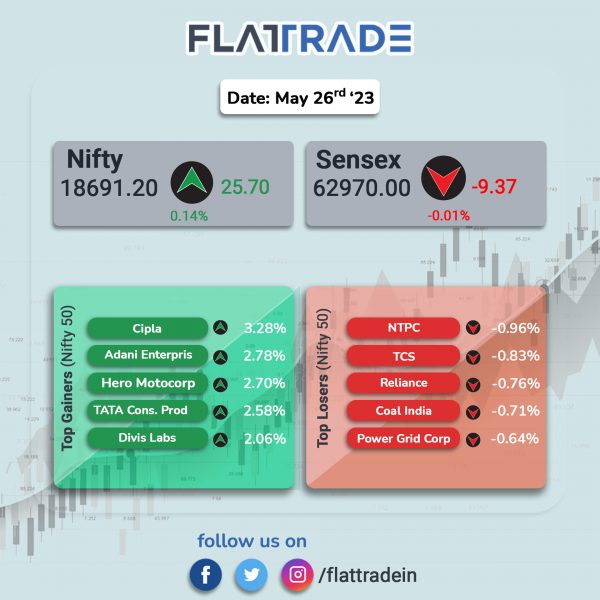

Sensex ended flat, while the Nifty 50 index closed slightly higher, helped by gains in pharma and auto stocks. The Sensex fell 0.01% and the Nifty 50 index rose 0.14%.

Broader markets performed better than headline indices. The Nifty Midcap 100 closed 0.92% higher at 35,120.45. The BSE Smallcap rose 0.71% to 32,216.89.

Top gainers among Nifty sectoral indices were Pharma [1.53%], Auto [1.15%], Metal [0.76%], FMCG [0.68%], and Realty [0.33%]. Top losers were Energy [-0.43%] and PSU Bank [-0.18%].

Indian rupee was unchanged at 80.04 against the US dollar on Monday.

Stock in News Today

ICICI Bank: The board of directors of the lender is scheduled to meet on June 29 to consider a proposal for delisting of equity shares of ICICI Securities. ICICI Bank held 74.85% stake in ICICI Securities as on March 2023. The stock broker’s current market capitalisation stands at Rs 18,207.04 crore. ICICI Securities is a subsidiary of ICICI Bank.

Infosys: The IT company said that it has signed a strategic collaboration with Danske Bank to accelerate the bank’s digital transformation initiatives. This collaboration will help Danske Bank achieve its strategic priorities towards better customer experiences, operational excellence, and a modernized technology landscape, powered by next-gen solutions.

Larsen and Toubro (L&T): The company said that its Power Transmission & Distribution Business of L&T Construction has secured significant new orders in India and abroad. As per L&T’s classification, the value of the orders lies between Rs 1,000 crore to Rs 2,500 crore.

Shree Cement: Shares of the company tumbled after media reports said that the cement manufacturer has allegedly evaded Rs 23,000 crore in taxes. However, the company said in an exchange filing that any information circulating in the media is incorrect and has been published without seeking prior inputs from the company. On June 21, 2023, the Income Tax department had conducted raids at five locations of Shree Cement in Rajasthan.

Tata Consultancy Services (TCS): The IT behemoth and Standard Life have partnered for digital solutions. TCS will enhance the customer experience for the policyholders of Standard Life in Europe, using the TCS Digital Platform for Life and Pensions, powered by TCS BaNCS. With this partnership, TCS will set up a customer operations center in Germany, and a future-ready Life and Pensions Digital Platform for Germany and Austria, with capabilities to extend into other European markets.

Kotak Mahindra Bank: The private lender announced that it has allotted 1,89,500 non-convertible debentures (NCDs) having a face value of Rs 1 lakh each aggregating to Rs 1,895 crore, on private placement basis. The NCDs will have a coupon rate of 7.55% per annum and the tenure of the instrument is 7 years and 1 day from the date of allotment. The maturity is June 24, 2030. The NCDs will be listed on the National Stock Exchange of India (NSE) and Bombay Stock Exchange (BSE).

