Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.23% lower at 18,424, signalling that Dalal Street was headed for negative start on Friday.

Asian shares were mixed as investors gauged the progress of the US debt-ceiling talks. The Nikkei 225 index rose 0.84% and the Topix gained 0.50%. The Hang Seng fell 1.93% and the CSI 300 index dropped 0.68%.

Indian rupee fell 6 paise to 82.74 against the US dollar on Thursday.

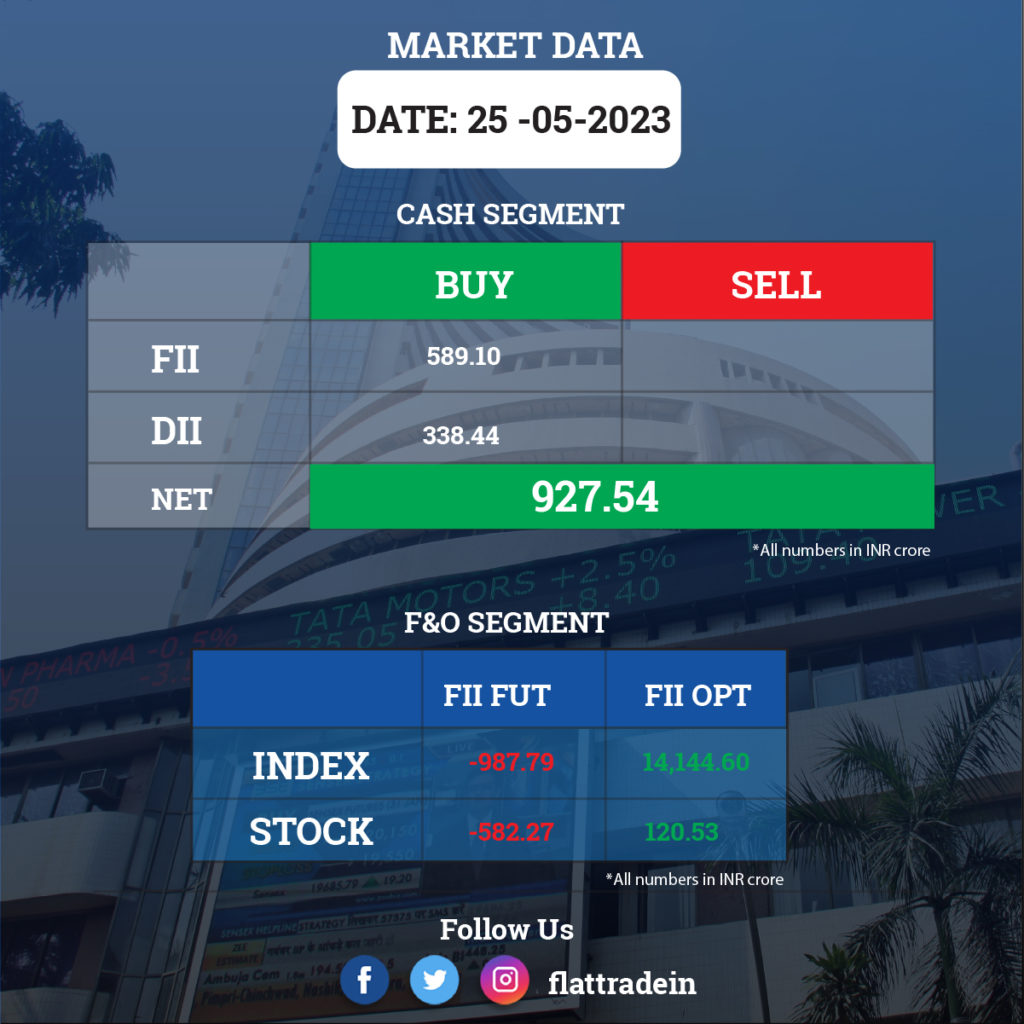

FII/DII Trading Data

Upcoming Results

Oil and Natural Gas Corporation, Sun Pharmaceutical Industries, Mahindra & Mahindra, Samvardhana Motherson International, Bharat Heavy Electricals, Chambal Fertilisers & Chemicals, BEML, Maharashtra Seamless, Power Mech Projects, KPI Green Energy, Karnataka Bank, City Union Bank, Dhani Services, Easy Trip Planners, Edelweiss Financial Services, Engineers India, PG Electroplast, Capacite Infraprojects, Gateway Distriparks, TCI Express, Indigo Paints, KDDL, Sunteck Realty, Hinduja Global Solutions, Housing & Urban Development Corporation, Imagicaaworld Entertainment, Inox Green Energy Services, Inox Wind, Ion Exchange (India), Inox Wind Energy, Nucleus Software Exports, Astra Microwave Products, Avalon Technologies, Bharat Bijlee, Bombay Burmah Trading Corp, BF Investment, Chemcon Speciality Chemicals, Electronics Mart India, Ester Industries, Finolex Cables, Grasim Industries, Garware Hi-Tech Films, Jain Irrigation Systems, Kama Holdings, Media Matrix Worldwide, MOIL, Info Edge (India), NCC, Nexus Select Trust, Optiemus Infracom, PNC Infratech, Polo Queen Industrial and Fintech, Precision Camshafts, Primo Chemicals, Puravankara, Shree Renuka Sugars, Repco Home Finance, Savita Oil Technologies, Steel Strips Wheels, Styrenix Performance Materials, Supriya Lifescience, TCPL Packaging, Tide Water Oil (India), Uniphos Enterprises, Vidhi Specialty Food Ingredients, and Wockhardt.

Stocks in News Today

Vodafone Idea: The telecom firm said its revenue was down 1.19% QoQ at Rs 10,532 crore in Q4FY23. Ebitda was up 0.70% QoQ at Rs 4,210 crore in Q4FY23. Net loss narrowed to Rs 6,419 crore in Q4FY23 from net loss of Rs 7,990 crore in the preceding quarter. ARPU remained flat at Rs 135 quarter-on-quarter. The company incurred exceptional loss of Rs 22.4 crore on account of remeasurement or sale of leasehold land.

