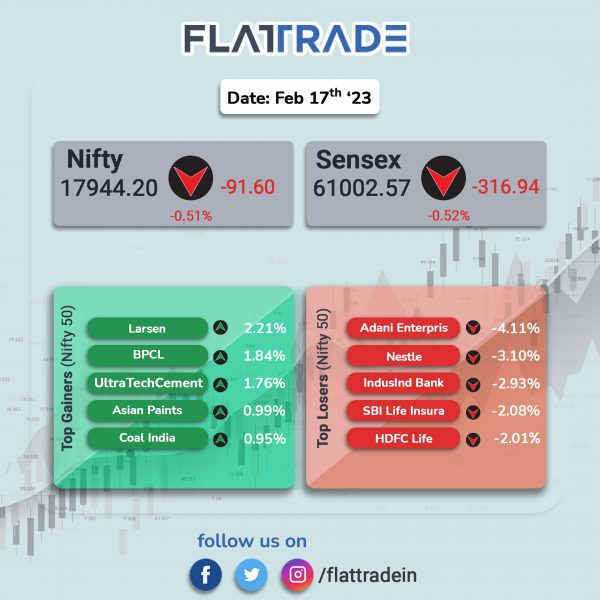

Indian stock indices ended lower snapping their three-day winning streak as investors were concerned over higher interest rates. IT, banking and realty indices were top losers among Nifty sectoral indices. The Sensex dropped 0.52% and the Nifty 50 index was down 0.51%.

Broader markets mirrored headline indices. The Nifty Midcap 100 index fell 0.79% and the BSE Smallcap index was down 0.24%.

Top losers were Realty [-1.78%], PSU Bank [-1.55%], Private Bank [-1.31%], IT [-1.21%], and Pharma [-1.18%]. Top gainers were Energy [0.19%] and Oil & Gas [0.15%].

Indian rupee fell 11 paise to 82.83 against the US dollar on Friday.

Stock in News Today

Bharat Electronics (BEL): The state-owned aerospace and defence electronics company and Israel Aerospace Industries (IAI), Israel’s leading aerospace and defence company, have concluded the MoA to form a joint venture subject to requisite statutory approvals and processes. The JV aims at a single point of contact for extending long-term product support services for India’s Defence Forces and providing life cycle support for MRSAM air-defence systems in the country. The new venture will have its headquarters in New Delhi and provide the required technical and maintenance support to the Armed Forces.

In other news, BEL has signed an MoU with the Indian Institute of Science (IISc), Bengaluru, to work together in Artificial Intelligence (AI), Machine Learning (ML) and other emerging technologies.

Separately, BEL has signed an MoU with Globals ITES for co-operation in technology development, co-creation and co-innovation, joint marketing and sales, in the fields of cyber warfare and cyber defence systems.

Godrej Properties: The company announced that it has acquired Raj Kapoor’s Bungalow in Chembur to develop a premium residential project. The site is located at Deonar Farm Road, Chembur, Mumbai, adjacent to Tata Institute of Social Sciences (TISS) and is considered to be one of the most premium residential neighbourhoods of Chembur.

GAIL (India): The gas distributor is looking to buy an equity stake of up to 26% in a liquefied natural gas (LNG) liquefaction plant or project in the United States, Reuters reported citing a document issued by the company. It did not say how much the Indian gas distributor had earmarked for any possible deal. In addition, GAIL, directly or through any of its affiliates, is interested to source 1 million tonnes per annum LNG from the LNG liquefaction plant or project on a free-on-board basis for a period of 15 years on mutually acceptable terms and conditions, the company said.

UPL: The company announced the completion of investment of Rs 1,580 crore ($200 Mn) by ADIA,TPG and Brookfield for 9.09% stake in UPL Sustainable Agri Solutions (UPL SAS). The investment will be utilised towards debt reduction target of $500 million by the end of March 2023.

PVR: The theatre operator announced the opening of eight screen multiplex at Phoenix Citadel Mall in Indore, Madhya Pradesh. With this launch, PVR has 1,642 screens at 354 properties in 113 cities (India and Sri Lanka). The cinema is equipped with advanced Laser Projection system for razor-sharp visuals, Dolby Atmos surround sound experience, 3D powered by Volfoni Smart Crystal Diamond solution.

Dilip Buildcon: The company announced that “Maradgi S Andola -Baswantpur Highways” wholly-owned subsidiary of the company has executed the concession agreement with the National Highways Authority of India. The project entails development of six lane Access Controlled Greenfield Highway from Maradgi S Andola to Baswantpur section of NH-150C (Package-III of Akkalkot-KNT/TS Border) on Hybrid Annuity Mode under Bharatmala Pariyojna. The company bid project cost is Rs 1,589 crore.

Glenmark Pharmaceuticals: The drug maker said that it has received second tentative approval by US Food & Drug Administration for Saxagliptin tablets, 2.5 mg and 5 mg. Saxagliptin is used to lower blood sugar levels in patients with type 2 diabetes (condition in which blood sugar is too high because the body does not produce or use insulin normally). The said drug is a generic version of Onglyza tablets of AstraZeneca AB. According to IQVIA sales data for the 12-month period ending December 2022, the drug achieved annual sales of approximately $122.3 million

PTC Industries: Shares of the company hit 10% upper circuit after the company announced that its subsidiary has bagged contract for supply of Titanium cast components for aero engines from Safran Aircraft. “This is the first time SAE would be developing and sourcing Titanium cast components for its Aero-engines from India, PTC Industries said.

Rajnish Wellness: The company has received a contract from Eastern Railway for setting up 270 healthcare focused multi-utility store (Wellness Centre) . The process of license fee has been initiated as conditions laid down by the railway authorities and the license will be granted for the 5 years from the date of commencement of the contract.

Greaves Cotton: The company’s subsidiary, Greaves Electric Mobility (GEMPL), marked its foray into the high speed electric two-wheeler segment with the launch of Ampere Primus at Rs 1,09,900 (ex-showroom price). The company’s all-new scooter offers optimum safety with LFP battery pack, improved performance with PMS motor, belt drive, and smart connected cluster for seamless navigation.

Schaeffler India: The company’s net profit rose 21.2% to Rs 230.98 crore on 17.8% increase in revenue from operations to Rs 1,794.65 crore in Q4CY22 over Q4CY21. The company’s net profit margin stood at 12.9% in the quarter ended 31 December 2022. Total expenses grew 16.71% year on year to Rs 1,503.35 crore during the quarter.

Minda Corporation: The company said that it has acquired 1,91,40,342 equity shares of Pricol, representing 15.70406% of the Pricol’s total issued and paid-up equity share capital. The said shares of Pricol have been acquired by Minda Corporation via the open market, at an average price of Rs 208.9820 per share aggregating to Rs 400 crore.

Themis Medicare: The company announced that it has received an approval from the Drug Controller General of India (DCGI) for import & marketing of Remifentanil Hydrochloride injection. Remifentanil is short-acting narcotic analgesic with a rapid onset & rapid offset of action that offers easy dose titration, predictable and precise intraoperative control, and reduced side effects.

Gensol Engineering: The company received orders from clients for the development of solar power projects aggregating to a capacity of over 247 MWp worth Rs 501.19 crore in February 2023. The orders received for development of projects in the states of Andhra Pradesh, Haryana, Gujarat, Jharkhand, Kerela, Madhya Pradesh, Maharashtra, Rajasthan, Tamil Nadu, Uttarakhand, and West Bengal. With this, the company’s total order book stands over Rs 1,025 crore.