Adani Power: The company said that it has commissioned Unit 2 of the 800 megawatt (MW) power project in Godda district, Jharkhand. Adani Power (Jharkhand) (APJL), a wholly-owned subsidiary of the company, will export entire power generated from the 2×800 MW Godda ultra-supercritical thermal power plant (USTCPP) directly to Bangladesh on a commercial basis. APJL APJL has a 25-year contract with Bangladesh Power Development Board.

NTPC: The state-run company announced that its board has approved raising up to Rs 12,000 crore in one or more tranches by issuing non-convertible debentures (NCDs) through private placement in the domestic market.

L&T Technology Services (LTTS): The company and BSNL have signed an agreement to enable private 5G network deployments for global enterprises. BSNL and LTTS plan to co-innovate and jointly bring to market private 5G connectivity solutions to accelerate digital transformation for enterprises, according to the company’s press release.

RailTel Corporation of India: The company announced that it has received a work order from Tamil Nadu State Marketing Corporation for Rs 294.37 crore. The order entails implementation of the project on integrated solution enabling end-to-end computerization & connectivity of core and support functions of TASMAC. The order is to be executed in a period of five years.

Yes Bank: The lender said that Moody’s Investors Service has affirmed the ratings assigned to the bank’s instruments with ‘stable’ outlook. The rating and stable outlook are driven by the improvement in India’s macro profile to ‘moderate+’ from ‘moderate’, along with Moody’s expectation that Yes Bank’s financial performance will remain stable over the next 12- 18 months. The agency also expects Yes Bank’s asset quality to be stable as the bulk of its legacy problem assets have been resolved, while India’s good economic momentum will support the performance of its newly originated loans.

Global Health (GHL): The company informed that CRISIL Ratings has upgraded its long-term rating on the bank facilities of the company to ‘CRISIL AA-/Stable’ from ‘CRISIL A+/Positive’ and has reaffirmed the short-term rating at ‘CRISIL A1+’. The rating agency said that the ratings were upgraded due to factors such as improvement in the business and financial risk profiles of the company, driven by faster-than-expected ramp-up of operations in the Lucknow (Uttar Pradesh) hospital, and the Patna (Bihar) hospital in fiscal 2023 and improving operating performance of the flagship hospital in Gurugram.

Mahindra and Mahindra (M&M): The company said that CRISIL Ratings has reaffirmed its ‘CRISIL AAA/Stable/CRISIL A1+’ ratings on the bank facilities and debt instruments of the company. CRISIL said that the rating continued to reflect the leadership position of M&M in the tractor industry in India, its strong presence in the light commercial vehicles (LCVs) segment and the benefits of diversification. The ratings also factor in the strong financial risk profile, supported by a robust balance sheet with low leverage and high financial flexibility.

Unichem Laboratories: The pharma firm announced that its board has approved the re-appointment of Dr. Prakash A. Mody as the chairman & managing director of the company for a period of three years, effective from 1 July 2023.

Capacite Infraprojects: The company received an order worth Rs 452.50 crore from a private sector client for construction of residential & commercial tower in National Capital Region (NCR).

Ajanta Pharma: The US drug regulator issued zero observations for the company’s Dahej Facility. The USFDA inspected the facility from 19 June 2023 to 23 June 2023.

MIC Electronics: The company said that it has received a work order from Jabalpur Railway Division for Rs 5.13 crore. The order entails supply, installation, testing and commissioning of passenger amenities at 15 Stations of Jabalpur division under Amrit Bharat Station Scheme. The work will be executed within 9 months from the date of issue of letter of acceptance.

RattanIndia Power: The company announced that it has refinanced its senior debt of Rs 1114 crore in a transaction led by Kotak Mahindra Bank. The company said its operational performance remains strong with average EBITDA exceeding Rs 1,000 crore per annum since commissioning over the last 8 years.

BIGBLOC Construction: The company said that its joint venture company, Siam Cement Big Bloc Construction Technologies, has entered into agreement for supply of machinery & technical services with China’s Changzhou Machinery And Equipment Imp. and Exp. Co. & Jiangsu Teeyer Intelligent Equipment Co. The contract is for supplying machinery and technical service for an autoclaved aerated concrete blocks (AAC) plant.