POST-MARKET REPORT

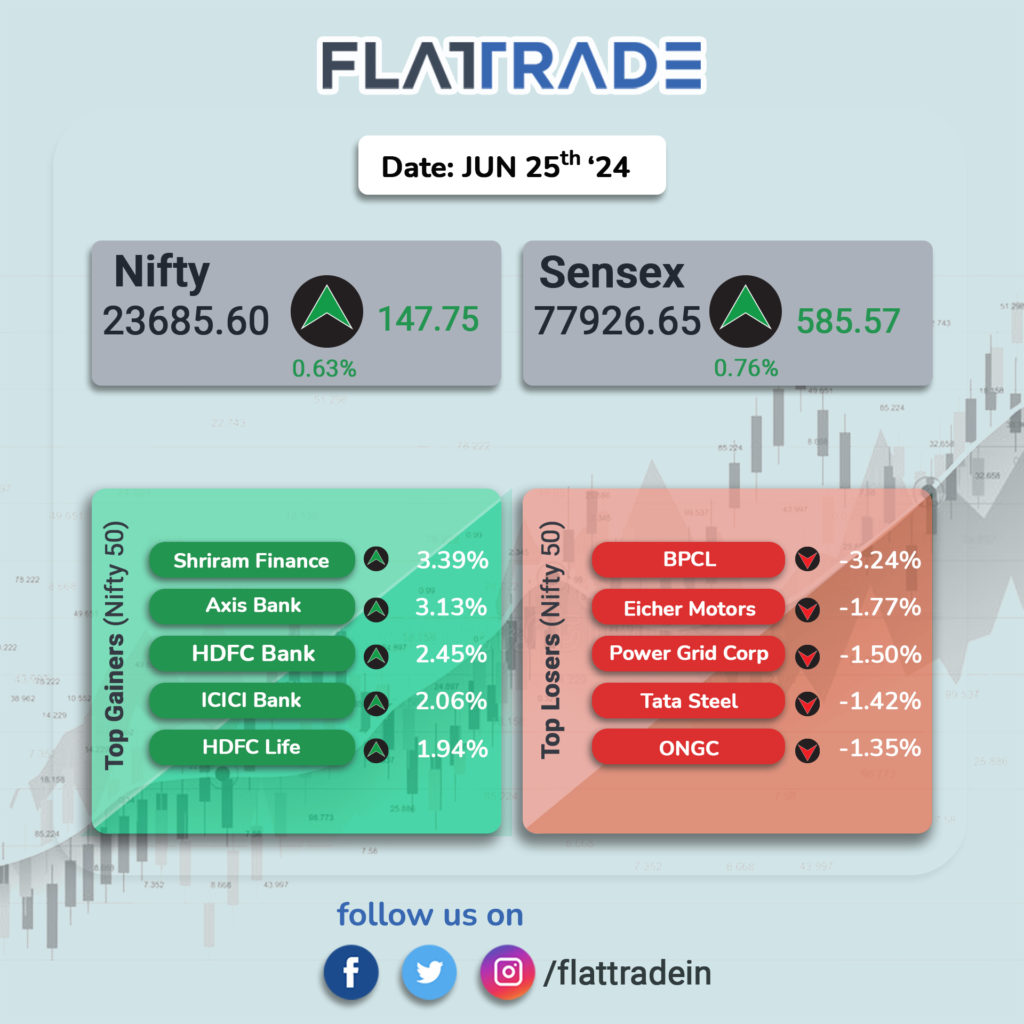

India’s benchmark Sensex and Nifty closed at fresh record highs on June 25 led by gains in banking and IT stocks. The surge in markets comes a day after RBI data showed the current account surplus stood at $5.7 billion, or 0.6 percent of the GDP, in the fourth quarter of the fiscal year 2023-24.

The Nifty 50 finally closed 183 points, or 0.78 percent, higher at 23,721.30, while the Sensex ended with a gain of 712 points, or 0.92 percent, at 78,053.52.

Shares of Axis Bank, ICICI Bank, and HDFC Bank ended as the top gainers in the Sensex index. On the flip side, shares of Power Grid, Tata Steel, and Asian Paints ended as the top losers in the index.

Among sectoral indices, Nifty Bank and Nifty Private Bank rose by 1.7 percent each, while Nifty IT saw an increase of 0.8 percent. On the other hand, Nifty Realty declined by 1.8 percent, with Nifty Metal and Nifty Media falling by 0.7 percent and 0.5 percent respectively. Among banking stocks, Axis Bank, HDFC Bank, and ICICI Bank surged.

The broader market underperformed the headline indices after the midcap index fell 0.4 percent, paring all gains after hitting a record high. Smallcap index inched higher by 0.2 percent.

STOCKS TODAY

Amara Raja: The stock zoomed 20 percent to hit an all-time high after the battery maker announced that it has entered into a technical licensing agreement with China-based Gotion High-Tech.

Shriram Finance: Shares of the Nifty 50 stock rose 4 percent to hit a 52-week high of Rs 2,999. In an interaction with CNBC-TV18, YS Chakravarti, the MD and CEO of the company said that Shriram Finance might increase its asset under management (AUM) growth guidance after the first half of the fiscal year 2025. He expects good growth numbers in Q3 and Q4 of FY25.

Borosil: Shares of the laboratory glassware and microwavable kitchenware manufacturer jumped 6 percent after the company informed that its board approved Qualified Institution Placement (QIP) at a floor price of Rs 331.75 per share. The company aims to raise Rs 250 crore through this route.

Craftsman Automation: Shares snapped a three-day losing run and rose over 10 percent after the company signed a Memorandum of Understanding (MoU) with Sunbeam Lightweighting Solutions and Kedaara Capital Fund II LLP to potentially acquire all or part of Sunbeam’s business.

Hitachi Energy India: Shares rose nearly 4 percent after the company announced that it has received an order worth Rs 790 crore from fellow subsidiary Hitachi Energy Australia Pty Ltd for the development of high voltage direct current links between Tasmania and Victoria.

Happiest Minds: Happiest Minds shares worth Rs 1,076 crore changed hands on the bourses in a block deal. Around 1.27 crore shares or 8.3 percent equity were exchanged, at an average price of Rs 847 per share. The stock fell nearly 9 percent.