POST-MARKET REPORT

Indian equity indices ended flat in the rangebound session on August 19 as investors awaited fresh cues from the US Federal Reserve.

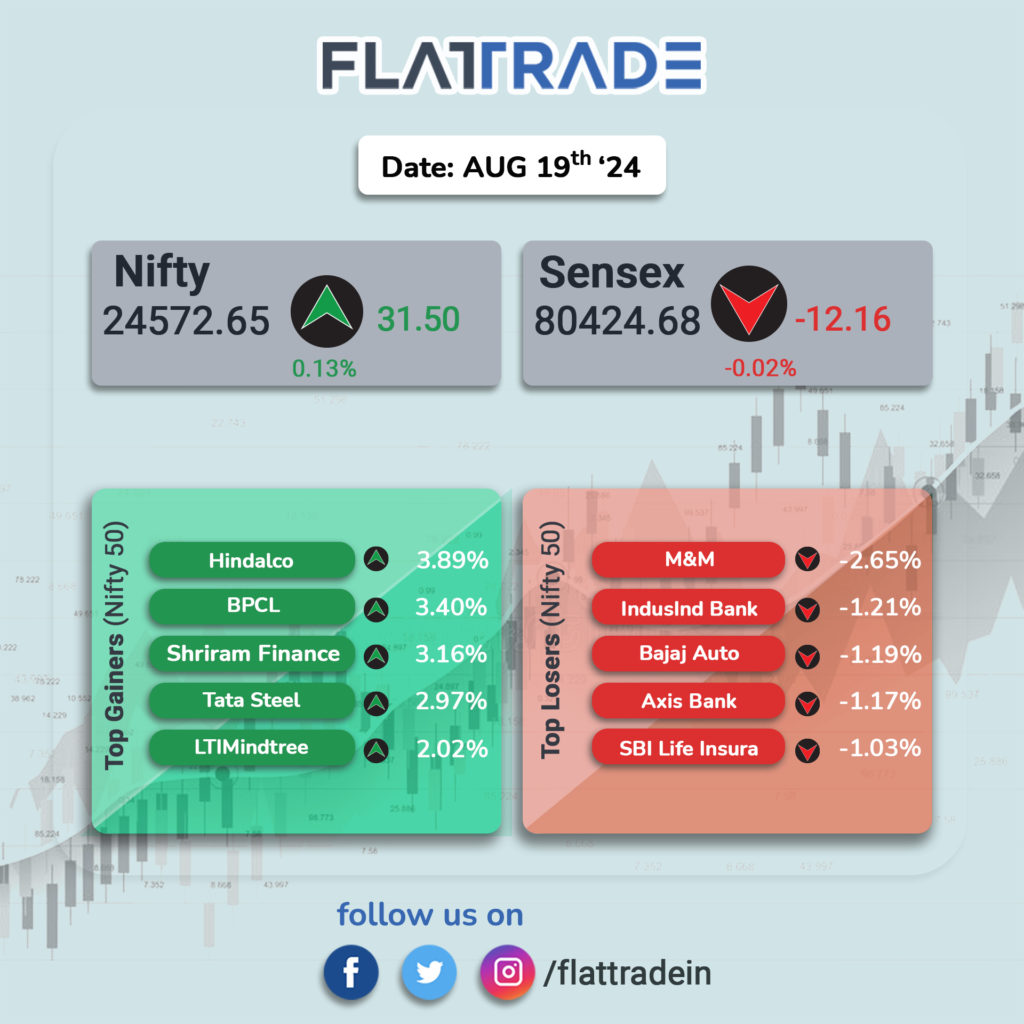

The Sensex was down 12.16 points or 0.02 percent at 80,424.68, and the Nifty was up 31.50 points or 0.13 percent at 24,572.70.

Top Nifty gainers were Hindalco Industries, BPCL, Shriram Finance, Tata Steel, and LTIMindtree, while losers were M&M, Bajaj Auto, Axis Bank, IndusInd Bank and SBI Life Insurance.

On the sectoral front, except auto and bank, all other indices ended higher with healthcare, IT, metal, oil & gas, power, telecom, and media up 0.5-2 percent.

The BSE midcap index was up 0.5 percent while smallcap index added 1 percent.

STOCKS TODAY

Genus Power Infrastructure: Shares saw only buyers as it was firmly locked in its five percent upper circuit as the firm’s wholly-owned subsidiary bagged three Letter of Awards, clocking in at almost Rs 3,000 crore.

Caplin Point Laboratories: Shares jumped 15.5 percent after the Brazilian Health Regulatory Agency concluded its inspection. The regulatory agency ANVISA inspected Caplin Steriles’ injectable and ophthalmic manufacturing facility located at Gummidipoondi. The inspection was conducted between August 12 and 16 and was concluded with zero observations.

DCX Systems: Shares snapped a three-day losing run to hit an upper circuit of 5 percent at Rs 337.95 after the company received orders worth Rs 107.08 crore from both domestic and international customers. These contracts involve the supply of electronic kits as well as cable and wire harness assemblies and are scheduled for completion within the next 12 months.

Hindustan Zinc: Shares declined 4,8 percent extending losses following Vedanta’s announcement of stake offloading via an offer-for-sale. Anil Agarwal-led Vedanta is divesting a 3.17 percent stake in Hindustan Zinc through an offer-for-sale (OFS) running from August 16-19.

Techno Electric & Engineering Company: Shares were stuck in a 5 percent upper circuit at Rs 1,729.25 on the BSE after it announced a partnership with IndiGrid to co-develop two greenfield Interstate Transmission System (ISTS) projects under IndiGrid’s portfolio.

Ola Electric Mobility: Share price hit the upper price band, extending its listing day gains and nearly doubling since its market debut. The stock jumped 10 percent to hit the highest trading permissible limit for the day at Rs 146.03 per share on the Bombay Stock Exchange (BSE). At the National Stock Exchange (NSE), shares of the firm advanced nearly 10 percent to hit the upper circuit limit of Rs 146.38 apiece.