Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.23% lower at 18,243.50, signalling that Dalal Street was headed for negative start on Friday.

Asian stocks were mixed as investors were worried about the US banking sector after shares of PacWest Bancorp and Western Alliance Bancorp plunged on Thursday. The Hang Seng rose 0.38%, while the CSI 300 index dropped 0.6%.

Indian rupee strengthened by 2 paise to 81.80 against the US dollar on Thursday.

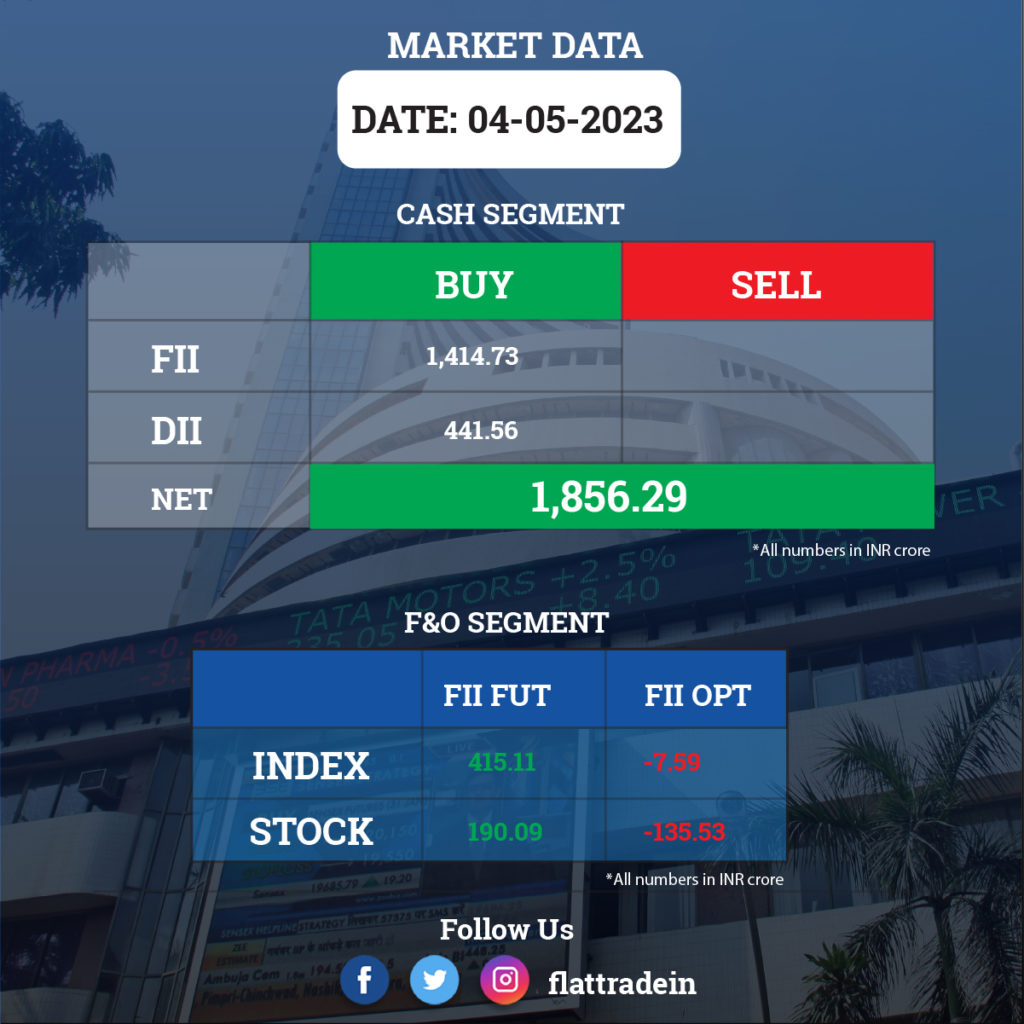

FII/DII Trading Data

Upcoming Results

Britannia Industries, One 97 Communications, Adani Power, Bharat Forge, Federal Bank, Ajanta Pharma, Alembic Pharmaceuticals, DCB Bank, Equitas Small Finance Bank, Gujarat Fluorochemicals, Marico, Olectra Greentech, Piramal Enterprises, Sundaram-Clayton, Symphony, Tata Investment Corporation and Windlas Biotech will report quarterly earnings on May 5.

