POST-MARKET REPORT

Indian equity indices failed to hold record highs and snapped the three-day run to end flat in the volatile session on September 24 after Sensex and Nifty crossed 85,000 and 26,000, intraday, respectively.

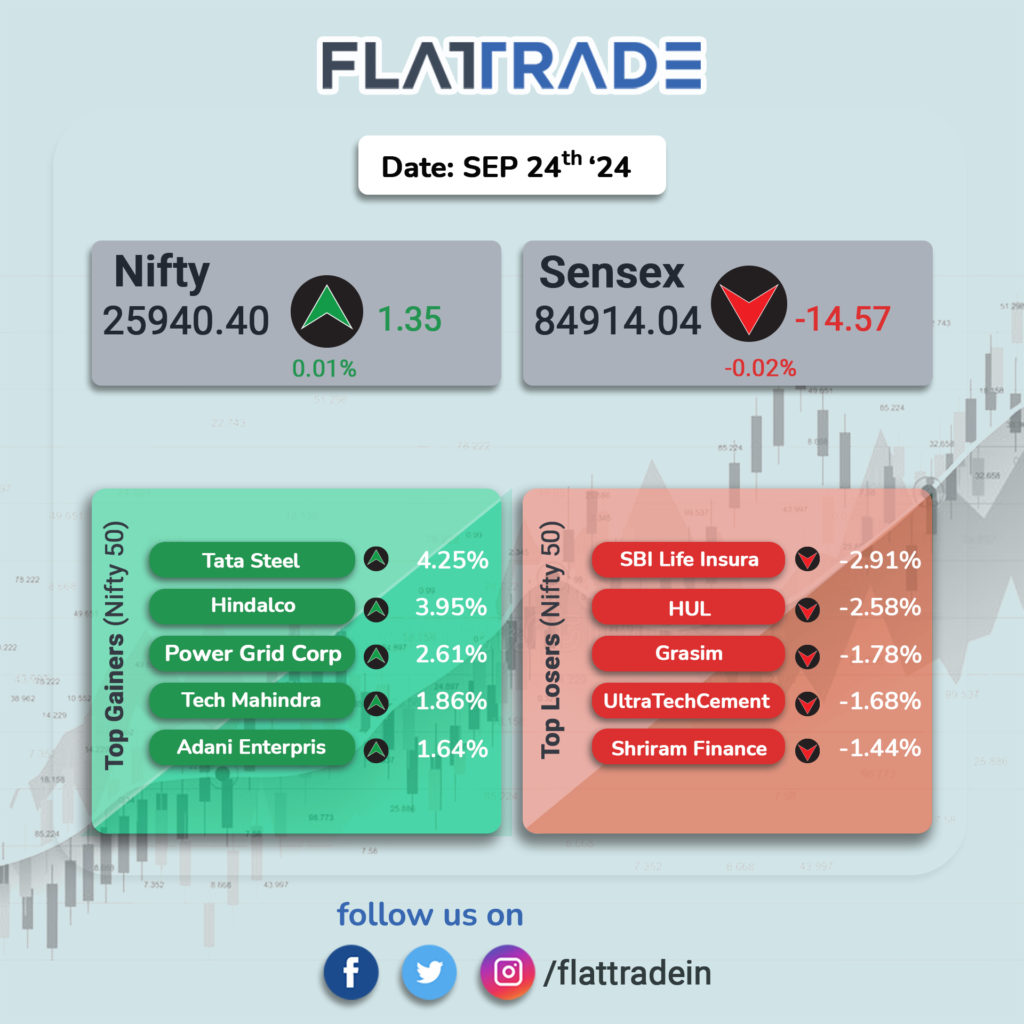

At close, the Sensex was down 14.57 points or 0.02 percent at 84,914.04, and the Nifty was up 1.40 points or 0.01 percent at 25,940.40. BSE Sensex and Nifty touched fresh highs of 85,163.23 and 26,011.55, respectively.

The biggest Nifty gainers of the day were Tata Steel, Hindalco Industries, Power Grid Corp, Tech Mahindra, and Adani Enterprises, while losers included SBI Life Insurance, HUL, Grasim Industries, UltraTech Cement, and Shriram Finance.

On the sectoral front, the metal index rose 3 percent, the oil & gas index was up 0.6 percent, power index added 1.4 percent. On the other hand, PSU Bank, FMCG, and telecom were down 0.5-1 percent.

The BSE midcap and smallcap indices ended on a flat note.

STOCKS TODAY

Reliance Power: The stock surged to hit the 5 percent upper circuit after the Anil Ambani-led company announced a preferential issue of 46.2 crore equity shares worth Rs 1,524.60 crore at Rs 33 per share, a 14 percent discount to the previous closing price. The issue is proposed to be made to promoter Reliance Infrastructure Ltd and non-promoter entities Authum Investment and Infrastructure Ltd and Sanatan Financial Advisory Services Private Ltd.

Sapphire Foods: Shares of the Pizza Hut and KFC operator surged 5.5 percent. The stock hit a fresh record high of Rs 401 on NSE intraday, driven by heavy volumes. A large trade occurred in the counter with 8.5 lakh shares or 1.3 percent equity changing hands for Rs 30.5 crore at a price of Rs 355 per share.

Spandana Sphoorty Financial: Spandana Sphoorty Financial shares surged almost four percent intraday after the firm sold its stressed loan portfolio for Rs 16.74 crore. It settled half a percent higher. The firm’s board approved the sale of a stressed loan portfolio, including a written-off loans pool, with an outstanding value of Rs 304.41 crore as of June 30, 2024, to an asset reconstruction company (ARC) on a security receipts consideration basis.

Firstsource Solutions: Shares of the company, part of the Rs 90,000 crore RP-Sanjiv Goenka Group, surged more than 6 percent after the firm announced that it acquired UK-based Ascensos, a customer experience outsourcing partner for retail and eCommerce businesses, for £42 million, including upfront payment and earnouts.

Sealmatic India: Shares surged nearly 3 percent after the company bagged an order from Bharat Heavy Electricals. The order is for engineered mechanical seals for the supercritical power plant for the DVC Raghunathpur Thermal Power Station Phase. Sealmatic is the only approved vendor for such super-critical applications for the 660 MW power plants at BHEL, other than a few foreign vendors.

PB Fintech: Shares of the Policybazaar parent fell more than 4 percent as investors rushed to book profits after a stellar run. The stock has been on a remarkable upward trajectory in recent months, consistently breaking record highs and delivering impressive returns to shareholders. So far this year, the stock has risen 128 percent, more than doubling investors’ capital.