Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.53% lower at 17,835, signalling a negative start for Dalal Street.

Stocks in the Asia traded mixed as investors gauged the future pace of central bank interest rate hikes. The Nikkei 225 index rose 0.54% and the Topix advanced 0.36%. The Hang Seng fell 0.97% and the CSI 300 index slumped 0.33%.

Indian rupee was nearly flat as it fell 2 paise to 82.51 against the US dollar on Thursday.

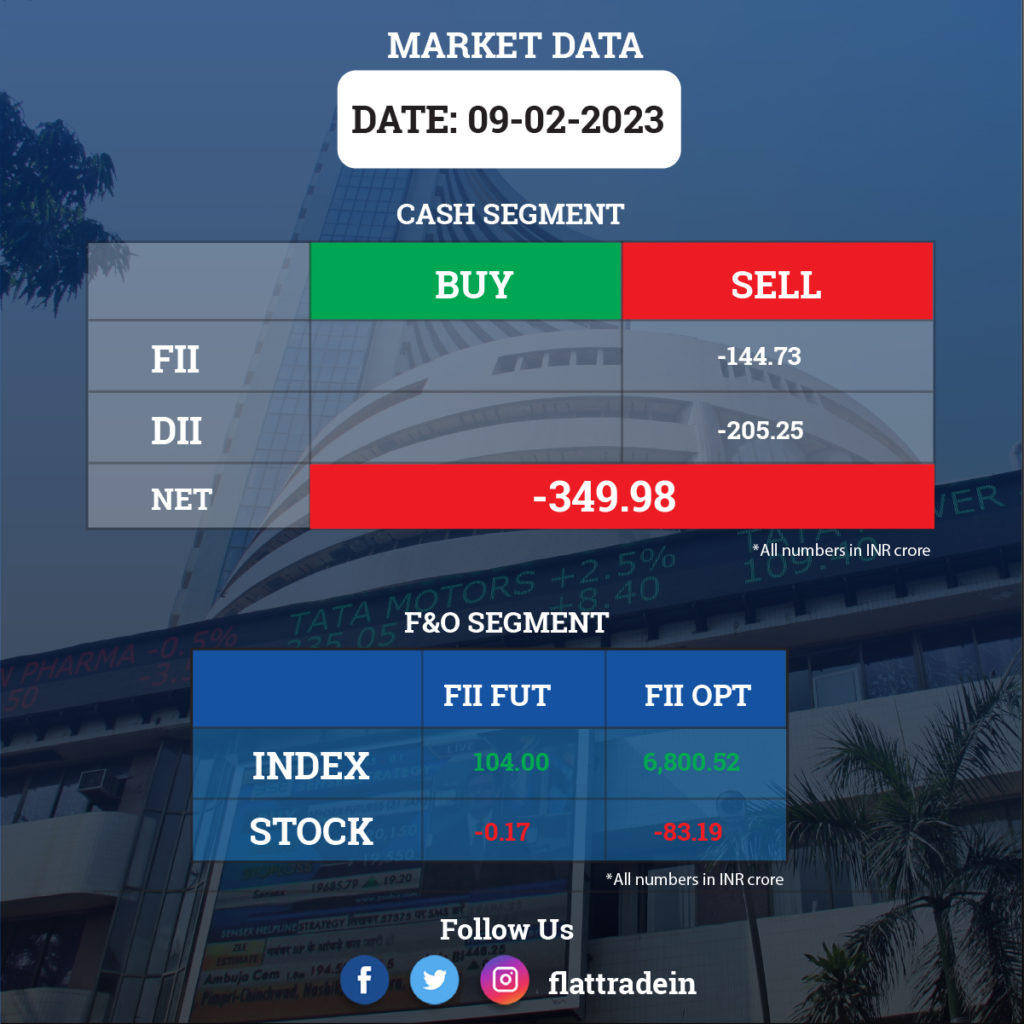

FII/DII Trading Data

Upcoming Results

Mahindra and Mahindra (M&M), BEML, Info Edge India, Oil India, PB Fintech, ABB India, Delhivery, Abbott India, Alkem Laboratories, Ashoka Buildcon, Astrazeneca Pharma, BHEL, Dilip Buildcon, EIH, Glenmark Pharmaceuticals, JK Lakshmi Cement, KFin Technologies, Lemon Tree Hotels, Metropolis Healthcare, and NALCO wil report their quarterly results today.

Stocks in News Today

Life Insurance Corporation of India (LIC): The life insurer has reported a standalone profit after tax (PAT) of Rs 8,334.2 crore for the quarter ended December FY23, rising multi-fold times compared to a PAT of Rs 234.91 crore in the same quarter last year on the back of strong growth. Net premium income for the quarter stood at Rs 1.11 lakh crore increasing by 14.5% over a year-ago period and new business premium climbed 11% YoY to Rs 9,725 crore for the quarter. Assets under management (AUM) increased to Rs 44.34 trillion as on December 31, 2022, compared with Rs 40.12 trillion in the year-ago period.

Hindustan Petroleum Corporation (HPCL): The oil marketing company said its standalone net profit in Q3FY23 stood at Rs 172.4 crore against a loss of Rs 2,172 crore in the previous quarter, with better operating performance. Standalone revenue grew by 1% to Rs 1.09 lakh crore compared to the previous year. Its EBITDA was at Rs 1,671.7 crore for the quarter ended December FY23, against a loss of Rs 1,497.9 crore in the preceding quarter of FY23.

