Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.32% lower at 18,101.51, signalling that Dalal Street was headed for negative start on Thursday.

Most Asian shares were trading higher after the Federal Reserve increased the interest rate by 25 basis points. The Hang Seng jumped 1.25% and the CSI 300 index rose 0.15%.

Indian rupee rose 6 paise to 81.82 against the US dollar on Wednesday.

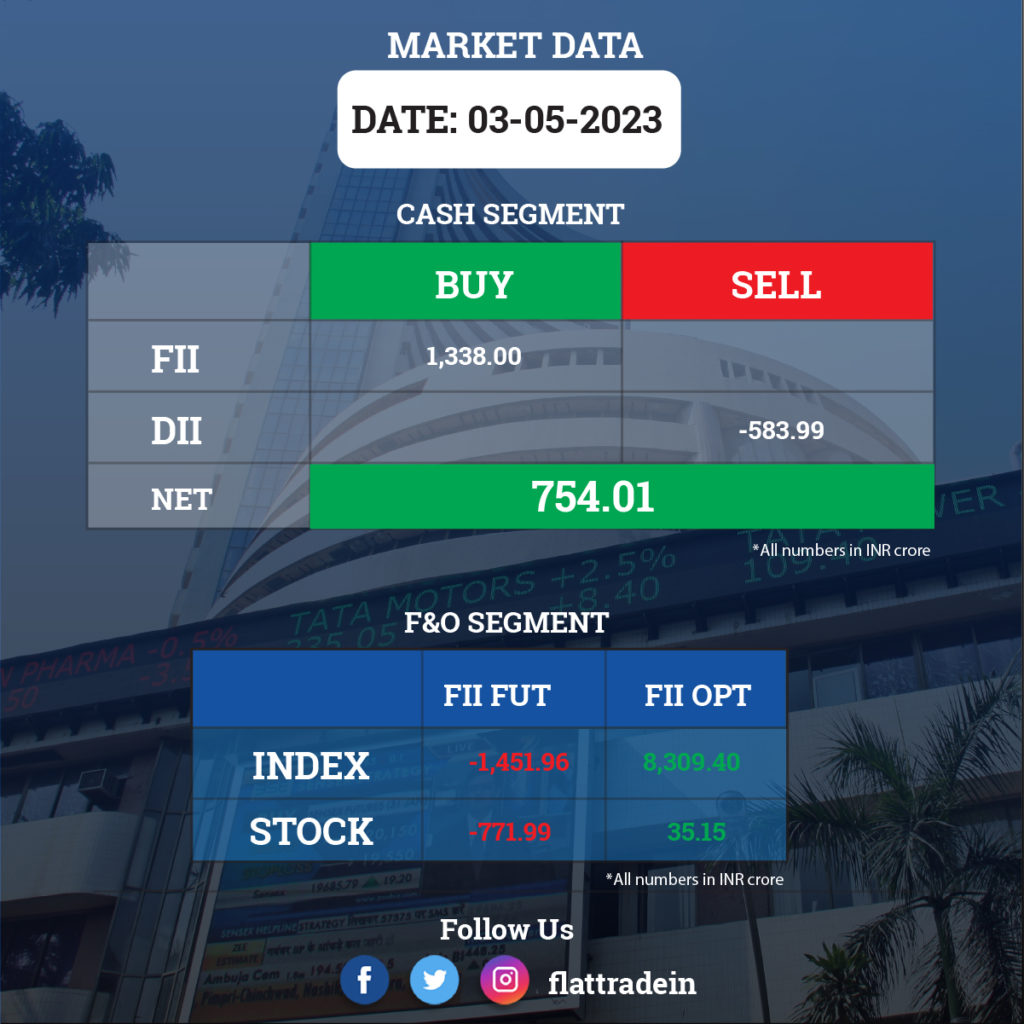

FII/DII Trading Data

Upcoming Results

Hero MotoCorp, Adani Enterprises, Housing Development Finance Corporation, Tata Power Company, TVS Motor Company, Ceat, Dabur India, United Breweries, Sundram Fasteners, Firstsource Solutions, Blue Star, Mindspace Business Parks REIT, 360 ONE WAM, Aptus Value Housing Finance India, IDFC, Choice International, AGI Greenpac, Bombay Dyeing and Manufacturing Co., Filatex India, Jammu and Kashmir Bank, and RattanIndia Power will report their quarterly results today.

Stocks in News Today

Titan: The company, which owns Tanishq brand, has recorded a 49.5% year-on-year growth in standalone profit at Rs 734 crore for the quarter ended March FY23, supported by topline and operating income. Standalone revenue from operations grew by 33.4% YoY to Rs 9,704 crore for the quarter with its jewellery business growing 33% to Rs 8,631 crore and the watches segment showing 40% growth to Rs 871 crore. The board has recommended a dividend of Rs 10 per share, to be paid on or after the seventh day from the conclusion of the 39th annual general meeting.

