POST-MARKET REPORT

The Indian Benchmark indices Sensex and Nifty ended higher on September 10, fueled by robust buying in IT, telecom, and healthcare stocks. However, gains were tampered with caution ahead of the US inflation data release scheduled for September 11.

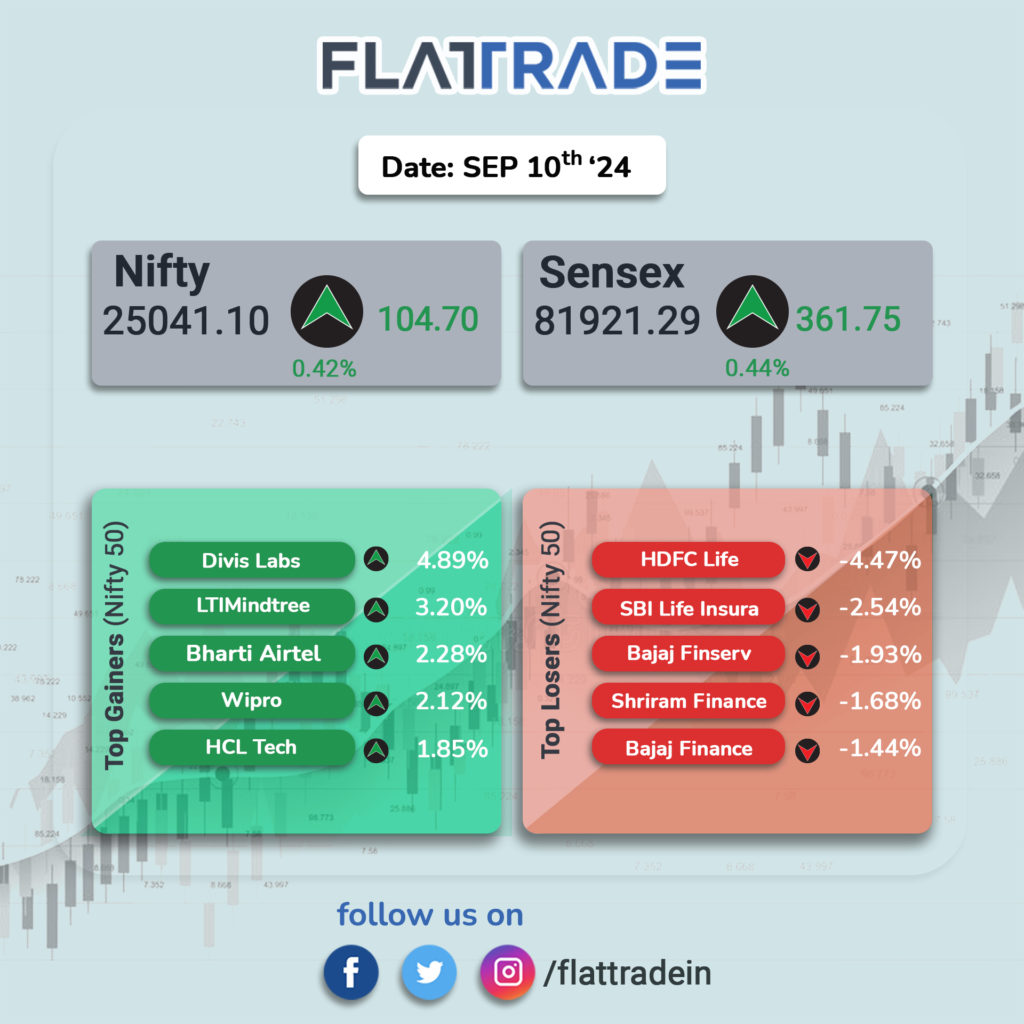

At close, The Sensex climbed 361.75 points, or 0.44 percent, to 81,921.29, while the Nifty rose 104.70 points, or 0.42 percent, to 25,041.10.

Divis Labs, LTIMindtree, Bharti Airtel, Wipro, and HCL Tech were among the major gainers on the Nifty, while losers were HDFC Life, SBI Life Insurance, Bajaj Finserv, Bajaj Finance, and Shriram Finance.

Among the Sectoral indices, Except oil & gas, all other sectoral indices ended in the green with Telecom and Media up 2 percent each, while capital goods, IT, healthcare, and power up 1 percent each. The Nifty IT index surged nearly 2 percent taking the lead.

Considering Broader market indices, the BSE Midcap index was up 0.5 percent and the Smallcap index gained 1.5 percent.

STOCKS TODAY

STOCKS TODAY

Inox Wind: Shares gained over 3 percent on high volumes and a rally in the broader market. A total of 2 crore shares of the company changed hands on BSE and NSE combined so far, compared to the one-week average trading volume of 1 crore shares.

Paytm: The stock surged over 4 percent amid heavy volumes. A total of 2 crore shares of the company changed hands on BSE and NSE combined so far, compared to the one-month average trading volume of 1 crore shares. The surge could also be attributed to the GST Council not making any announcements in regards to GST on UPI transactions below Rs 2,000.

Suzlon Energy: The stock gained 5 percent as Morgan Stanley maintained an ‘Overweight’ rating on the stock with a target price of Rs 73, following a significant 1.17 GW order win from NTPC. This is a notable achievement for Suzlon, as it has secured a PSU order after a long hiatus, the brokerage said. Suzlon stock is currently trading above the target price.

IREDA: The stock surged over 5 percent, a day after the company signed a Memorandum of Understanding (MoU) with SJVN Ltd., GMR Energy Ltd., and their associated companies for the development and implementation of the 900 MW Upper Karnali hydro-electric project in Nepal.

HG Infra Engineering: The stock surged 8 percent following the company’s recent win of a major Rs 781 crore contract from the Ministry of Road Transport & Highways (MoRTH). The contract involves upgrading a 10.630 km stretch of National Highway 47 (NH-47) in Gujarat, specifically between Narol and Sarkhej junctions.

Ahluwalia Contracts (India): The surged over 4 percent after securing an order worth Rs 1,144 crore from Gurugram-based realty firm Signature Global Business Park for a group housing project. The project, titled “De-luxe DXP,” will be located in Sector 37D, Dwarka Expressway, Gurugram, and is expected to be completed within a five-year regulatory timeframe.