Stocks in News Today

Hero MotoCorp: The two-wheeler manufacturer said its consolidated revenue was up 12.51% at Rs 8,434.28 crore in Q4FY23 and volumes rose 7% in the same period. Consolidated net profit rose 31.7% YoY to Rs 805.12 crore in Q4FY23. Ebitda climbed 31.34% YoY to Rs 1,124.2 crore in Q4FY23. The board recommended a final dividend of Rs 35 per share for the fiscal 2023.

Adani Enterprises: The company said its consolidated revenue up 26.06% YoY at Rs 31,346.05 crore in Q4FY23. Consolidated net profit rose 137.41% YoY to Rs 722.48 crore in Q4FY23. Ebitda jumped 184.14% YoY to Rs 3,587.07 crore in Q4FY23. The board recommended a dividend of Rs 1.20 per share for the fiscal 2023 and approved the reappointment of Gautam Adani as executive chairman for five years, effective December 1, 2023.

Tata Power Company: The power generation and distribution company has recorded a massive 48.5% on-year growth in consolidated profit at Rs 939 crore for March FY23 quarter on a low base and higher other income. Revenue from operations grew by 4.1% year-on-year to Rs 12,454 crore in Q4FY23, supported by its transmission and distribution business. Ebitda rose 3.2% YoY to Rs 1,927.71 crore in the quarter under review. The board has approved a dividend of Rs 2 per share for the year ended March 31, 2023.

TVS Motor Company: The two-wheeler and three-wheeler manufacturer has reported a standalone net profit of Rs 410 crore for the quarter ended March 2023, a 50% growth over a year-ago period. Standalone revenue from operations for the quarter at Rs 6,605 crore, a increase of 19.4% over the corresponding period last fiscal.

United Breweries: The alcoholic and non-alcoholic beverages maker has recorded a 94% year-on-year decline in profit at Rs 9.7 crore for the quarter ended March FY23, as operating performance dented due to continued inflationary pressures on the cost base, particularly on prices of barley and packaging materials. Revenue for the quarter grew by 3.4% to Rs 1,764.5 crore compared to the year-ago period. The board approved a dividend of Rs 7.50 per share for financial year 2022-23.

Ceat: The RPG Group company has reported consolidated profit at Rs 133.7 crore for the March FY23 quarter, rising more than five-fold compared to Rs 25.3 crore in the same period last year due to healthy operating performance with a fall in input cost. Revenue from operations at Rs 2,875 crore grew by 11% over a year-ago period. Ebitda was up 96% YoY at Rs 367.81 crore in Q4FY23. The board approved a final dividend of Rs 12 per share for the fiscal ended March 31, 2023.

Zydus Life Sciences: The pharma company has received final approval from United States Food and Drug Administration (USFDA) to manufacture and market Sucralfate tablets USP, 1 gram. Sucralfate is used to treat and prevent ulcers in the intestines by forming a coating over ulcers, protecting the area from further injury.

Indraprastha Gas: Diversified renewable energy company ACME Cleantech Solutions and city gas distribution company IGL signed a memorandum of understanding (MoU) to jointly explore the potential business opportunities of green hydrogen.

Blue Star: The company said its consolidated revenue was up 16.4% YoY at Rs 2,623.83 crore in Q4FY23. Consolidated net profit rose 195.76% YoY at Rs 225.25 crore in Q4FY23. Ebitda rose 25.34% YoY to Rs 179.17 crore in the reported quarter. The board approved a final dividend of Rs 12 per share for the year ended March 2023. It also approved issue of bonus shares in 1:1 ratio.

Zydus Lifesciences: The company received approval from USFDA to manufacture and market Sucralfate tablets used to treat and prevent ulcers in intestines.

SBI Life Insurance Company: The board approved extending the term of Mahesh Kumar Sharma as managing director and chief executive officer of the company up to Sept. 30, 2023, subject to approvals from regulator IRDAI and shareholders.

