Market Opening - An Overview

GIFT Nifty futures on the NSE IX was trading higher by 0.12% at 20,150.50, signalling that Dalal Street was headed for positive start on Wednesday.

Most Asian shares were trading lower. Japan’s Topix fell 0.25%, while the Nikkei 225 index rose 0.13%. In China, the CSI 300 index dropped 0.59% and the Hang Seng slumped 1.49%.

The Indian rupee appreciated by 4 paise to close at 83.34 against the US dollar on Tuesday.

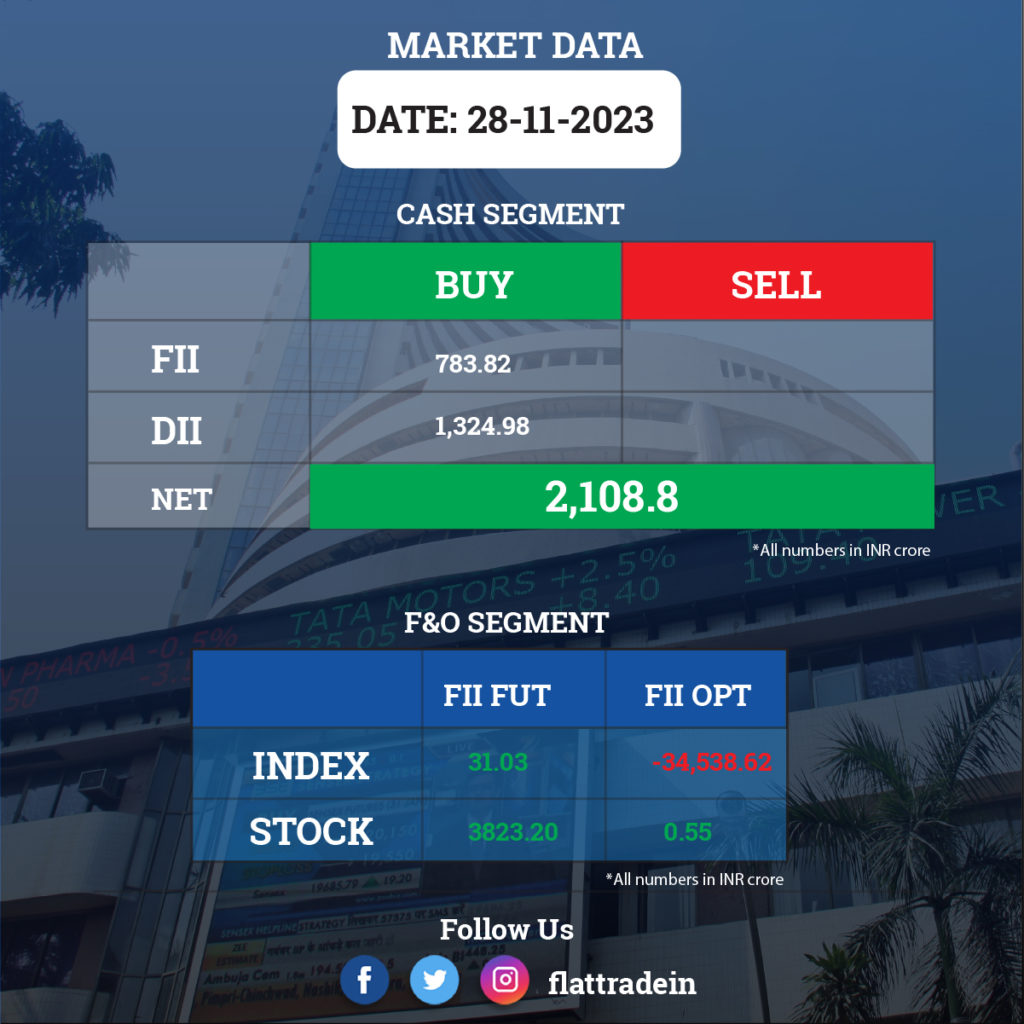

FII/DII Trading Data

Stocks in News Today

Canara Bank: The state-owned bank has received approval from the RBI for divesting 70% stake in its unlisted subsidiary Canbank Factors. Further, Canara Bank is holding 69.14 % shares in its unlisted subsidiary, Canbank Computer Services Ltd (CCSL), and proposes to buy shares of other shareholders i.e Bank of Baroda (BOB) and DBS Bank India Ltd (DBIL). Canara Bank is also exploring transferring the credit Card and other digital product portfolio of the Bank to CCSL, according to its exchange filing.

