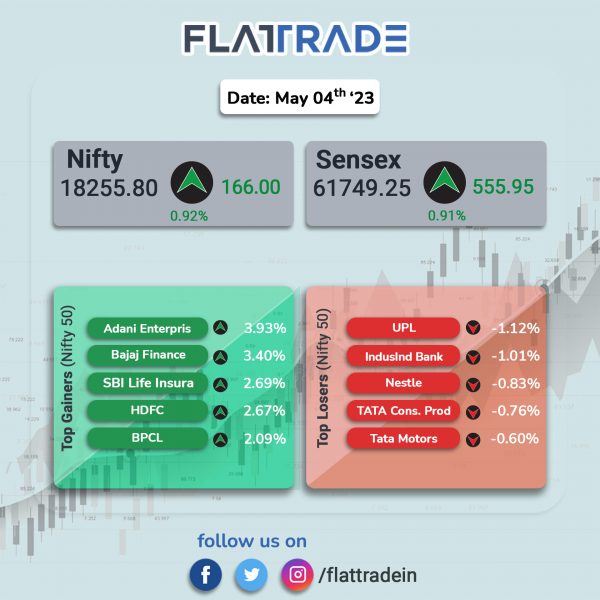

Benchmark equity indices closed higher as investor optimism was boosted after Federal Reserve hiked key monetary policy rates by 25 bps and gains in index heavyweights. The Sensex jumped 0.91% and the Nifty 50 index gained 0.92%.

In broader markets, the Nifty Midcap 100 index rose 0.58% and the BSE Smallcap climber 0.83%.

Top gainers among Nifty sectoral indices were Financial Services [1.55%], PSU Bank [1.23%], Metal [1.22%], Bank [0.86%], and Private Bank [0.62%]. Top loser was FMCG [-0.13%].

Indian rupee strengthened by 2 paise to 81.80 against the US dollar on Thursday.

Stock in News Today

Housing Development Finance Corporation (HDFC): The mortgage lender posted about 20% year-on-year (YoY) growth in standalone net profit for the quarter ended March 2023 at Rs 4,425.50 crore. Total revenue from operations increased by 35.6% YoY to Rs 16,679.43 crore. The net interest income (NII) for the quarter ended March 2023 stood at Rs 5,321 crore compared to Rs 4,601 crore in the previous year, registering a growth of 16%. The company’s board has approved an interim dividend of Rs 44 per share for FY23.

Adani Ports and Special Economic Zone (APSEZ): The company said that it has entered into share purchase agreement (SPA) with Solar Energy Limited for divestment of 100% stake of Coastal International Terminals for total consideration of $30 million. Solar Energy will pay the said amount to the APSEZ within 3 business days on completing all the necessary compliance by the APSEZ. On receipt of the total transaction value, APSEZ shall transfer the equity to the Solar Energy and its exit will be completed.

Meanwhile, the company handled 32.3 MMT of total cargo in April 2023, implying a YoY growth of 12.8%. The growth in cargo volumes was supported by dry cargo volumes increase of 9% (iron ore 64%, non-coking coal 22%, and coastal coal 67%) and container volume increase of 13.6%.

Dabur: The FMCG major said its consolidated net profit rose 2.25% to Rs 300.83 crore on 6.35% increase in revenue from operations to Rs 2,677.80 crore in Q4FY23 over Q4FY22. Dabur said that the strong execution of the power brand strategy coupled with distribution footprint enhancement helped the company to report a steady performance during the fourth quarter and the full year. The company’s board has recommended a final dividend of Rs 2.70 per share for the financial year 2022-23. On a full year basis, the firm’s consolidated net profit stood at Rs 1,707.15 crore in FY23, up 1.84% as against Rs 1739.22 crore posted in FY22. Revenue grew by 5.89% year on year to Rs 11,529.89 in financial year ended March 2023.

Indian Energy Exchange (IEX): The company announced that it has recorded 7,928 MU overall volume in April 2023, a growth of 6% YoY. On a sequential basis, the company’s total volume slipped 13.94% month on month (MoM) basis in April 2023. The overall volume in March 2023 was including green market trade of 280 MU, 1.99 lac RECs (equivalent to 199 MU) and 1.23 ESCerts (equivalent to 123 MU). The power exchange said that while increase in power demand is expected in the coming months, the supply side liquidity is likely to be maintained due to improved coal supply.