ICICI Prudential Life Insurance Company: The company said Insurance regulator IRDAI has approved the appointment of Anup Bagchi as the executive director and chief operating officer of the company from May 1, 2023, and as managing director and CEO of the company from June 19, 2023.

Raymond: The company’s board will meet on May 9 to consider fundraising of Rs 2,200 crore via non-convertible debentures in two or more tranches for repayment of external debt.

Sundram Fasteners: The company’s consolidated net revenue was up 8.07% YoY at Rs 1,447.95 crore in Q4FY23. Ebitda was up 18.5% YoY to Rs 226.97 crore in Q4FY23. Consolidated net profit up 18.61% YoY at Rs 126.36 crore in the quarter under review. The board declared a second interim dividend of Rs 3.06 per share for the fiscal 2023, with the record date set as May 16, 2023.

360 ONE WAM: The company’s consolidated revenues was up 7.29% YoY at Rs 479.91 crore in Q4FY23. Ebitda jumped 43.18% YoY at Rs 270.65 crore in Q4FY23. Consolidated net profit was down 6.05% YoY at Rs 155.45 crore in Q4FY23. The board approved first interim dividend of Rs 4 per share for the financial year 2022-23, and the record date has been fixed as May 12, 2023.

Aptus Value Housing Finance: The lender said its net profit was up 23% YoY at Rs 135.30 crore. Net NPA ratio stood at 0.86% in Q4FY23 as against 1.08% in the preceding quarter. The board approved the second interim dividend of Rs 2 per share for the fiscal 2023. The record date for the dividend has been fixed at May 12, 2023.

Meanwhile, the company said it will raise Rs 1,000 crore via non-convertible debentures. The board has approved the appointment of M Anandan as executive chairman. It also appointed P Balaji as managing director for five years and John Vijayan Ravappa as chief financial officer. All appointments come into effect from May 4, 2023 and are subject to shareholders’ approval.

Bank of India and Future Lifestyle Fashions: The National Company Law Tribunal admitted the plea of Bank of India to initiate insolvency proceedings against Future Lifestyle Fashions on alleged default of Rs 495.91 crore. The NCLT also approved the appointment of Ravi Sethia as an Interim Resolution Professional.

Sterlite Technologies: The board will take up, among other things, the proposal to raise funds by issuing equity shares or other securities convertible into equity shares or a combination thereof by way of further public offer, rights issue, American Depository Receipts, Global Depository Receipts, Foreign Currency Convertible Bonds, qualified institutions placement, preferential issue or any other permitted method.

PNB Housing Finance: The board has approved allotment of 9.06 crore rights equity shares of face value of Rs 10 at a price of Rs 275 per equity share, according to its exchange filing.

Bombay Dyeing and Manufacturing: The company’s consolidated revenue was up 12.07% YoY at Rs 670.17 crore in Q4FY23. Ebitda loss of Rs 95.33 crore in the reported quarter compared to Ebitda profit of Rs 69.99 crore in the year-ago period. Consolidated net loss widened to Rs 246.09 crore from a loss of Rs 41.74 crore.

Manappuram Finance: The Enforcement Directorate has frozen the company’s assets worth Rs 143 crore following searches at six premises belonging to the firm and its managing director VP Nandakumar, the probe agency said in a statement.

Rattanindia Power: The company has posted a consolidated loss of Rs 483.2 crore for quarter ended March FY23, widening from Rs 310.4 crore in same period last year, with finance cost rising 9% and other income falling 58% YoY. Revenue from operations for the quarter at Rs 900.6 crore increased by 9.4% over a year-ago period.

AGI Greenpac: The packaging products company has registered 152% year-on-year growth in profit at Rs 95.8 crore for January-March FY23 quarter. Revenue from operations grew by 58% YoY to Rs 680 crore in Q4FY23. The sales and profitability boosted by improved product mix, and increase in demand for the non-alcoholic & alcoholic beverages and packed food segment for the glass containers products. The company announced a dividend of Rs 5 per share for FY23.