Tata Chemicals: The Tata Group company clocked 61.87% YoY growth in consolidated profit at Rs 709 crore for the March FY23 quarter, driven by healthy operating performance and strong growth in topline. Consolidated revenue at Rs 4,407 crore for the quarter has grown 26.6% over the year-ago period. The board approved a dividend of Rs 17.50 a piece for the fiscal 2023.

Dabur India: The Investment Board of Nepal (IBN) has approved an additional investment of Nepalese rupees Rs 969 crore (approximately Rs 608 crore) in Dabur Nepal, a subsidiary company of Dabur India in Nepal. This investment will enable Dabur Nepal to expand and grow its business by way of capacity expansion, product diversification, upgradation of plant facility etc., over the next 4 to 5 years.

Petronet LNG: The liquified natural gas importer registered an 18.1% YoY decline in standalone profit at Rs 614.25 crore for the March FY23 quarter, dented by weak operating numbers. Revenue for the quarter at Rs 13,874 crore grew by 24.35% over the corresponding period of last fiscal. The board has recommended a final dividend of Rs 3 a share for the fiscal 2023. The board has also approved the appointment of Milind Torawane as additional director, with effect from April 10, 2023.

Hero MotoCorp: The company said it will expand its e-mobility brand Vida to 100 cities across India by the end of 2023.The company slashed the prices for its electric scooters Vida V1 Plus and Vida Vi Pro to Rs 1.2 lakh and Rs 1.4 lakh, respectively (ex-showroom), including portable charger and FAME II subsidy.

SJVN: The company has obtained a 200 MW grid-connected solar power project in Khavda Solar Park through an e-Reverse auction conducted by Gujarat Urja Vikas Nigam. The tentative cost for the development of this project will be approximately Rs 1,200 crore.

Sona BLW Precision Forgings: The company said its consolidated revenue was up 35.54% YoY at Rs 742.59 crore in Q4FY23. Ebitda jumped 50.12% YoY to Rs 199.97 crore in the reported quarter. Consolidated net profit rose 14.48% YoY to Rs 119.81 crore in Q4FY23. The board has recommended a final dividend of Rs 1.53 pe share for the fiscal ended March 2023. The record date for the same has been fixed as June 30, 2023.

ABB India: The company said its consolidated revenue was up 22.5% YoY at Rs 2411 crore in Q1CY23. Consolidated net profit fell 34% YoY to Rs 244.89 crore in the reported quarter. Ebitda fell 52% Yoy to Rs 285.31 crore in the quarter under review.

Bajaj Consumer Care: The company said its consolidated revenue was up 14.29% YoY at Rs 249.42 crore in Q4FY23. Consolidated net profit was rose 12.95% YoY to Rs 40.46 crore in Q4FY23. Ebitda rose 20.11% YoY at Rs 41.69 crore in Q4FY23. The company announced a final dividend of Rs 5 per share for the financial year 2022-23.

Reliance Power: The utilities company said its revenue was down 6.28% YoY at Rs 1,729.84 crore in Q4FY23. Ebitda loss stood at Rs 159.14 crore as against Ebitda profit of Rs 185.15 crore in the eyar-ago period. Consolidated net profit stood at Rs 321.79 crore as against a net loss of Rs 657.89 crore in the year-ago period.

Central Bank of India: The state-run bank clarified that it has a total exposure of Rs 1,987 crore to Go Air as of March 31, 2023, representing 0.91% of total advances. Shares of the lender tanked 5.13% on the NSE on Wednesday.

GR Infraprojects: The company has been selected as the lowest bidder for the construction of four-lane highway along the NH-731A in Kausambi, Uttar Pradesh. The bid project cost is Rs 737.17 crore.

AstraZeneca Pharma India: The company has received approval from Central Drugs Standard Control Organisation to import breast cancer drug Trastuzumab deruxtecan, or Enhertu, for sale and distribution in India.

HG Infra Engineering: The company will sell its entire shareholding in four wholly owned subsidiaries—Gurgaon Sohna Highway, HG Rewari Ateli Highway, HG Ateli Narnaul Highway, and HG Rewari Bypass—to Highway Infrastructure Trust for an equity value of Rs 531 crore.

Seamec: The company completed the acquisition of 100% stake in Aarey Organic Industries for a consideration of Rs 17.40 crore.

Bosch: Markus Bamberger has resigned as the chairman and director of the company, with effect from close of business hours on Aug. 1, 2023, as part of succession planning.

Karur Vysya Bank: The lender appointed Jana Sivaramakrishna as its chief risk officer, with effect from May 3, 2023, following the resignation of S Kalyanram from the position.