Market Opening - An Overview

GIFT Nifty on the NSE IX was trading 0.16% higher at 19,269, signalling that Dalal Street was headed for positive start on Monday.

Asian shares were trading higher after Beijing announced new measures to support its economy. The Nikkei 225 index rose 1.68% and the Topix jumped 1.36%. The Hang Seng surged 2% and the CSI 300 index advanced 2.36%.

The Indian rupee depreciated by 6 paise to 82.65 against the US dollar on Friday.

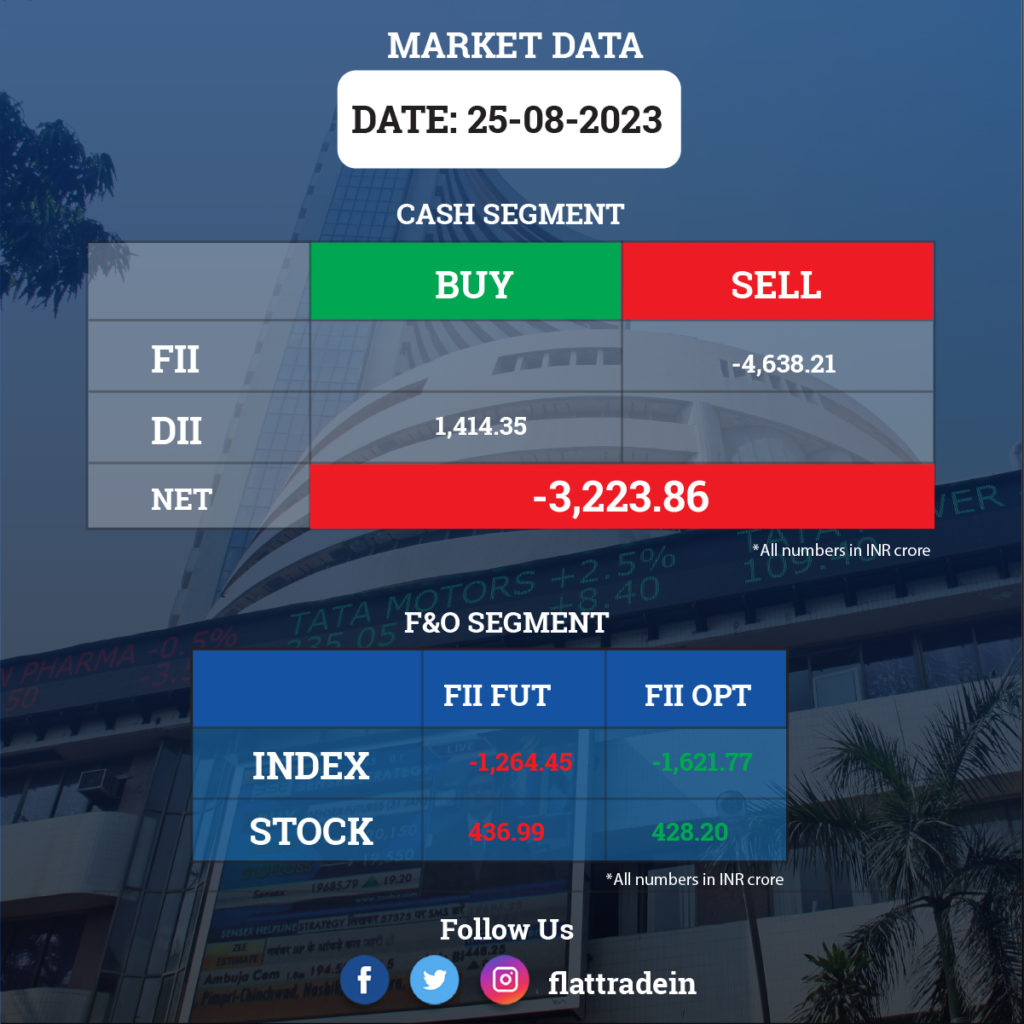

FII/DII Trading Data

Stocks in News Today

Jio Fnancial Services: The removal of the company’s shares from Sensex and other BSE indices has been postponed again by another three days to September 1 as the stock hit the lower circuit on both August 24 and 25. Earlier, Jio Financial was scheduled to be dropped from Nifty 50 and Sensex on August 24, which was postponed to August 29 as the stock kept hitting the lower circuit. Meanwhile, Motilal Oswal Mutual Fund has bought 3.72 crore shares or 0.58% stake in Jio Financial, via open market transactions at an average price of Rs 202.8 per share.

Bharat Electronics: The PSU company has received new defence and non-defence orders worth Rs 3,289 crore during July and August 2023. It includes a Rs 1,075 crore order from Hindustan Shipyards for the supply of CMS, communication systems, electronic warfare systems, and other sensors for fleet support ships.

Larsen & Toubro (L&T): The infrastructure conglomerate has received shareholder approval for a proposal to buyback shares of up to Rs 10,000 crore.

HDFC Bank: The biggest private sector lender in India has reappointed Sanmoy Chakrabarti as Chief Risk Officer for a period of five years, with effect from Decemeber 14, 2023.

BEML: The company has secured an export order worth $19.71 million from Russia-based KAMSS for its Dozer BD355. The contract will be executed in different phases starting this month.

Linde India: The company has received a letter of acceptance from SAIL for the installation of a 1000-tonne-per-day cryogenic oxygen plant at Rourkela to construct, operate, and maintain the plant for a period of 20 years.

Elpro International: In a regulatory filing, the Pune-based company has acquired about 1.5 lakh shares of Jio Financial Services totalling Rs 3.10 crore, around 3 lakh shares in Manappuram Finance aggregating up to Rs 4.20 crore, and 1.07 lakh shares of BSE worth Rs 10 crore.

IndoStar Capital Finance: The company has sold a significant portion of its legacy corporate loan book to Phoenix ARC, which consists of certain accounts tagged in Stage 2, aggregating to outstanding dues of Rs 915 crore, according to its exchange filing. As per the agreement, Phoenix ARC will set up a trust to monitor the progress of real estate projects and will also consider funding certain amounts towards financing the completion of these projects.

Garden Reach Shipbuilders & Engineers: The state-owned warship builder has signed Memorandum of Understanding (MoU) with the DEMPO Group, the business house of Goa, to launch a collaboration model to build commercial vessels in three premier shipyards of DEMPO at Goa and Bhavnagar.

India Grid Trust: The company has completed the acquisition of 100% of the units in Virescent Renewable Energy Trust for Rs 4,000 crore. The acquisition adds 16 operating solar projects held by 15 SPVs with a capacity of 538 MWp.

NMDC Steel: The company’s Nagarnar steel plant achieved the feat of producing hot-rolled coil in nine days from hot metal. The plant has a capacity of three million tonnes.

Karur Vysya Bank: The bank has inaugurated 10 new branches, increasing its branch network to 822. The ATM network of the bank will increase to 1,640 and cash recyclers to 611.

Crompton Greaves Consumer Electricals: The company has launched its mass premium induction products, HighSpeed Java and HighSpeed TORO in the domestic market.

Somany Ceramics: The company will invest Rs 33 crore in its subsidiary — Sudha Somany Ceramics — and divest its entire 51% stake in Somany Fine Vitrified.

Waaree Renewable Technologies: The company’s CFO, Hitesh Pranjivan Mehta, has resigned from the post, but will continue to be an executive director. The company’s board has nominated Dilip Panjwani as the company’s CFO.

NDTV: The media company announced that it will launch a new regional channel, NDTV Rajasthan, on September 5.

Brightcom Group: The company said that Chairman and Managing Director Suresh Reddy and CFO Narayana Raju have resigned.