POST-MARKET REPORT

Indian stock market benchmarks, the Sensex and the Nifty 50 closed with significant gains on Monday, April 29, led by strong buying in banking and financial stocks after upbeat March quarter results of their sectoral heavyweights.

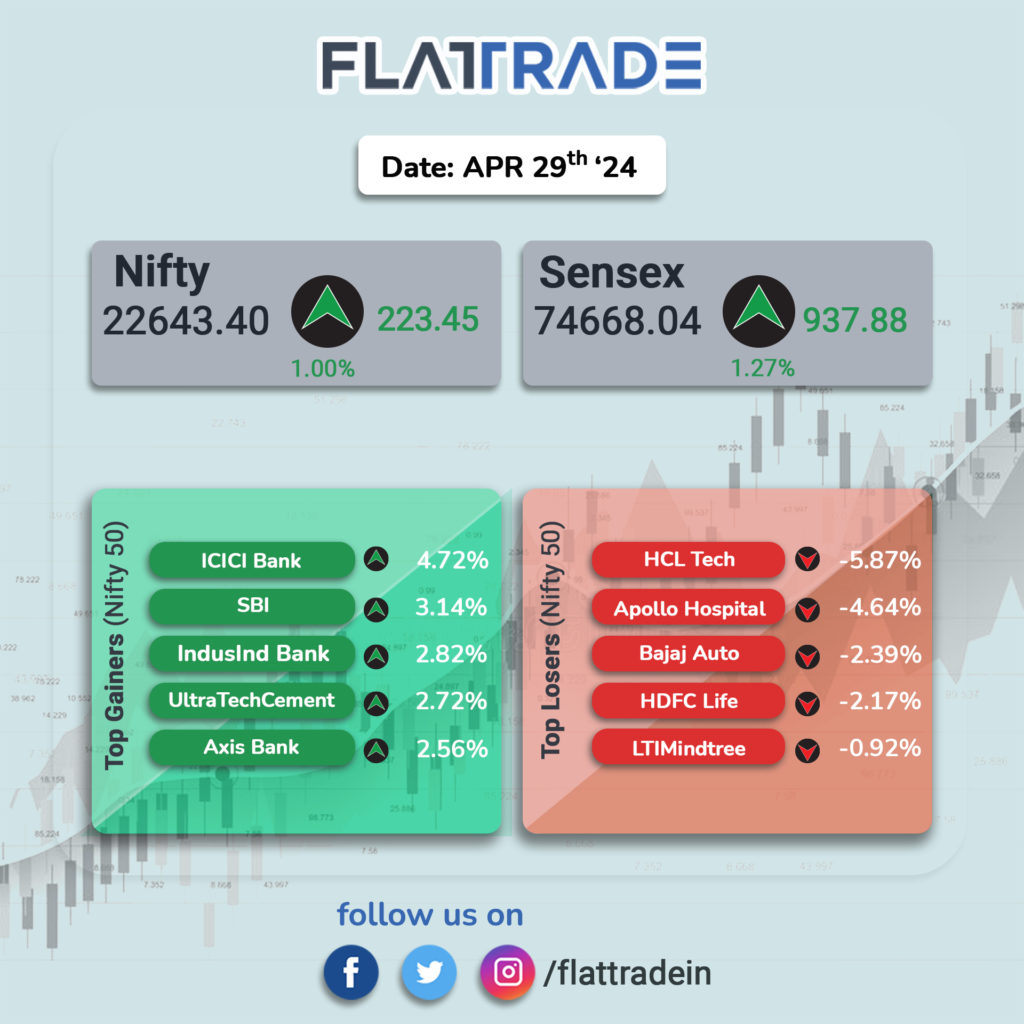

At close, the Sensex was up 941.12 points or 1.28 percent at 74,671.28, and the Nifty was up 223.45 points or 1 percent at 22,643.40.

Gainers and Losers on Nifty

18 of the 50 stocks on the Nifty 50 were in the red. HCLTech, Apollo Hospital Enterprises, Bajaj Auto, HDFC Life, and LTIMindtree were the top losers, while ICICI Bank, SBI, UltraTech Cement, IndusInd Bank, and Axis Bank were the top gainers.

Gainers and Losers on Sensex

Only five stocks, HCLTech, Wipro, ITC, Maruti Suzuki India, and Bajaj Finserv, were in the red in the 30-stock Sensex, while ICICI Bank, SBI Bank, UltraTech Cement, IndusInd Bank and Axis Bank were the top gainers.

Sectoral indices performance

The Bank and Financial Services indices were the top gainers for the day, having climbed 2.62%, and 2.23%, respectively.

Following them in gains was the Oil & Gas index, which was up 0.94%. Furthermore, MCG, Health, Pharma, and Consumer Durables indices were trading in the green.

Heavyweight indices like Auto, and IT, were down 0.12% and 0.24%, while the Realty index was down 1%.

Broader Market indices

The broader market was in the green, with the BSE MidCap index up 0.57% and the BSE SmallCap index up 0.11%.

STOCKS TODAY

Techno Electro and Engineering: Shares of Techno Electro and Engineering surged 6 percent after the company won orders worth Rs 4000 crore. It got orders from Power Grid Corporation of India, Adani Transmission, Millenium Challenge Account (MCA), Nepal, IndiGrid Trust, Damodar Valley Corporation and REC Power Distribution Company, the engineering firm told exchanges.

ICICI Bank: ICICI Bank stock rose 4 percent after the company posted strong Q4 earnings on April 27. In the process, the Bank became the fifth Indian company and the second bank to surpass Rs 8-lakh-crore market capitalization. The lender thrived, reporting a Q4 FY24 net profit of Rs 10,708 crore, up 20 percent from Q4 FY23, driven by robust advances and reduced credit costs, despite margin pressure.

Ultratech Cement: Ultratech Cement stock gained 2 percent after the company’s net profit surged 35.5 percent YoY to Rs 2,258 crore on the back of robust demand for building materials and lower operating costs. The board also reported a dividend of Rs 70 per equity share.

Apollo Hospitals: Apollo Hospitals stock fell over 4 percent after the street remained cautious around the valuations commanded by the company’s arm, Apollo HealthCo, in its recent deal with Advent International. Apollo HealthCo, which manages the company’s Apollo 24/7 vertical, will raise Rs 2,475 crore from global private equity investor Advent International.

HCLTechnologies: Shares of HCLTechnologies fell over 5 percent after the company’s Q4FY24 results fell short of the street’s expectations and the company issued a bleak growth guidance for FY25. The IT services major recorded an 8.4 percent sequential decline in net profit to Rs 3,986 crore but revenue rose 0.2 percent to Rs 28,499 crore.

Supreme Industries: Shares of Supreme Industries jumped 14 percent after the plastic products maker recorded a 16 percent gain in revenue in the March quarter. Supreme Industries reported a 1.3 percent fall in consolidated net profit at Rs 354.8 crore from a year earlier. Revenue rose to Rs 3,007.9 crore from Rs 2,598.3 crore, rising almost 16 percent on a YoY basis.

KPIT Tech: KPIT Technologies stock gained 6 percent after the company recorded a CC growth of 39.1 percent, higher than the company’s increased guidance for the year. For FY25, the company guided for 18-22 percent revenue growth and EBITDA margin at 20.5 percent.