POST-MARKET REPORT

The domestic benchmark indices, Sensex and Nifty 50 closed in the green on Wednesday’s trading session led by banks and heavyweights.

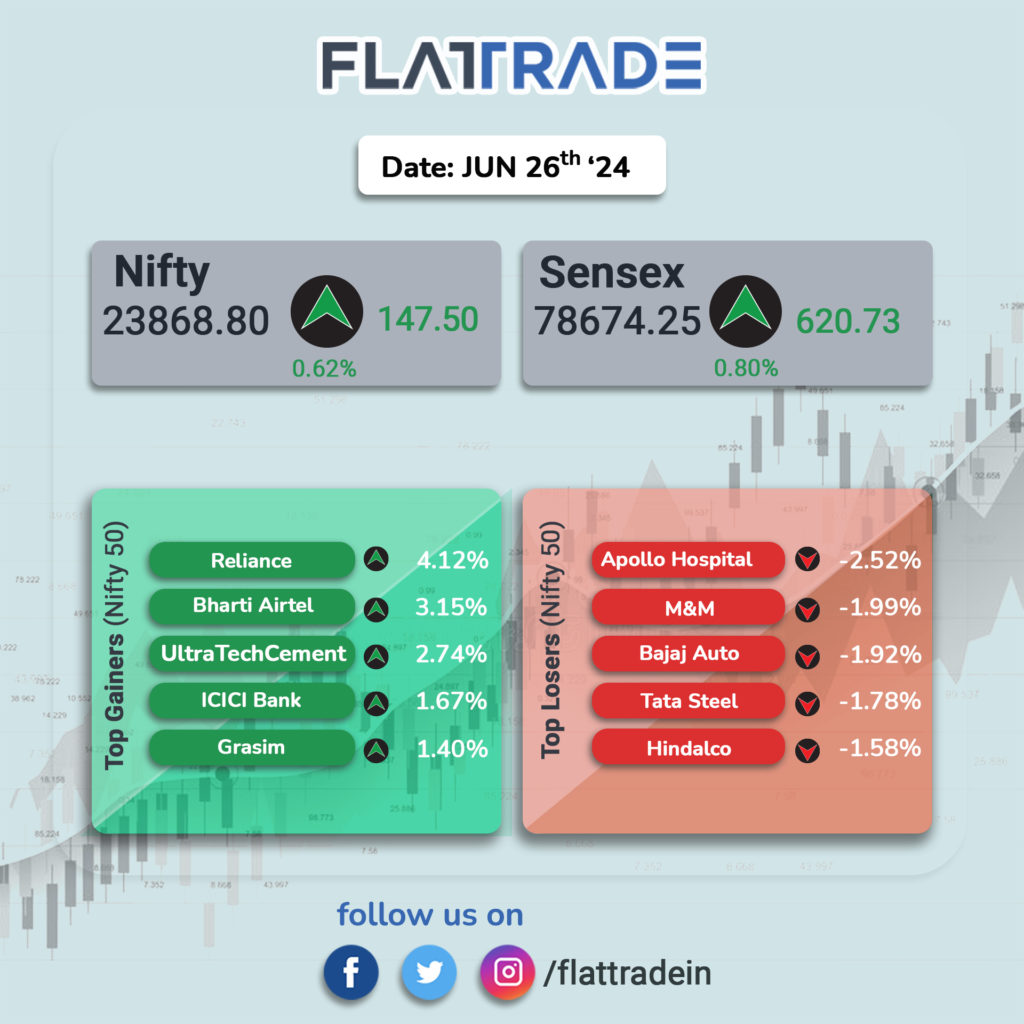

The BSE Sensex ended higher by 620.73 points or 0.80% at 78,674.25 level while the Nifty 50 closed at 23,868.80 level, up 147.50 points or 0.62%. Further, BSE Sensex and Nfity50 indices hit new record highs of 78,759.40 and 23,889.90, respectively.

Biggest gainers on the Nifty included Reliance Industries, UltraTech Cement, Bharti Airtel, ICICI Bank and Grasim Industries, while losers were Apollo Hospitals, Bajaj Auto, M&M, Tata Steel and Hindalco Industries.

Financial Services, Media, Oil & Gas, FMCG, PSU Banks, and Private Banks were among the sectoral indices at the NSE that were trading in the green, while Auto, Metal, Realty, and Consumer Durables were among those that traded in the red. IT and Pharma ended flat.

The BSE midcap index was down 0.30 percent while the smallcap index ended on a flat note.

STOCKS TODAY

Hindustan Foods: Shares zoomed 15 percent in trade following a block deal worth Rs 638.40 crore. Around 1.27 crore shares of Hindustan Foods changed hands on the exchanges at a floor price of Rs 502 per share.

Mazagon Dock Shipbuilders: Shares soared 7.5 percent in trade to hit a fresh record high of Rs 4,271.20 after the company became the latest to join the list of companies to be granted the ‘Navratna’ status by the Department of Public Enterprises.

Sanghi Industries: Shares slumped around 6 percent in opening trade after the company announced that its promoters Ambuja Cements and Ravi Sanghi will sell up to 3.52 percent stake in the company through an offer for sale (OFS).

Zee Media Corporation: Shares rose over eight percent after the announcement that its Board of Directors has approved the exploration of various fundraising options, aiming to raise Rs 200 crore.

Borosil: Borosil shares fell 3.5 percent. The company announced the completion of fundraising Rs 150 crore through a qualified institutional placement (QIP) route. The issue price was Rs 318 per share, a 4 discount to the floor price of Rs 331.75 per share.

Meghna Infracon Infrastructure: Shares surged 19 percent, reaching a 52-week high of Rs 468 on the BSE following its acquisition of a prestigious residential project in Goregaon West, Mumbai.

CE Info Systems: Shares fell over 5 percent after promoter and managing director Rakesh Kumar Verma sold a 0.9 percent stake in the company via a block deal.

Sharda Motor Industries: Shares skyrocketed around 10 percent and hit an all-time high of Rs 2,193.10 after a block deal worth Rs 474 crore took place on the exchanges.