Zomato: The food delivery company has posted a consolidated net loss of Rs 346.6 crore for the December FY23 quarter, widening from a net loss of Rs 63.2 crore in the year-ago period due to higher expenses. Consolidated revenue rose 75.2% YoY to Rs 1,948.2 crore for the quarter, while at the operating level, the EBITDA loss of Rs 366.2 crore for the quarter narrowed compared to the EBITDA loss of Rs 488.8 crore in the corresponding period last fiscal.

Adani Total Gas: The company reported a 13% increase in net profit of Rs 148 crore in October-December 2022 quarter as against Rs 132 crore net profit in the same period a year back. Revenue from operations rose to Rs 1,186 crore in the reported quarter as against Rs 932 crore in the yar-ago period. Further, CNG sales climbed 15% to 116 million standard cubic metres, while piped natural gas (PNG) sales dropped 23% to 70 mmscm.

Mahindra & Mahindra (M&M): The automaker has signed an MoU with Telangana Government to expand its existing manufacturing facilities at Zaheerabad plant. The company will invest approximately Rs 1,000 cr over 8 years for the proposed expansion. Expansion will include three- and four-wheeler EV making.

Varun Beverages: The company’s promoters are planning to sell Rs 850 crore worth of shares via block deal today. They will likely offer up to 5-7% discount in share price on the block deal.

ITC: The company’s subsidiary ITC Infotech India has incorporated a wholly-owned subsidiary in France under the name of ITC Infotech France SAS. Consequently, ITC France has become a step-down wholly owned subsidiary of ITC.

Aurobindo Pharma: The pharma company has recorded an 18.7% year-on-year fall in consolidated profit at Rs 491 crore for the quarter ended December FY23, dented by weak operating margin performance. Consolidated revenue for the quarter at Rs 6,407 crore increased by 6.7% over a year-ago period with the US formulations business growing 9.3 percent, the Europe formulation segment showing a 0.4% increase and growth markets business rising 25.7% YoY. On the operating front, EBITDA fell 6% YoY to Rs 954.4 crore for the quarter with the margin declining 204 bps YoY to 14.89% due to higher spending on R&D.

MTAR Technologies: The precision engineering solutions company has recorded a standalone profit of Rs 31.4 crore for the quarter ended December FY23, growing 136.2% over a year-ago period. Revenue from operations more than doubled to Rs 160.2 crore in Q3FY23, against Rs 78.1 crore in the same period last year. EBITDA at Rs 45 crore for the quarter grew by 97.4% over the corresponding period last fiscal, but the margin fell by 110 bps YoY to 28.09% on a significant increase in input cost.

United Breweries: The company posted a net loss of Rs 2.1 crore for the December FY23 quarter, against a net profit of Rs 90.56 crore in the same period last year, impacted by weak operating performance and exceptional loss of Rs 33.12 crore. Revenue for the quarter at Rs 1,611 crore grew by 1.9% over a year-ago period. On the operating front, EBITDA fell 54% YoY to Rs 76.65 crore and the margin plunged 623 bps to 4.75% in the same period. Numbers missed analysts’ expectations.

Voltas: The air conditioning and engineering services provider posted a consolidated loss of Rs 110.38 crore for the quarter ended December FY23, against a profit of Rs 96 crore in the same period last year, as there was an exceptional loss of Rs 137.39 crore related to provision arising out of cancellation of contract and encashment of bank guarantee. Revenue for the quarter grew by 12% YoY to Rs 2,005.61 crore with growth in unitary cooling products as well as electro-mechanical projects & services segments. EBITDA at Rs 76.37 crore for the quarter declined by 51% YoY with a margin contraction of 490 bps YoY.

Pfizer: The pharma company has reported a 4.7% year-on-year growth in profit at Rs 150.66 crore for three-month period ended December FY23, driven by good operating performance, but revenue from operations fell 8% YoY to Rs 621.75 crore for the quarter. The company appointed Meenakshi Nevatia as the Managing Director and Additional Director for five years.

Greaves Cotton: The company will acquire 100% equity stake through multiple tranches in motion‐control systems player, Excel Controlinkage.

Piramal Pharma: The company reported a net loss of Rs 90 crore on a consolidated basis for the third quarter ended December 2022. The company had reported a net profit of Rs 163 crore in the year-ago quarter. Revenue from operations stood at Rs 1,716 crore for the third quarter, while the same was at Rs 1,539 crore in the year-ago period. The company said the third quarter results were not comparable to the same period last year as the NCLT in August 12, 2022 approved the composite scheme of demerger of the pharma business from Piramal Enterprises Ltd (PEL) into Piramal Pharma Ltd.

Indian Overseas Bank (IOB): The lender reported a 23% rise in net profit for the third quarter of FY23 at Rs 555 crore, compared to Rs 451 crore the same quarter last year. The state-owned bank’s total income increased by 13% to Rs 6008.07 crore in 2022-23, from Rs 5318.8 crore in Q3FY22. The bank’s operating profit for the quarter ended in December 2022 was Rs 1,540 crore compared to Rs 1,461 crore during the same period last fiscal. Net NPA ratio during the eported quarter dropped to 2.43% as against 2.63% in the year-a-go period.