Indian Bank: The state-run bank announced that its board will consider fund raising on Monday, 8 May 2023. The fundraising will be through qualified institutional placement (QIP) / follow-on public offer (FPO) /rights issue and/or in combination thereof. Separately, the public lender said that the Central Government has appointed Ashutosh Choudhury as executive director of the bank for a period three years with effect from May 3.

Rane Engine Valve: Share price of the company hit an upper limit of 20% after the company reported strong earnings. Its net profit stood at Rs 4.9 crore in Q4FY23 compared to a net loss of Rs 0.01 crore in Q4FY22. The company’s total revenue for Q4FY23 was Rs 136.5 crore, a 24.7% increase from Rs 109.5 crore in Q4FY22. Ebitda was at Rs 16.6 crore, a 66.9% increase from Rs 9.9 crore in Q4FY22. For FY23, the company’s total revenue reached Rs 4,996 crore, a 29.8% increase from Rs 3,850 crore in FY22. The net loss for FY23 was Rs 0.1 crore, significantly lower than the net loss of Rs 11.9 crore in FY22.

SIS: The company’s Q4 net profit was down 4.4% at Rs 93.10 crore for the quarter ended March 2023 as against Rs 97.40 crore in the corresponding quarter a year ago. Total income, however, was up 13.1% YoY at Rs 2,995.70 crore.

KEC International: The company reported a 35.6% YoY fall in net profit at Rs 72.17 crore in Q4FY23 as against Rs 112.04 crore in Q4FY22. Total income surged 29.3% YoY to Rs 5,530.53 crore. Ebitda improved by 13% YoY to Rs 283 crore in the fourth quarter. The company’s board has recommended a dividend of Rs 3 per equity share for FY23.

Cholamandalam Investment: The company posted a 24% YoY increase in net profit during the fourth quarter of 2022-23 to Rs 853 crore, as compared to Rs 690 crore during the same period in 2021-22. Net income rose 32% YoY to Rs 2,060 crore.

Apollo Micro Systems: Shares of the company traded after split today with a face value of Re 1 per share. Earlier, the face value was Rs 10 per share which was divided into 10 equity shares with a face value of Re 1 each. The stock price closed at Rs 34.65 apiece.

Mindspace Business Park: The company’s net profit for the quarter ended March 2023 stood at Rs 33.8 crore as against Rs 94.4 crore in the year-ago period. Revenues stood at Rs 168.6 crore in the reported quarter as against Rs 150.4 crore in the year-ago period.

Sula Vineyards: The company reported a consolidated net profit of Rs 14.25 crore in Q4FY23, up by 5% from Rs 13.59 crore in the year-ago period. Revenue from operations rose 7% YoY to Rs 120.90 crore for the quarter under review from Rs 112.79 in the year-ago period.

AAVAS Financiers: The company reported a 9.6% YoY rise in net profit at Rs 126.75 crore in Q4FY23 and its net interest income rose 17.6% YoY to Rs 283.38 crore in Q4FY23. AUM as on 31 March 2023 was Rs 14,166.7 crore, of which Home Loans contributed 69.9% and Other Mortgage Loans contributed 30.1%. For full year, the company recorded a 20.5% jump in net profit at Rs 430.07 crore on a 23% rise in net interest income at Rs 1,011.53 crore in FY23 as compared with FY22.

Patel Engineering: The company and its joint venture partner have bagged Tumkur Branch Canal (Package III) Micro Irrigation Project and Sher Micro Irrigation Project. Patel Engineering is a 51% partner in the Tumkur Branch Canal project, with a share of Rs 158.68 crore, and a 35% share in the Sher Micro Irrigation Project, with a share of Rs 349.56 crore. The total value of both contracts is Rs 1,309.88 crore. The Tumkur Branch Canal (Package-III) project and Sher Micro Irrigation Project are expected to be completed within 24 months and 60 months, respectively.