Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.43% lower at 18143, signalling a negative start for Dalal Street on Wednesday.

Asian shares were mixed as investors were cautious ahead of the Fed’s monetary policy decision. The Nikkei 225 index rose 0.12%, the Topix was down 0.12%. The Hang Seng dropped 1.45%, while the CSI 300 index was up 1.02%.

Indian rupee fell 5 paise to 81.88 against the US dollar on Tuesday.

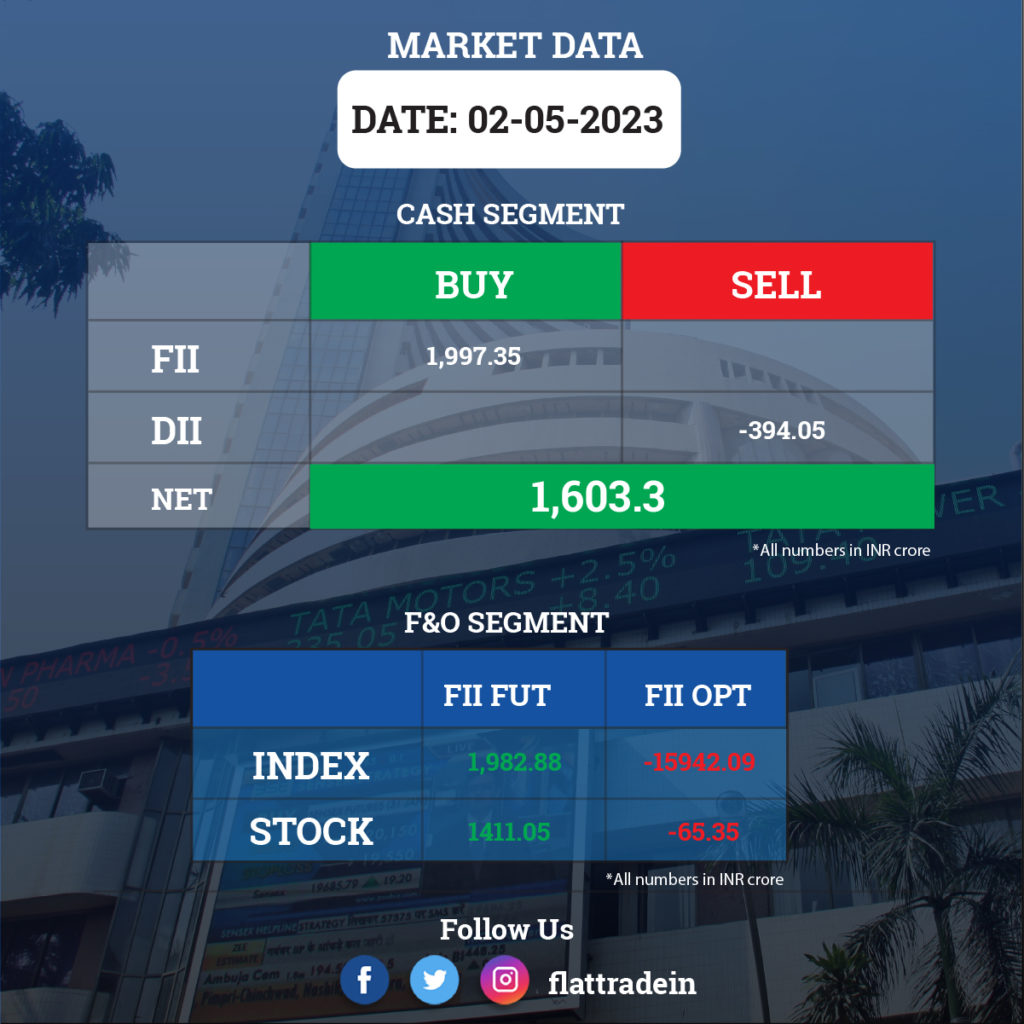

FII/DII Trading Data

Upcoming Results

Titan Company, Adani Wilmar, Tata Chemicals, ABB India, KEC International, Sona BLW Precision Forgings, Godrej Properties, Havells India, SIS, Solar Industries, Petronet LNG, KPR Mill, Jyothy Labs, Anupam Rasayan, Aavas Financiers, Bajaj Consumer Care, MRF, Reliance Power, PNB Gilts, Cholamandalam Investment & Finance, Sula Vineyards, Foseco India, R Systems International, ISMT, Vishnu Chemicals.

Stocks in News Today

Tata Steel: The Tata Group steel company has recorded 84% year-on-year decline in consolidated profit at Rs 1,566.2 crore for the quarter ended March FY23, impacted by weak operating performance and lower topline. Revenue from operations declined 9.2% to Rs 62,961.5 crore compared to the year-ago period. On the operating front, EBITDA plunged 52% YoY to Rs 7,219.2 crore with the margin falling 1,022 bps to 11.46% for the quarter, but overall numbers above analysts’ estimates. The board announced a dividend of Rs 3.6 per share for FY23.

Ambuja Cements: The company has reported a standalone profit of Rs 502.4 crore for the quarter ended March 2023, a 1.6% growth YoY, helped by strong sales and other income. Revenue grew by 8.4% year-on-year to Rs 4,256.3 crore, with sales volumes increasing by 8% YoY to 8.1 million tonnes. EBITDA stood at Rs 788.3 crore in Q4FY23, down 0.6% YoY, with margin falling 170 bps to 18.5%. The board recommended a final dividend of Rs 2.50 per share for the fiscal 2023.

