POST-MARKET REPORT

Indian share market ended with marginal gains in the rangebound session on August 21 as investors remain cautious ahead of US PMI data and US Fed Chair Jerome Powell’s speech at the Jackson Hole Symposium.

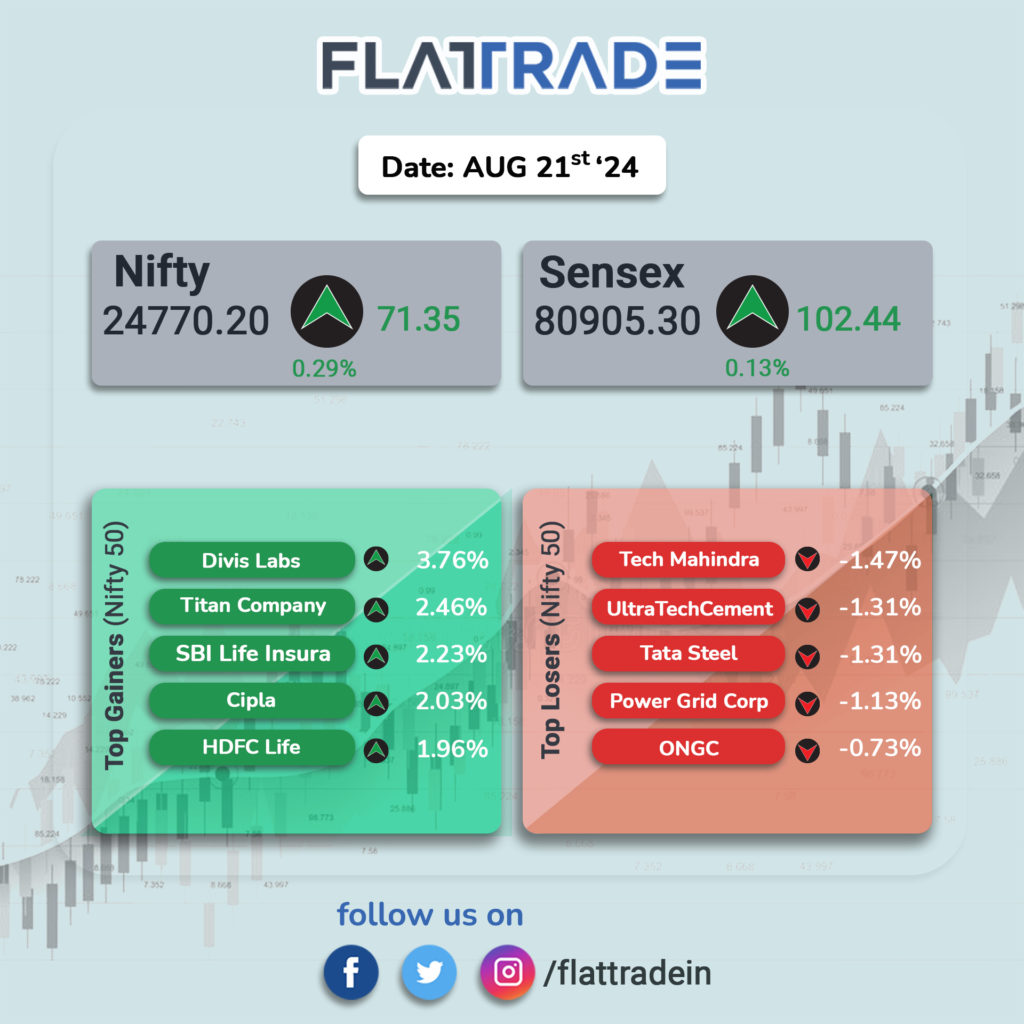

At close, the BSE Sensex was up 102.44 points or 0.13 percent at 80,905.30, and the Nifty was up 71.37 points or 0.29 percent at 24,770.20.

Top Nifty gainers were Divi’s Labs, Titan Company, SBI Life Insurance, Cipla, and Grasim Industries, while losers were Tech Mahindra, UltraTech Cement, Tata Steel, Power Grid Corp, and HDFC Bank.

On the sectoral front, the Realty index shed 1.3 percent, the bank index was down 0.2 percent, while FMCG, pharma, metal, telecom, and media were up 0.5-1 percent.

The BSE midcap index rose 0.4 percent while the smallcap index added nearly 1 percent, outperforming headline indices.

STOCKS TODAY

GE T&D India: Shares fell 5 percent to the lower circuit after the electric equipment company said that the promoter entities are considering selling a minority equity stake, from their combined 75 percent holding now. In the morning trade.

Cyient: Shares rose nearly 4 percent after the company likely sold as much as a 14.5 percent stake in Cyient DLM through a block deal. Around 1.2 crore shares of Cyient DLM changed hands at a floor price of Rs 766 per share, taking the overall transaction value to Rs 883.20 crore. Cyient also revealed plans to use the proceeds from the stake sale for capital needs and debt repayment.

Genus Power Infrastructures: Shares soared 5 percent to end in the upper circuit at Rs 437.75 after the company announced its wholly-owned subsidiary received three Letters of Award (LOA) worth Rs 3,608.52 crore. The orders involve appointing Advanced Metering Infrastructure Service Providers (AMISPs) to design, supply, install, and commission an Advanced Metering Infrastructure (AMI) system.

Varun Beverages: Shares of the franchise partner of PepsiCo, gained 3.5 percent as the Bank of America Securities (BofA Sec) issued a “Buy” call on the stock with a target price of Rs 1,840 per share. The international brokerage highlighted that despite a recent pullback in share price, the company’s business fundamentals remain robust, presenting an enhanced buying opportunity.

NHPC: The stock fell nearly a percent after a major landslide in East Sikkim caused significant damage to the 510-MW hydroelectric project on the Teesta River. The full extent of the damage to the power station is still being assessed, especially since the dam has been non-operational since October 2023 following flash floods.

SJVN: Shares fell nearly 1 percent after Goldman Sachs maintained its ‘Sell’ recommendation on the state-run hydropower producer. The brokerage firm simultaneously raised the target price on the stock to Rs 85 from Rs 75.