Tata Power: The company’s subsidiary, Tata Power Renewable Energy, has received a Letter of Award (LOA) for developing a 200 MW firm and dispatchable renewable energy (FDRE) project with SJVN.

Bharat Heavy Electricals (BHEL): The company has signed a Memorandum of Cooperation with a French state-owned company, Electricité de France S.A., France, to explore the opportunity to maximise the local content of the Jaitapur nuclear power project to be established by NPCIL in India. The Ministry of Defence inked a contract with BHEL to procure 16 upgraded Super Rapid Gun Mounts and accessories worth Rs 2,956.89 crore for the Indian Navy.

Zomato: Alipay is likely to offload a 3.14 percent stake or 29.6 crore shares in the food delivery giant at a price of Rs 111.28 apiece aggregating up to Rs 940 crore via a block deal, according to various media reports.

Siemens: The technology company has recorded a 49.8% YoY growth in net profit at Rs 571.6 crore for the quarter ended September FY23, backed by topline and operating performance. Revenue from operations grew by 24.7% year-on-year to Rs 5,807.7 crore. New orders increased 12 % YoY to Rs 4,498 crore during the quarter under review.

GAIL India: The Ministry of Petroleum and Natural Gas has appointed Rajeev Kumar Singhal as Executive Director with effect from the date of his assumption of charge of the post till the date of his superannuation which will be February 29, 2028.

PCBL: The carbon black manufacturer has received approval from its board for the acquisition of Aquapharm Chemicals for Rs 3,800 crore. With this acquisition, the company forays into the global specialty segments of water treatment chemicals and oil and gas chemicals.

Aster DM Healthcare: The board of directors of Affinity has approved the sale of shares held by Affinity in Aster DM Healthcare FZC (“Aster FZC”) to Alpha GCC Holdings Limited and the execution of definitive agreements in connection with the transaction. The consideration receivable from the transaction is USD 1.001 billion of which USD 903 million is payable at closing and up to USD 98.8 million may be received subsequently subject to certain contingent events. This includes an earnout of up to USD 70 million based on EBITDA achieved by the GCC business for the Financial Year ending 31 March 2024. Alpha GCC Holdings Limited will be owned by the promoter/ promoter group of Aster India and funds managed by Fajr Capital Advisors Limited in the shareholding ratio of 35:65, respectively, at closing of the transaction.

Wipro: The technology services and consulting company has launched a continuous compliance solution built on Amazon Security Lake in collaboration with Amazon Web Services (AWS). This solution is designed to equip enterprises with advanced capabilities to meet compliance requirements.

Tube Investment of India: The Ministry of Corporate Affairs has approved the scheme of amalgamation of Cellestial E-Mobility and Cellestial E-Trac with Tl Clean Mobility.

ICICI Lombard General Insurance: The company said in an exchange filing that MD and CEO Bhargav Dasgupta has sold 2.5 lakh equity shares in tranches, and the last transaction was undertaken by him on Nov. 28.

Havells: The company has launched its consumer durable brand ‘Lloyd’ in the Middle East market. Lloyd has joined hands with TeknoDome, a distribution conglomerate headquartered in Dubai, for the desired coverage and reach in the Middle East region.

Varun Beverages: The company has incorporated a subsidiary company in Mozambique, i.e., VBL Mozambique, SA, to carry on the business of distribution of beverages.

R Systems International: The board of unit Velotio Technologies has approved the acquisition of an additional 60% equity share of Scaleworx Technologies. Post-acquisition, Scaleworx will become a wholly owned subsidiary of Velotio.

Global Health: Sanjeev Kumar has resigned as chief financial officer and key managerial personnel w.e.f. November 28.

Timex Group: Sylvain Ernest Louis Tatu has resigned as Non-Executive Director w.e.f. November 27 due to personal reasons.

IG Petrochemicals: The company has decided to file an appeal against an income tax demand amounting to Rs 46.26 crore with the Karnataka High Court.

PDS: The board has appointed Sandra Campos as an additional woman independent director for a period of two years, w.e.f. November 28.