA tanked 25% to Rs 151.4 crore with the margin down 550 bps from the year-ago period.

Indian Energy Exchange: The company has registered a 4% year-on-year fall in consolidated profit at Rs 77.2 crore for quarter ended December FY23, due to double-digit decline in revenue and operating income. Its consolidated revenue from operations stood at Rs 100.3 crore, a fall of 14.7% compared to year-ago period.

Petronet LNG: The comapny has recorded 58.6% quarter-on-quarter growth in profit at Rs 1,180.5 crore for quarter ended December FY23 on strong operating performance, beating analysts’ estimates. Revenue from operations fell by 1.3% QoQ to Rs 15,776 crore, but EBITDA grew by 43% sequentially to Rs 1,675 crore for the quarter.

Saregama India: The company has registered a 20% year-on-year growth in consolidated profit at Rs 52.3 crore for quarter ended December FY23, led by other income and top line. Consolidated revenue from operations grew by 23.4% to Rs 185.5 crore for the quarter. EBITDA was at Rs 62.6 crore for the quarter which grew by 15% over a year-ago period.

Shakti Pumps: The pump manufacturer has reported a 24% year-on-year decline in profit at Rs 11.2 crore for December FY23 quarter, impacted by weak operating performance and lower other income. Revenue from operations grew by 17% YoY to Rs 314.2 crore for the quarter.