POST-MARKET REPORT

The markets ended lower in the volatile session on March 26 with Nifty around 22,000 amid selling seen in the Information Technology, Bank, and Media sectors.

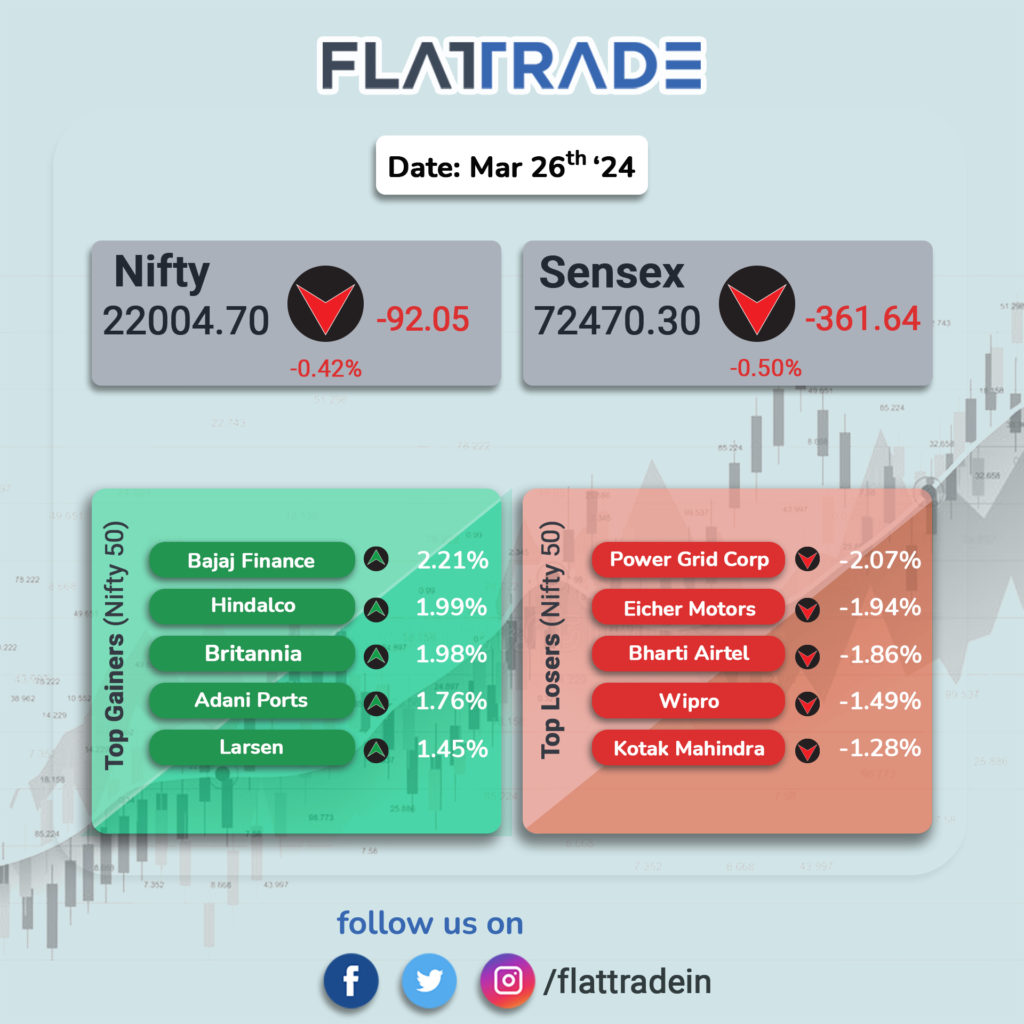

At close, the Sensex was down 361.64 points, or -0.5 percent, at 72,470.30, and the Nifty was down 92.10 points, or -0.42 percent, at 22,004.70.

Bajaj Finance, Hindalco Industries, Britannia Industries, Adani Ports, and L&T were among the top gainers on the Nifty, while losers were Power Grid Corporation, Eicher Motors, Bharti Airtel, Kotak Mahindra Bank and Wipro.

Among the sectors, Bank and Information Technology indices were down 0.5 percent each, while Capital Goods, Realty, Oil & Gas, and Metal indices gained 0.5-1 percent.

The broader indices outperformed the main indices with the BSE Midcap index rising 0.7 percent and the Smallcap index closing flat.

STOCKS TODAY

JSW Energy: The company shares gained 2.5 percent in trade today after the company’s subsidiary announced it would acquire a 45 MW Vashpet wind project from Reliance Power. JSW Renewable Energy (Coated), a wholly-owned subsidiary of JSW Neo Energy and a step-down subsidiary of JSW Energy, agreed to acquire 45 MW of renewable energy generation capacity from Reliance Power, in Maharashtra. The transaction values the project at Rs 132 crore adjusted for net working capital.

InterGlobe Aviation: After an analysts’ meeting on March 22, brokerages such as UBS Securities, Kotak Institutional Equities, and Motilal Oswal Financial Services expect strong growth for IndiGo on the back of its expansion plans as well as robust growth in the domestic air travel sector.

Ambuja Cements: On March 26, shares of Adani Group-owned Ambuja Cements were trading in the green after it sold 51.66 lakh equity shares of Sanghi Industries, which represents around two percent of the paid-up equity of the firm. The stake was offloaded by Ambuja Cements through open market transactions to comply with the minimum public shareholding norms.

SpiceJet: Low-cost airline SpiceJet Ltd on March 26 announced a settlement with Export Development Canada (EDC) to settle liabilities worth Rs 755 crore, prompting a sharp uptick in the share price on BSE. The agreement is being termed by the airline as the ‘biggest breakthrough in SpiceJet’s financial restructuring efforts”. The settlement will generate savings to the tune of Rs 567 crore for the airline.

RateGain Travel Technologies: The shares advanced over 3 percent on March 26 morning after the company announced a strategic partnership with Madrid-based Summerwind GSA for airline representation. The company’s AI-powered pricing solution AirGain will collaborate with Summerwind’s deep industry experience and global reach, it said. Summerwind can offer its airline clients access to AirGain’s data and insights, giving them a competitive edge in the fast-paced aviation market.

Dr Lal PathLabs: Shares of Dr Lal PathLabs jumped over 5 percent on March 26 after the diagnostics services provider received a “double” upgrade from Kotak Institutional Equities. The brokerage upgraded the stock to “add” from “sell” and raised fair value (FV) to Rs 2,360 from Rs 1,975, largely led by increased growth estimates beyond FY26, as it built in lower competitive intensity.