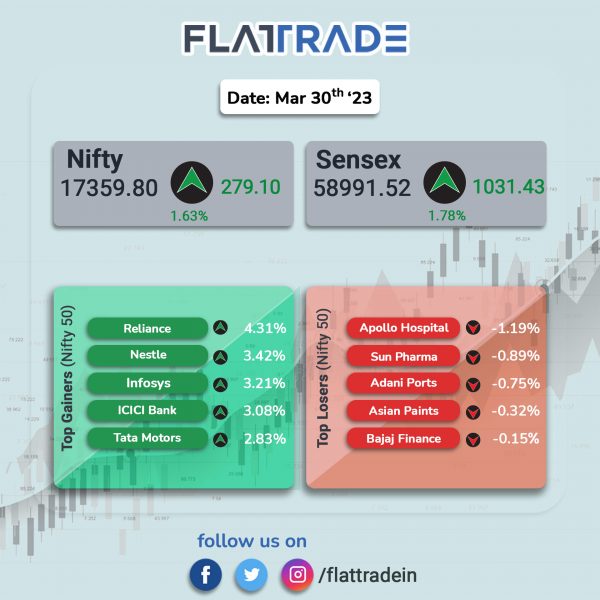

Major Indian equity indices soared on broad-based buying as investors’ risk appetite recovered, led by gains in IT sector as well index heavyweight Reliance Industries. The Sensex surged 1.78% and the Nifty zoomed 1.63%.

In broader markets, the Nifty Midcap 100 index gained 0.87% and the BSE Smallcap index rose 1.35%.

Top gainers were IT [2.45%], Energy [1.97%], Private Bank [1.92%], Bank [1.75%], Oil & Gas [1.74%]. All indices closed in the green.

Indian rupee appreciated by 17 paise to 82.17 against the US dollar on Friday.

Stock in News Today

Bharat Dynamics (BDL): The company said that it has signed a contract with the Ministry of Defence, Government of India, for production and supply of Akash Weapon System to the Indian Army for Rs 8,161 crore. The contract is for two regiments of the Indian Army and will be executed in three years. Further, the PSU company has also received an order of Rs 261 crore for counter measures dispensing system (CMDS) for MLH helicopters. The consolidated order book position of BDL has now reached Rs 24,021 crore approximately with signing of this new contract.

Larsen & Toubro (L&T): The company’s power transmission and distribution business has secured orders to establish gas insulated substations in renewable energy zones of Khavda in Gujarat and Kurnool in Andhra Pradesh. It has also won an order to develop distribution infrastructure in two circles of Rajasthan’s prominent discom. As per project classification by the company, ‘significant’ orders range between Rs 1,000 crore to Rs 2,500 crore.

VA Tech Wabag: The company with joint venture partner Metito Overseas has won a seawater reverse osmosis project from Chennai Metropolitan Water Supply and Sewerage Board. The project worth Rs 4,400-crore will be funded by Japan International Cooperation Agency. The design, build, and operate order entails the desalination of 400 million litres of seawater per day for an intake of 42 months followed by 20 years of operation and maintenance.

SBI Cards and Payment Services: Brokerage firm Jefferies initiated coverage on the stock with a ‘buy rating, betting on its strong franchise in credit cards. The brokerage initiated coverage on the stock with a ‘buy’ rating and price target of Rs 900, implying a potential upside of 27%. SBI Cards should gain share in card spends as scope to increase penetration within SBI’s large customer base is large, the brokerage said.

Westlife Foodworld: The company has informed that the royalty payable by its subsidiary to McDonald’s for FY24 will be 4.5%. Westlife Foodworld focuses on setting up and operating Quick Service Restaurants (QSR) in India through its subsidiary Hardcastle Restaurants Pvt. Ltd. (HRPL). HRPL owns & operates McDonald’s restaurants across West and South India.As on December 2022, HRPL operated 341 McDonald’s restaurants across 52 cities.

Lupin: The pharma company announced that it has received an approval from the USFDA for its abbreviated new drug application (ANDA) for Tenofovir Alafenamide tablets. The approved ANDA is a generic equivalent of Vemlidy Tablets of Gilead Sciences, Inc. Tenofovir alafenamide is used to treat chronic hepatitis B virus (HBV) infection in patients with compensated liver disease. According to IQVIA MAT December 2022 data, Tenofovir Alafenamide tablets had estimated annual sales of $531 million in the U.S.

Maharashtra Seamless: The company announced that it has received orders from Oil and Natural Gas Corporation (ONGC) with cumulative basic value of Rs 537 crore for supply of seamless casing pipes. The scope of order entails supply of pipes in various states including Maharashtra, Gujarat, Rajasthan, West Bengal, Andhra Pradesh, Assam and Tripura as required by ONGC. The order is to be executed through gradual dispatches over the course of 46 weeks.

Shipping Corporation of India (SCI): Shares of the company declined after company’s shares turn ex-date for demerger. Further, SCI has announced to demerge its non-shipping business into a separate entity.

Rail Vikas Nigam (RVNL): Shares of the company rose after RVNL said that it has received an LoA from Ministry of Railways for manufacturing and maintenance of Vande Bharat trainsets including upgradation of the government manufacturing units and trainset depots. The total quantity is 200 trainsets and cost per set of Rs 120-crore and the period of execution is 82 months.

Tilaknagar Industries: The company plans to invest Rs 9.75 crore in Spaceman Spirits Lab Private Limited (SSLPL) in two tranches. Post the investment, the company shall hold 10% of the issued and paid-up share capital in SSLPL on a fully diluted basis. With this investment, Tilaknagar will make an entry into the premium craft gin segment.