Bharti Airtel: The Indian telecom firm along with Dialog Axiata Plc and Axiata Group Berhad has signed a binding term sheet to combine operations of Bharti Airtel Lanka, the company’s wholly owned subsidiary, with Dialog. The deal will see Bharti Airtel acquire a stake in Dialog, representing the fair value of Airtel Lanka. Discussions with respect to the proposed transaction are ongoing between the parties and also with the relevant regulatory authorities.

BL Kashyap and Sons: The civil engineering and construction company has secured new order worth Rs 238 crore, from Embassy Construction. The said contract is expected to be executed within 28 months. The total order book as on date stands at Rs 2,518 crore.

Godrej Consumer Products: The FMCG company said the board members will be meeting on May 10 to consider approval for raising funds amounting to Rs 5,000 crore via non-convertible debentures (NCDs) in one or more tranches.

Mukand: The company has completed the sale and transfer of 25.71 lakh equity shares or a 5.51% stake in Mukand Sumi Special Steel to Jamnalal Sons, at Rs 574 per share, and received the entire amount of Rs 147.58 crore. Mukand Sumi Special Steel is a joint venture of Bajaj Group, and Jamnalal Sons is a promoter group entity of Mukand.

Mahindra & Mahindra Financial Services: The NBFC has recorded an overall disbursement at Rs 3,775 crore in April this year, up 39% from the year-ago period. Healthy disbursement trends have led to business assets at approximately Rs 83,900 crore in April, a growth of 1.4% over March 2023. The collection efficiency was at 92% for April against 90% YoY. The company continued to maintain a comfortable liquidity chest of about 3-month’s requirement.

KEI Industries: Consolidated revenue was up 9.06% at Rs 1,954.53 crore in Q4FY23. Ebitda rose 18.51% YoY to Rs 203.81 crore in Q4FY23. Net profit was up 19.07% YoY at Rs 138.1 crore in the reported quarter.

DCM Shriram: The company announced that its consolidated revenue was down 0.86% YoY at Rs 2,848.65 crore in Q4FY23. Ebitda fell 45.44% YoY to Rs 346.22 crore in the quarter under review. Consolidated net profit fell 53.47% YoY to Rs 186.67 crore. The company declared a dividend of Rs 3.6 per share for the fiscal 2023. It also announced the appointment of Aditya Sharma as Deputy Managing Director of the company, with effect from July 2, 2023.

Vedanta, Hindustan Zinc: Promoter Vedanta had encumbered 8.05 crore shares of subsidiary Hindustan Zinc on April 28, representing 1.91% of the total share capital of the latter, for a loan to raise long-term working capital.

Indostar Capital Finance: The company will open its two-day offer for sale on May 3, where promoters Everstone Capital Partners II LLC and Indostar Capital will offload more than 1.93 crore shares, representing 14.21% stake of the company.

Ahluwalia Contracts: The company received an order worth Rs 2,450 crore from Rail Land Development Authority for redevelopment of Chhatrapati Shivaji Maharaj Terminus at Mumbai.

Infosys: The IT bellwether has collaborated with software provider SolarWinds to help the latter advance to a new SaaS model.

Indian Bank: The bank reduced treasury bills linked lending rates across tenors in the range of 5-25 basis points, effective May 3, 2023. The bank has kept marginal cost of funds based lending rates unchanged across tenors.

Thomas Cook (India): The company subsidiary, Desert Adventures Tourism, has signed a memorandum of understanding with Yusuf bin Ahmed Kanoo Company to develop a destination management company in the Kingdom of Saudi Arabia.

Grasim Industries: The company announced that its operations had stopped at the company’s VSF manufacturing unit in Harihar, Karnataka. Production is expected to be resumed at the facility in three to four weeks’ time.

Godrej Consumer Products: The company’s board shall meet on May 10 to consider a proposal to raise up to Rs 5,000 crore via non-convertible debentures (NCDs).

Axiscades Technologies: The company’s board will meet on May 6 to consider a proposal to raise Rs 210 crore via non-convertible debentures to refinance existing debt.

Cipla: The pharma firm informed the regulators that a routine current Good Manufacturing Practices (cGMP) inspection was conducted by the USFDA at the manufacturing facility of InvaGen Pharmaceuticals, a wholly-owned subsidiary of the company, in the US from April 24 to May 1. The inspection concluded with zero Form 483 observations.

Punjab & Sind Bank: The lender’s net profit jumped 32% YoY to Rs 457 crore in Q4FY23 as its interest income rose by 17% YoY to Rs 2,105 crore.

Max Healthcare Institute: The company has moved the Bombay High Court against Touch Healthcare, Quality Care India, and the Evercare Group management for an alleged breach of contract after its (Max’s) offer to acquire Care Hospitals was turned down.

Fino Payments Bank: The firm reported a 25.3% YoY growth in March quarter net at Rs 22.08 crore, backed by a 13.4% increase in total income to Rs 323.43 crore.

Astec LifeSciences: The company reported a net loss of nearly Rs 5 crore for Q4FY23 as against a net profit of Rs 43.04 crore in Q4FY22. Total income plunged 53.5% YoY to Rs 129.54 crore.

Sasken Technologies: The company’s net profit tanked over 36% to Rs 17.07 crore in Q4FY23 compared with Rs 26.88 crore in the quarter ended March 2022. Total income was down 2.2% YoY at Rs 111.27 crore.