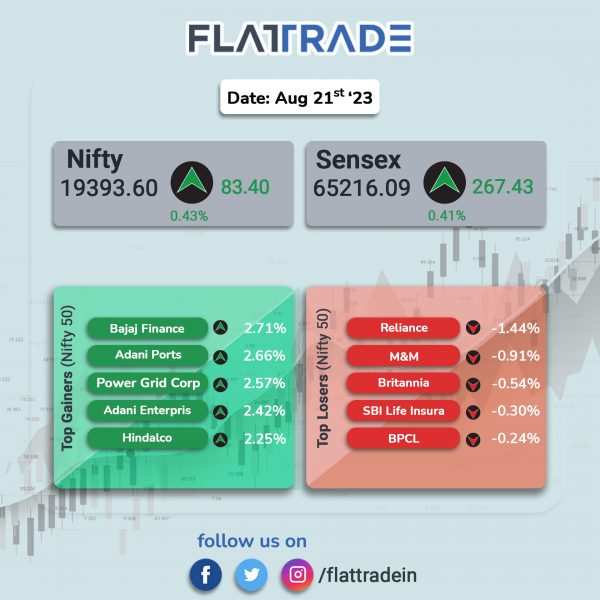

Dalal Street closed higher, aided by gains in IT, financial services and Adani Group stocks. The Sensex closed 0.41% higher and the Nifty ended 0.43% higher.

In broader markets, the Midcap 100 index rose 0.82% and the BSE Smallcap gained 0.71%.

Top gainers were Metal [1.3%], IT [1.09%], Realty [0.99%], FMCG [0.65%], and Private Bank [0.56%]. Top losers were PSU Bank [-0.64%], Media [-0.29%], Oil & Gas [-0.19%].

The Indian rupee stood at 83.10 against the US dollar on Monday.

Stock in News Today

Larsen & Toubro (L&T): The energy hydrocarbon arm of the company has secured ‘significant’ order from Saipem & Clough JV (SCJV), Australia, for fabrication and supply of process and piperack modules for 2.3 MMTPA of Perdaman Chemicals and Fertilisers Pty urea plant. As per Larsen & Toubro’s (L&T) classification, the project is worth between Rs 1,000 crore and Rs 2,500 crore. The plant will be constructed on the Burrup Peninsula, approximately 20 km north of Karratha, Western Australia. On completion, this facility will be the largest urea plant in Australia and one of the largest in the world, said the company. The scope comprises about 50,000 MT of modules to be delivered in 32 months.

ABB India: The company said that it has secured a major automation contract from Reliance Life Sciences (RLS), to automate their new biopharmaceutical manufacturing plants in Nashik, Maharashtra. The manufacturing plant, which is spread over 160-acre, will produce plasma proteins, biopharmaceuticals, oncology pharmaceuticals, and vaccines. ABB will deliver the DCS on the latest Windows Server 2022 platform, which will ensure extended lifecycle support and best-in-class software management.

Bharat Heavy Electricals (BHEL): The company said that it has received an order from Mahan Energen, a wholly owned subsidiary of Adani Power worth Rs 4,000 crore. The order entails supply of equipment and supervision of erection & commissioning for 2×800 MW power project based on supercritical technology at Bandhaura, Madhya Pradesh.

Bharat Forge: The company announced that its wholly owned defence subsidiary, Kalyani Strategic Systems, has bagged two export orders aggregating around Rs 850 crore. Kalyani Strategic Systems received export orders from friendly countries for the supply of components and armored vehicle chassis, to be executed over a period of 18 months.

Navin Fluorine International: The company has informed that Rajendra Sahu has been promoted to ‘chief executive officer- designate’ (CEO-designate) of CDMO business with effect from 1 October 2023. Sahu has been with the company since April 2020 and is currently the president – operations of CDMO business. He has over 26 years of experience working with companies like Dr. Reddy’s, Glenmark, Ranbaxy, Sun Pharmaceutical and PI Industries, handling diverse set of roles spanning across projects, process engineering, technology transfer, production and business development.

Mahindra & Mahindra (M&M): The company announced that it will be undertaking proactive inspection and rectification of its select XUV range of products due to the potential risk of wiring loom and ineffective brake potentiometer. The auto maker will inspect wiring loom routing in the engine bay of 1,08,306 units of XUV700 manufactured between 8 June 2021 to 28 June 2023 for a potential risk of abrasion cut of wiring loom. Additionally, 3,560 units of XUV400 vehicle manufactured between 16 Feb 2023 to 5 June 2023, will be inspected for ineffective spring return action of the brake potentiometer.

CreditAccess Grameen: The company said that the executive, borrowings and investment committee of its board has approved the issue of non-convertible debentures (NCDs) for Rs 400 crore with a green shoe option of up to Rs 600 crore. The secured rated, listed, redeemable NCDs have a face value of Rs 1,000 each. The issue will be from 24 August 2023 to on 6 September 2023. These debentures are proposed to be listed on National Stock Exchange of India (NSE) and Bombay Stock Exchange (BSE).

Inox Green Energy Services: The company announced that its subsidiary I-Fox Windtechnik India has won an order from NLC India, a state-owned enterprise, for the Operation & Maintenance (O&M) of 51MW WTGs located in Tamil Nadu. The scope of the contract comprises comprehensive O&M, including power evacuation system, for a period of five years with a revenue realisation of about Rs 40 crore during the contract period.

PNB Housing Finance: The company said that it has resolved and fully recovered its large corporate non-performing account of Rs 784 crore, which translates into around 1.3% of its total loan asset as on 30 June 2023. At the end of June 2023 quarter, the gross non-performing assets of the company stood at Rs 2,270 crore (3.76% of loan asset), while loan assets was at Rs 60,395 crore.

Lemon Tree Hotels: The company announced the opening of its sixth property in Gujarat under the brand ‘Lemon Tree Hotel’. The hotel features 42 well-appointed rooms and suites, complemented by a multicuisine coffee shop as well as a well-equipped fitness center and a refreshing swimming pool. The hotel will be managed by Carnation Hotels, a wholly owned subsidiary and the hotel management arm of Lemon Tree Hotels.

Syschem (India): Shares of the company hit an upper limit of 20% after the company said it has received sales order worth Rs 83.23 lakhs from a domestic entity for supplying products. The said order entails supplying 1350 KGS of Cefadroxil Monohydrate IP/BP Power Make in 25 packings. The company is required to deliver this order within a timeframe of 15 days. In a separate announcement, Syschem (India) informed today that it has received a legal notice on behalf of Atul Chaubey and Rama Atul Chaubey, demanding payment of Rs 40.40 lakh under section 140 of the Indian Contract Act, 1872.

Knowledge Marine & Engineering: The company’s subsidiary bagged four different letter of intents (LOIs) from four different sand buyers for a cumulative amount of Rs 342.06 crore. The contract pertains to the “supply and sale of dredged marine sand,” and it encompasses a combined value of about Rs 342.06 crore, over a steadfast period of five years. The project is slated to commence during the third quarter of the fiscal year 2024.

Jio Financial Services: The company shares got listed at Rs 262 apiece on NSE as against derived price of Rs 261.85, while it got listed at Rs 265 apiece on BSE. Shares of the company closed at Rs 248.9 on the NSE and 251.7 on the BSE. Shares on the BSE touched a high of Rs 278.2 and on the NSE, shres touche a high of Rs 262.05 per share.