Reliance Industries (RIL): The company said Reliance Consumer Products, the FMCG arm and a wholly-owned subsidiary of Reliance Retail Ventures, has completed the acquisition of a 51% controlling stake in LOTUS for Rs 74 crore, and subscribed to non-cumulative redeemable preference shares of LOTUS for Rs 25 crore. Reliance Consumer Products has also completed the acquisition of equity shares pursuant to the open offer and has taken sole control of LOTUS with effect from May 24.

Page Industries: The innerwear retailer has reported a 59% year-on-year growth in profit at Rs 78.4 crore for the quarter ended March FY23, impacted by weak operating as well as topline numbers. Revenue fell 12.8% YoY to Rs 969.1 crore for the quarter YoY. The board approved fourth interim dividend of Rs 60 per share. The company has appointed Deepanjan Bandyopadhyay as Chief Financial Officer (CFO) with effect from June 1, 2023. Current CFO Chandrasekar K will retire due to his superannuation with effect from May 31. The company has also reappointed Shamir Genomal as Deputy Managing Director for another 5 years with effect from September 1, 2023.

Zee Entertainment Enterprises (ZEE): The company reported a net loss of Rs 196 crore, compared to a net profit of Rs 181 crore in the corresponding period last year. Its revenue during the January-march quarter came in at RS 2,112.1 crore, registering a decline of 9%, compared to Rs 2,323 crore in the year-ago period. Ebitda during the fourth quarter stood at Rs 151.7 crore, down 71.2%, compared to Rs 526.4 crore in the same period last year. The company suffered a loss of Rs 123.14 crore from discontinuing operations and exceptional loss of Rs 89.97 crore.

Steel Authority of India: The company’s consolidated revenue was down 5.29% YoY at Rs 29,130.66 crore in Q4FY23. Ebitda was down 32.59% YoY at Rs 2,924.16 crore in Q4FY23. Consolidated net profit was down 53.24% YoY at Rs 1,159.21 crore in Q4FY23. The company saw an exceptional loss of 40.42 crore during the quarter. The board recommended a final dividend of Rs 0.50 per share for fiscal 2023.

Praj Industries: The industrial biotechnology company has received board approval for forming a 50:50 joint venture with Indian Oil Corporation to set up biofuel production facilities and marketing of CBG, ethanol, SAF & other co-products. Both companies will infuse Rs 50 lakh each into the joint venture company. The company reported a consolidated profit of Rs 88.1 crore for the quarter ended March FY23, growing 53% over a year-ago period, while revenue from operations grew by 21% to Rs 1,004 crore compared to the same period last year.

