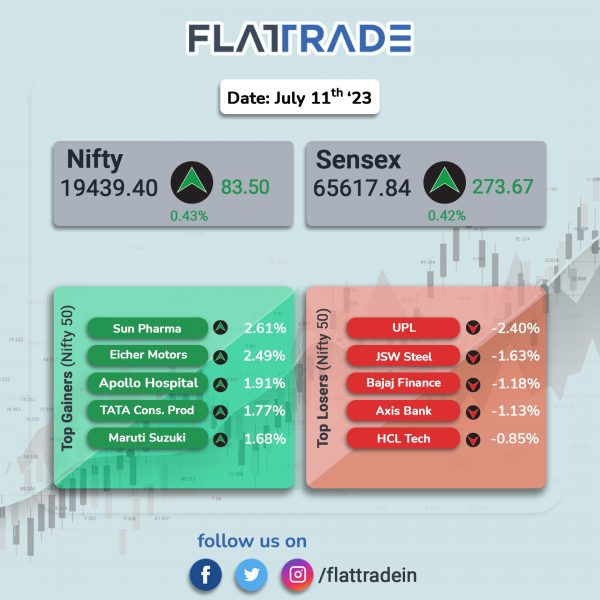

Dalal Street ended higher, aided by positive global cues as well as gains in auto and healthcare stocks. The Sensex rose 0.42% and the Nifty 50 index gained 0.43%.

In broader markets, the nifty Midcap 100 advanced 0.88% and the BSE Smallcap rose 0.82%.

Top gainers among Nifty sectoral indices were Auto [1.39%], Consumer Durables [1.31%], FMCG [1.23%], Healthcare [1.18%], and Pharma [1.04%]. Top losers were Financial Services [-0.44%], Bank [-0.26%], Metal [-0.25%], and PSU Bank [-0.19%].

Indian rupee appreciated by 21 paise to 82.37 against the US dollar on Tuesday.

Stock in News Today

Larsen and Toubro (L&T): The company’s Kattupalli Shipyard near Chennai has qualified for the Master Shipyard Repair Agreement (MSRA) after elaborate assessment by the US Navy and the Military Sealift Command. “The agreement marks yet another step in the growing relationship between the biggest and the oldest democracies of the world, further strengthening the strategic partnership between them in the defence sector”, the company said in a press release.

IDFC FIRST Bank: The bank said that CRISIL Ratings has reaffirmed its ratings on the debt instruments of the bank at ‘CRISIL AA+/Stable/CRISIL A1+’. CRISIL said that the rating continues to be driven by steady scale up of business, backed by strengthening of both retail asset and liability side franchise, improved asset quality, and expectation of continued improvement in operating and overall profitability. Furthermore, the ratings reflect the bank’s healthy capitalisation level.

Suzlon Energy: The company received order from The KP Group for the development of a 47.6 (megawatt) MW wind power project located at Vagra, Gujarat. Suzlon will supply their S133 wind turbines (equipment supply) and supervise execution and commissioning of the project. The firm will also provide comprehensive operations and maintenance services post‐commissioning. The said project is expected to be commissioned in 2024.

Zen Technologies: The company said in an exchange filing that it has bagged an export order valued at approximately Rs 340 crore ($41.5 million). Zen Technologies is a leading provider of military training and anti-drone solutions.

Elecon Engineering: The company’s consolidated net profit surged 72.44% to Rs 72.96 crore in Q1FY24 from Rs 42.31 crore in Q1FY23. Revenue from operations increased 26.43% YoY to Rs 414.34 crore in the quarter ended June 2023. During the quarter, adjusted EBITDA grew 33.2% YoY to Rs 96 crore, while adjusted EBITDA margin improved by 117 basis points on YoY basis to 23%.

SBI Cards and Payment Services: The company announced that Rama Mohan Rao Amara has tendered his resignation from the position of managing director & chief executive officer (CEO) of the company with effect from the close of business hours on August 11, 2023. Rao resigned as he has been transferred back to State Bank of India, said the company. Meanwhile, the company’s board has appointed Abhijit Chakravorty as managing director & CEO of the company, effective from August 12, 2023, for a period of two years, subject to necessary approvals.

IFGL Refractories: The company has received an approval from Industrial Promotion and Investment Corporation of Odisha (IPICOL) to set up new manufacturing facility of Casting Refractories. The manufacturing facility’s installed capacity will be 240,000 pieces per annum. The project costs will be in the region of Rs 150 crore and commercial production target of March 2025. The new plant is part of its overall growth strategy to the meet the expected growth of the domestic Indian steel sector.

Premier Explosives: Shared of the company hit an upper circuit of 20% after the company announced that it has received orders worth Rs 552.26 crore from the Ministry of Defence for procurement of flares and chaffs. Both the orders are to be executed within twelve months.

Cyient DLM: Nippon India Mutual Fund bought 0.63% stake via bulk deal on Monday (July 10). Nippon India Mutual Fund A/c Power and Infra Fund bought 5,00,000 shares of Cyient DLM at an average price of Rs 403 per share, according to NSE data.

Minda Corporation: The company has secured a significant contract from a leading OEM to produce battery chargers for electric vehicles (EVs) worth Rs 750 crore. The product will be manufactured at Spark Minda’s, Spark Minda Green Mobility Systems (a wholly owned subsidiary of Minda Corporation) facility at Pune.

PCBL: The company announced the commissioning of first phase of its specialty chemicals capacity expansion at Mundra, Gujarat. After completion, PCBL will have a specialty chemicals production capacity of 40,000 MTPA at its Mundra plant.

Motherson Sumi Wiring India: The company informed that its board has appointed Mahender Chhabra as chief financial officer (CFO) of the company effective from July 10, 2023. Further, Gaya Nand Gauba will be superannuating on 31 August 2023 and accordingly will be handing over his responsibilities of chief financial officer to Mahender Chhabra effective from 10 July 2023.

Roto Pumps: The board of directors has approved the allotment of 1,57,03,805 equity shares of Rs 2 each as fully paid-up bonus equity shares. The company issued one bonus share for each equity share held, to the eligible shareholders. The company had announced July 8 as the record date for this purpose.

DCB Bank: The bank announced that it has partnered with Max Life to offer a comprehensive range of life insurance solutions. Through this collaboration, Max Life and DCB Bank will provide a variety of life insurance products to the bank’s customers.