Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.15% higher at 19,485.50, signalling that Dalal Street was headed for positive start on Tuesday.

Asian shares were trading higher, tracking the US markets overnight, ahead of inflation data and earnings season. The Nikkei 225 index rose 0.28% and the Topix gained 0.13%. The Hang Seng jumped 1.15% and the CSI 300 index rose 0.16%.

Indian rupee ended 18 paise down at 82.57 against the US dollar on Monday.

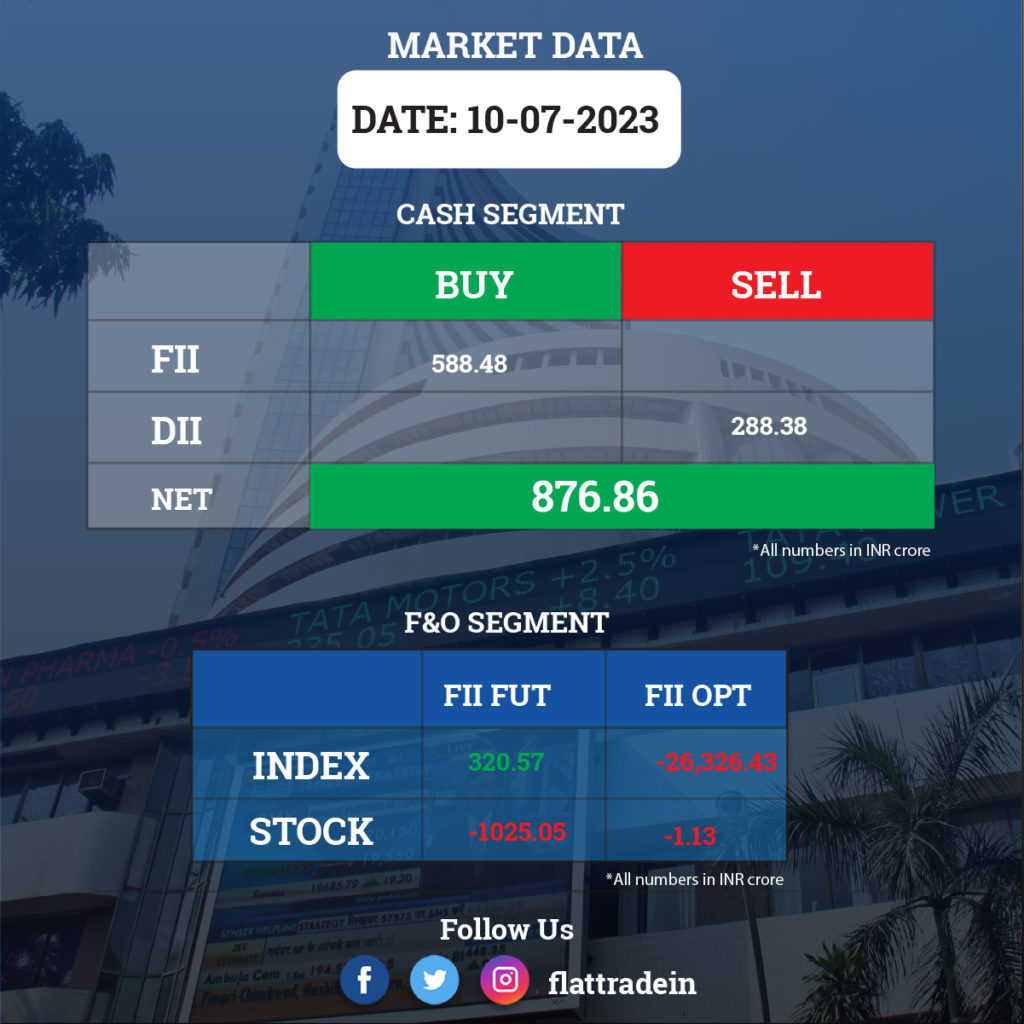

FII/DII Trading Data

Upcoming Results

PCBL, Elecon Engineering Company, Excel Realty N Infra, Generic Engineering Construction and Projects, Plastiblends India, Eiko Lifesciences, and Welcure Drugs & Pharmaceuticals will be in focus ahead of the quarter earnings on July 11.

Stocks in News Today

State Bank of India (SBI): The country’s largest lender has proposed to participate in an initial public offering (IPO) of National Securities Depositories (NSDL) via offer for sale of up to 2% equity stake or 40 lakh shares in NSDL. The bank holds 5% stake in NSDL.

Vedanta: Taiwan’s Foxconn said that it is pulling out of the joint venture with billionaire Anil Agarwal-led Vedanta that was set up to produce semiconductors from India. Foxconn further said that it was working to remove the Foxconn name from what now is a fully-owned entity of Vedanta. It has no connection to the entity and efforts to keep its original name would cause confusion for future stakeholders, the electronic major added. Meanwhile, Vedanta said it was fully committed to its semiconductor fab project and has lined up other partners to set up India’s first foundry, CNBC-TV18 reported.

Tata Communications: The company’s subsidiry — Tata Communications International Pte Ltd (TCIPL) — has entered into a share purchase agreement to acquire the remaining equity ownership of Oasis Smart Sim Europe SAS (OSSE France). As a result, TCIPL will increase its equity shareholding in OSSE France from its current stake of 58.1% to 100%.

APL Apollo Tubes: Chhattisgarh government has granted incentives of Rs 500 crore to the company’s subsidiary APL Apollo Building Products. The incentives are for setting up a manufacturing facility at Baloda Bazar in Chhattisgarh.

Power Finance Corporation (PFC): The firm has raised Rs 6,100 crore through a blend of medium-term (22 months) and long-term bonds (10-year) for onward lending in the key infrastructure sector.

Nazara Technologies: The gaming and sports media platform has received approval from its board of directors for raising of funds up to Rs 750 crore via issuance of equity shares through one or more qualified institutional placements or preferential allotment.

Sanghvi Movers: The crane rental company has received work orders worth Rs 150 crore from Independent Power Producers (IPP) in the renewable energy sector for a duration of 18 months. The company will provide crane rental services along with allied services. Crane services account for approximately 50% of the total contract value.

Satin Creditcare Network: The microfinance company has received board approval for fund raising up to Rs 5,000 crore via non-convertible debentures, on a private placement basis, in one or more tranches, within one year from the date of shareholders’ approval. The board has also approved the appointment of Vikas Gupta as Chief Compliance Officer with effect from July 11.

Gravita India: The company expects a loss of Rs 2.50 crore at its manufacturing unit at Mundra in Gujarat due to Cyclone Biparjoy which will be covered by insurance. The company is facing a partial production loss of about 20 days which includes reworking on finished goods.

CarTrade Tech: The company has inked share purchase agreement to buy 100% stake in Sobek Auto India from its holding company, OLX India B.V., in a deal worth Rs 537 crore.

Mcleod Russel India: The company will exclusively discuss, negotiate and evaluate mechanism with Carbon Resources for monetizing identified assets of the company. This is for a one-time settlement of debt owed by the company to its lenders.

Taylormade Renewables: The company’s board has approved a proposal to migrate its equity shares from BSE SME platform to the main board of BSE.