PRE-MARKET REPORT

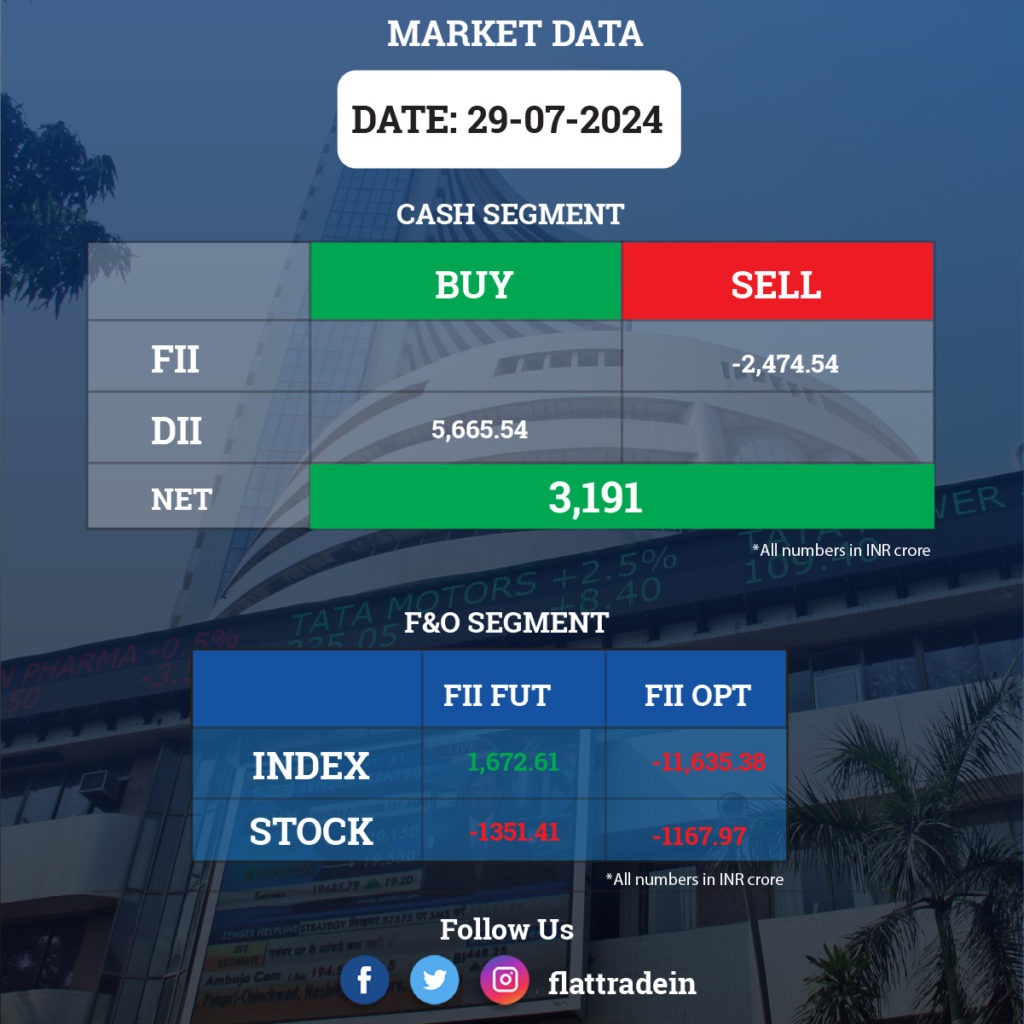

The domestic equity benchmark indices, Sensex and Nifty 50, are expected to open lower on Tuesday following weak sentiment in global markets.

Gift Nifty was trading around 24,878 level, a discount of nearly 45 points from the Nifty futures’ previous close, indicating a negative start for the Indian stock market indices.

The US stock market ended Monday’s choppy session mixed. The Dow Jones Industrial Average fell 49.41 points, or 0.12%, to 40,539.93, while the S&P 500 rose 4.44 points, or 0.08%, to 5,463.54. The Nasdaq Composite closed 12.32 points, or 0.07%, higher at 17,370.20.

Asian markets traded lower on Tuesday following a mixed trend overnight on Wall Street and as the Bank of Japan begins its two-day monetary policy meeting.

Japan’s Nikkei 225 declined 0.57%, while the Topix fell 0.56%. South Korea’s Kospi dropped 0.73%, and the Kosdaq fell 0.4%. Hong Kong Hang Seng index futures indicated a lower opening.

STOCKS TODAY

Colgate Palmolive India: The company reported a consolidated net profit of ₹364 crore for the June quarter in FY25, a 33% growth from ₹273.68 crore in the same quarter of the previous year. Net sales rose 13% to ₹1,485.8 crore from ₹1,314.7 crore, with rural market demand outpacing urban growth for the second consecutive quarter. Domestic revenues grew 12.8% YoY driven by toothpaste, toothbrush, and personal care. EBITDA margins remained consistent despite a 10% increase in advertising spend.

Pfizer: The drugmaker reported a 61.2% YoY jump in net profit at ₹150.7 crore for Q1FY25, up from ₹94 crore. Revenue from operations increased 5.9% to ₹563 crore from ₹531.4 crore. EBITDA jumped 60.2% to ₹177.5 crore from ₹110.8 crore. EBITDA margin stood at 31.5%, up from 20.9%.

Jindal Saw: The company reported a 66.7% YoY jump in net profit at ₹441.1 crore for Q1FY25, up from ₹265 crore. Revenue from operations increased 12% to ₹4,939 crore from ₹4,410 crore. EBITDA jumped 38.2% to ₹839.6 crore from ₹607.7 crore. EBITDA margin stood at 17%, up from 13.8%. The company’s current order book stood at ₹165 crore, up from ₹153 crore.

Novartis India: The company reported net sales of ₹92.29 crore for June 2024, up 1.87% YoY. Net profit rose 27.05% to ₹25.74 crore. EBITDA increased 15.41% to ₹34.38 crore. EPS increased to ₹10.42. Shares closed at ₹1,156.00 on July 26, 2024.

KEI Industries: The company reported a 23.8% YoY rise in net profit to ₹150.2 crore for Q1FY25. Revenue increased 15.7% to ₹2,060.4 crore. EBITDA rose 21.8% to ₹214.4 crore. EBITDA margin stood at 10.4%. Domestic institutional wire and cable sales were ₹574 crore. EHV cable sales were ₹79 crore. Total institutional cable and wire sales contributed 38.97%.

Tata Steel: The company acquired over 557 crore equity shares in its Singapore-based arm for $875 million. The board had approved the infusion of funds into T Steel Holdings Pte Ltd (TSHP) by subscribing to equity shares. Post-acquisition, TSHP will continue to be a wholly-owned subsidiary.