Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.72% higher at 17,041, signalling that Dalal Street was headed for positive start on Monday.

Asian shares were mixed as investors were cautious and gauged the impact of interest rate hikes on the economy. The Nikkei 225 index rose 0.30% and the Topix gained 0.40%. The Hang Seng tanked 1.91% and the CSI 300 index fell 0.60%.

Indian rupee fell 22 paise to 82.48 against the US dollar on Friday.

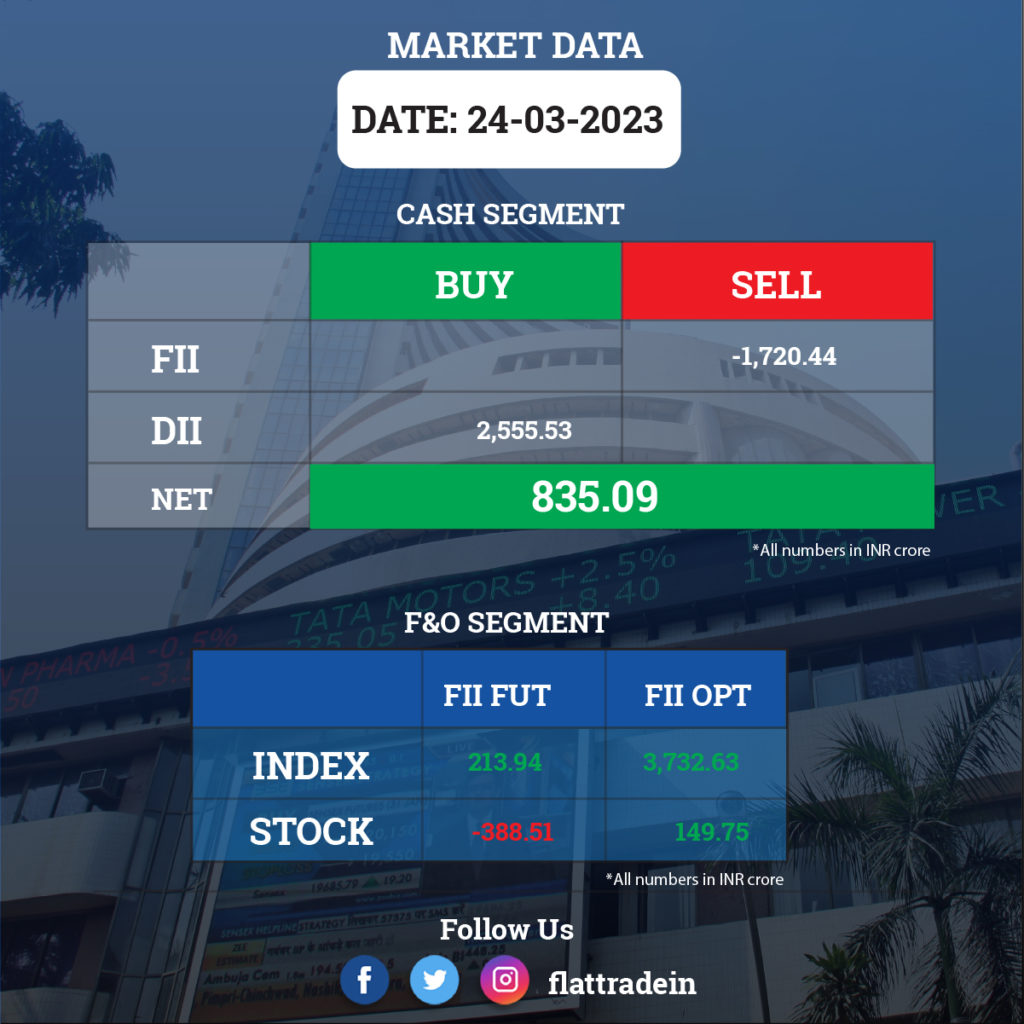

FII/DII Trading Data

Stocks in News Today

Reliance Industries (RIL): The company has appointed Srikanth Venkatachari as Chief Financial Officer with effect from June 1, 2023. Alok Agarwal, the incumbent CFO, will assume the role of Senior Advisor to RIL Chairman Mukesh Ambani.

Sun Pharmaceutical Industries: The pharma major has entered into an agreement to acquire a 60% shareholding in Vivaldis Health and Foods for Rs 143.3 crore. The remaining 40% shareholding will be acquired in the future on certain terms and conditions.

Bharat Electronics (BEL): The defence ministry has signed a Rs 3,000-crore contract with Bharat Electronics for the supply of integrated electronic warfare systems to the Indian Army. BEL has also received several contracts adding to Rs 1,300 crore in the last fortnight from the Indian Navy.

