POST-MARKET REPORT

Indian markets climbed to a fresh all-time high and snapped a three-day losing streak on September 16, with Nifty finishing near 25,400 led by bank, metal, and energy names.

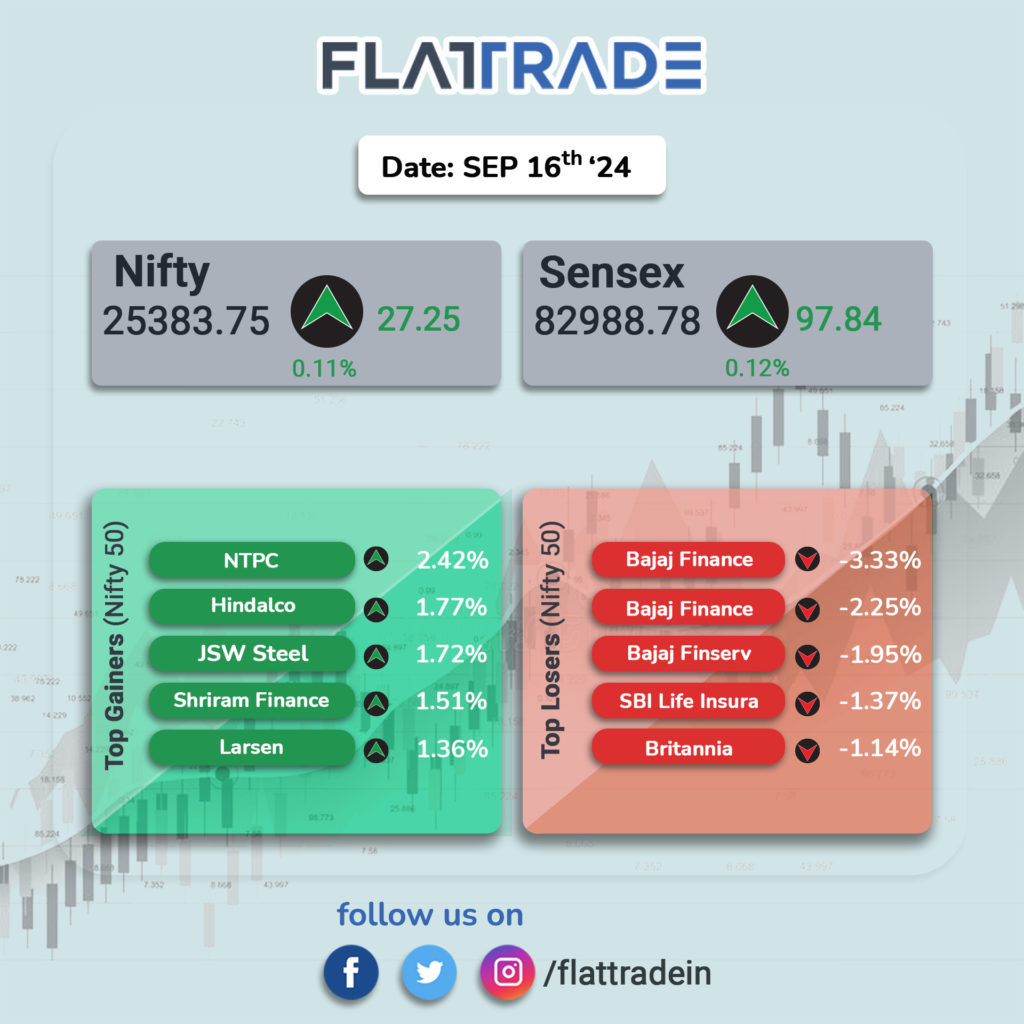

At close, the Sensex was up 97.84 points or 0.12 percent at 82,988.78, and the Nifty was up 27.25 points or 0.11 percent at 25,383.75.

After a positive start, the market extended the gains to hit a fresh record high. However, it erased the gains as the day progressed, but buying at lower levels helped to close the session in the green territory.

Top Nifty gainers included NTPC, JSW Steel, Hindalco Industries, Shriram Finance, and L&T, while losers were Bajaj Finance, HUL, Bajaj Finserv, SBI Life Insurance, and Britannia Industries.

Among sectors, except FMCG and Telecom, all other sectoral indices ended in the green with bank, capital goods, power, realty, media, and metal up 0.4-1 percent.

Broader indices also rallied to record highs with the BSE midcap index ending on a flat note, while smallcap index was up 0.3 percent.

STOCKS TODAY

Union Bank of India: The stock rallied almost 3 percent on September 16, following an upgrade by Investec, which moved the stock to a ‘buy’ rating and set a target price of Rs 151, indicating a potential 19 percent upside from current levels.

Bajaj Finance: Shares of Bajaj Finance dipped nearly 4 percent on the BSE on September 16 after the listing of Bajaj Housing Finance on the bourses. Bajaj Housing Finance shares made a bumper debut on the stock exchanges with the shares getting listed at Rs 150 on the BSE. This was a 114.28 percent premium over the IPO issue price of Rs 70.

Bajaj Finserv: Shares slipped 2 percent after the listing of Bajaj Housing Finance on the bourses. Bajaj Housing Finance shares made a bumper debut on the stock exchanges with the shares getting listed at Rs 150 on the BSE. This was a 114.28 percent premium over the IPO issue price of Rs 70.

Stove Kraft: The stock surged almost 8 percent after Emkay Global initiated a ‘buy’ rating with a target price of Rs 1,350. Analysts are optimistic, citing the stock’s attractive valuations and the company’s strong innovation and ‘value for money’ positioning.

Adani Power: Shares soared around 6 percent on September 16 after the two Adani group companies said they had received a Letter of Intent (LoI) for the supply of 6,600 MW hybrid solar and thermal power from Maharashtra State DISCOM.

Galaxy Surfactants: The stock zoomed over 8 percent on September 16 on the National Stock Exchange (NSE), driven by high volumes. So far in the day, a total of 1 lakh shares of the company changed hands on BSE and NSE combined, compared to the monthly average trading volume of 27,000 shares.