PRE-MARKET REPORT

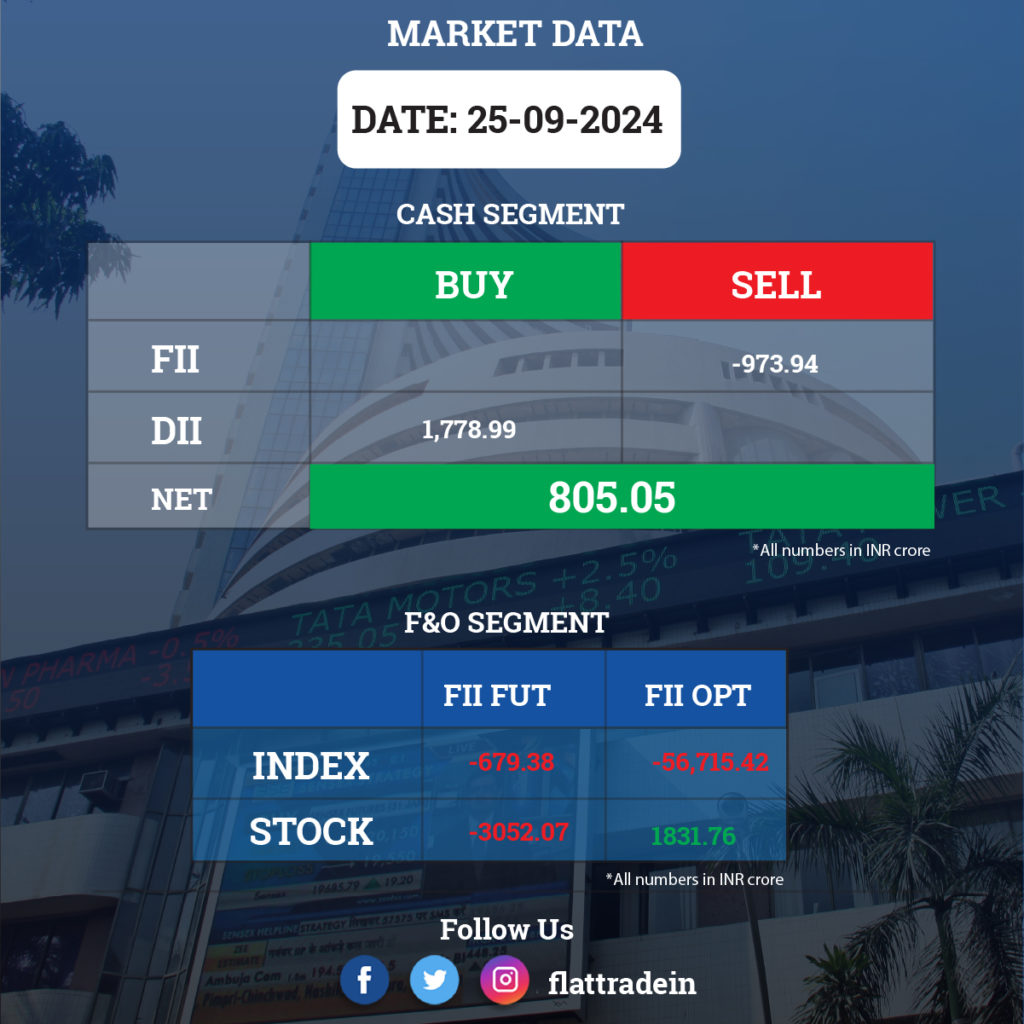

Indian equity benchmark indices, Sensex and Nifty 50, are expected to remain volatile on Thursday ahead of monthly futures & options (F&O) expiry, amid a mixed trend in the global markets.

Gift Nifty was trading around the 26,045 level, a premium of nearly 40 points from the Nifty futures’ previous close, indicating a positive start for the Indian stock market indices.

The US stock market ended mixed on Wednesday with the blue-chip Dow Jones slipping after hitting record highs, snapping a four-day gaining streak.

The Dow Jones Industrial Average declined 293.47 points, or 0.70%, to 41,914.75, while the S&P 500 fell 10.67 points, or 0.19%, to 5,722.26. The Nasdaq Composite closed 7.68 points, or 0.04%, higher at 18,082.21.

Asian markets traded higher on Thursday, with the Chinese markets extending their winning streak for the fifth straight session.

Japan’s Nikkei 225 rallied 1.7%, while the Topix gained 1.2%. South Korea’s Kospi surged 1.77%, and the Kosdaq rose 1.51%. Hong Kong’s Hang Seng index futures indicated a higher opening, set for a third straight day of gains. Mainland China’s CSI 300 hit its highest levels in almost two months.

STOCKS TODAY

PB Fintech: The company may explore plans to enter the healthcare sector by establishing its chain of hospitals, reports CNBC-TV18, quoting sources. With these hospitals, the company aims to tap into new levels of value creation.

Adani Green Energy: Promoter entities Hibiscus Trade and Investment, and Ardour Investment Holding have bought a 2.96% stake in the company. Hibiscus acquired 2.01 crore equity shares (1.27% stake) between July 30 and September 18, 2024, while Ardour purchased 2.67 crore shares (1.69% stake) between September 19 and September 23, 2024.

Coromandel International: The company has acquired an additional 8.82% stake in Baobab Mining and Chemicals Corporation (BMCC), a Senegal-based rock phosphate mining company, bringing its total shareholding to 53.8%. It will invest $3.84 million (Rs 32 crore) in BMCC and a loan infusion of $6.5 million (Rs 54 crore) to fund expansion projects and meet working capital requirements.

Infosys: The IT services company has announced a strategic collaboration with Polestar, the Swedish electric performance car brand. The partnership will focus on Polestar’s in-car infotainment development, software and electronics engineering, user experience, and cloud-powered digital services.

KPR Mill: SBI Mutual Fund has acquired an additional 2.8% stake in KPR at an average price of Rs 925 per share, valued at Rs 900.54 crore. Meanwhile, promoter K P Ramasamy has sold a 3.07% stake in the company at an average price of Rs 925.12 per share, amounting to Rs 971.37 crore.