Dalmia Bharat: The company’s wholly owned subsidiary, Dalmia Cement, has inked a pact to sell its 42.36% stake in an associate firm to Sarvapriya Healthcare Solutions for Rs 800 crore, a regulatory filing said on March 26.

Tata Steel (TSL): The company announced that it has acquired 4,65,116 equity shares of its wholly owned subsidiary, Tata Steel Utilities and Infrastructure Services (TSUISL), on rights basis amounting to Rs 10 crore. TSUISL allotted the shares to TSL at Rs 215 each. The funds shall be utilized by TSUISL to invest in its step-down subsidiary, Tata Steel Special Economic Zone (TSSEZ), and to assist TSSEZ in partial repayment of its existing loans and to do other capital expenditures.

Mahindra & Mahindra: The company will acquire around 7.68 crore shares of subsidiary Mahindra Aerospace, taking its shareholding to 100%, for Rs 31.47 crore.

One97 Communications (OCL): The fintech company said its subsidiary Paytm Payments Services Ltd (PPSL) has received an extension from the Reserve Bank of India (RBI) to resubmit its application for a payment aggregator (PA) licence. The RBI had in November 2022 asked Paytm to reapply for the licence within 120 days and stopped it from signing up new online merchants for the platform.

Crompton Greaves: The company merged with Butterfly Gandhimati Appliances to accelerate and smoothen realisation of synergies of the combined business. Wtih this merger, the public shareholders of Butterfly as on the record date will receive 22 equity shares of Crompton for every 5 equity shares held by them in Butterfly.

Lupin: The drugmaker informed that the UK Medicines and Healthcare products regulatory agency successfully carried inspection at the company’s Pithampur facilities in India. The inspection was carried from March 20 to March 24.

Greaves Cotton: The company’s subsidiary Greaves Electric Mobility collaborated with Royal Challengers Bangalore as their official EV partner for ‘Ampere electric two-wheelers’ for the upcoming T20 season.

ISGEC Heavy Engineering: The company bagged Rs 197.2 crore worth order from Maharashtra State Power Generation for renovation and modernisation of ESP at Chandrapur Thermal Power Station in Chandrapur.

Khadim India: The footwear company entrusted Rittick Roy Burman, whole-time director, to manage the regular affairs & overall operations. Rittick is a member of the promoter group and a key managerial personnel of the company.

L&T Finance Holdings: The Reserve Bank of India has given its approval for the merger of L&T Finance, L&T Infra Credit & L&T Mutual Fund Trustee with L&T Finance Holdings. The board had in January 2023 approved the amalgamation of the said subsidiaries through merger.

IndusInd Bank: The private sector lender has announced the appointment of Vikas Muttoo as COO & Head Member Services of its subsidiary Bharat Financial Inclusion.

BBCC India: The company’s subsidiary, HSCC (India), has received a work order worth Rs 81.19 crore from the All India Institute of Medical Sciences (AIIMS), New Delhi.

Shriram Finance: The NBFC announced that its banking and finance committee has approved issuance of $150 million senior secured floating rate notes due 2026 on private placement basis. The notes will be issued on 29 March 2023 and will be redeemed on 29 September 2029. It will be listed on Indian International Exchange (INX).

Zydus Lifesciences: The drug firm recalled over 55,000 bottles of generic medication used to cure gout, in the US market due to failed impurities specifications. The affected lot is manufactured by Ahmedabad-based Zydus Lifesciences and marketed in the US by New Jersey-based Zydus Pharmaceuticals (USA) Inc.

Grasim Industries: The company leased 220 acres of land in Gujarat Industrial Development Corporation for Rs 254.7 crore for setting up manufacturing facilities in due course.

RITES: The company, with a JV partner, has secured a project management consultancy work under Assam Health System Strengthening Project. The likely cost of work for the project is Rs 122 crore, with RITES share at Rs 77 crore.

Karur Vysya Bank: The RBI imposed monetary penalty of Rs 30 lakh on the bank for non-compliance with certain provisions of directions issued by the RBI.

Eris Lifesciences: The pharma company completed the acquisition of nine dermatology brands from Dr Reddy’s Labs for Rs 275 crore.

Alembic Pharmaceuticals: The United States Food and Drug Administration (USFDA) conducted an inspection at Alembic Pharmaceuticals’ injectable and ophthalmic facility (F-3) at Karkhadi during March 16-24. The USFDA has issued a Form 483 with 2 minor procedural observations.

Deepak Fertilisers and Petrochemicals Corporation: The board approved the reappointment of chairman and managing director for five years from April 1, 2023.