Emami: The FMCG company has registered a 56.4% year-on-year growth in consolidated profit at Rs 144.43 crore for the March FY23 quarter despite healthy operating numbers, as the base in Q4FY22 was higher due to tax write-back. Revenue from operations for the quarter at Rs 836 crore increased by 8.8% over a year-ago period, with domestic sales growing 5% and international business rising 19%.

Religare Enterprises: The company’s subsidiary, Religare Finvest, has received the no-dues certificates (NDC) from all 16 secured OTS (one-time settlement) lenders against their total outstanding dues including dues toward their unsecured exposure. In March, Religare Finvest completed the entire OTS payment of Rs 2,178 crore to all 16 secured OTS lenders. Accordingly, the OTS stands completed.

Max India: The stock will be in focus as the board has given approval for an infusion of Rs 294 crore in its wholly owned subsidiary companies, i.e. Rs 177 crore for Antara Senior Living, and Rs 117 crore for Antara Assisted Care Services, to meet their funding/business expansion requirements. The company posted a consolidated loss of Rs 4.18 crore for the March FY23 quarter, widening from Rs 1.08 crore in the same period last year. Revenue from operations for the quarter grew by 12.6% year-on-year to Rs 56.35 crore.

Emami: The FMCG company’s consolidated revenue was up 8.82% YoY at Rs 835.95 crore in Q4FY23. Ebitda was up 22% YoY at Rs 200 crore in Q4FY23. Consolidated net profit was down 60% YoY at Rs 141.62 crore in Q4FY223.

MedPlus Health Services: The company’s consolidated revenue was up 30% YoY at Rs 1,253 crore in Q4FY23. On a consolidated basis, operating profit was up 56% YoY at Rs 82 crore in Q4FY23. Consolidated net profit was up 127% YoY at Rs 27 crore in Q4FY23. The company avail deferred tax benefit of Rs 18.78 crore during the March 2023 quarter.

AIA Engineering: The company’s consolidated revenue was up 16.48% YoY at Rs 1,273.56 crore in Q4FY23. Ebitda was up 39.75% YoY at Rs 315.74 crore in Q4FY23. Consolidated net profit was up 37.95% YoY at Rs 267.66 crore in Q4FY23. The company will pay a dividend of Rs 16 per share.

Mrs Bectors Food Specialities: The company’s consolidated revenue was up 37.16% YoY at Rs 346.08 crore in Q4FY23. Ebitda was up 49.48% YoY at Rs 68.70 crore in Q4FY23. Consolidated net profit was up 171.08% YoY at Rs 27.65 crore in Q4FY23. The company will pay a final dividend of Rs 1.75 per share.

GMM Pfaudler: The company’s Q4FY23 consolidated revenue rose 23.82% YoY to Rs 865.95 crore in Q4FY23. Ebitda was up 33.93% YoY at Rs 96.20 crore in Q4FY23. Consolidated net profit was up 139.84% at Rs 38.47 crore in Q4FY23. The board recommended a final dividend of Rs 1 per share for fiscal 2023.

Harsha Engineers International: The company’s consolidated revenue was down 6.83% YoY at Rs 343.69 crore in Q4FY23. Ebitda rose 5.43% YoY at Rs 50.80 crore in Q4FY23. Consolidated net profit was up 8.66% YoY at Rs 32.62 crore in Q4FY23. The company will pay a final dividend of Rs 1 per share and the record date is fixed at September 21.

Triveni Engineering & Industries: The company said that its consolidated revenue was up 53.08% YoY at Rs 1817.7 crore in Q4FY23. Ebitda up 54.87% YoY at Rs 264.32 crore in Q4FY23. Consolidated net profit was up 86.34% YoY at Rs 189.58 crore in Q4FY23. The board has approved a dividend of Rs 3.25 per share.

Gujarat State Fertilizers & Chemicals: The company’s consolidated revenue rose 17.15% YoY to Rs 2,383.87 crore in Q4FY23. Ebitda was down 22.19% YoY at Rs 326.10 crore in Q4FY23. Consolidated net profit was down 21.26% YoY at Rs 224.91 crore in Q4FY23. The company announced a dividend of Rs 10 per share.

Life Insurance Corporation of India: The insurance company increased its stake in Tata Power to 7.94% from 5.91%. Further, it also increased its stake in Bata India to 6.53% from 4.5%.