POST-MARKET REPORT

Bears took charge of Dalal Street on September 30 and dragged the BSE Sensex more than 1,300 points and Nifty below 25,800, intraday, amid rising geopolitical tensions and ahead of Federal Reserve Chair Jerome Powell’s speech later tonight.

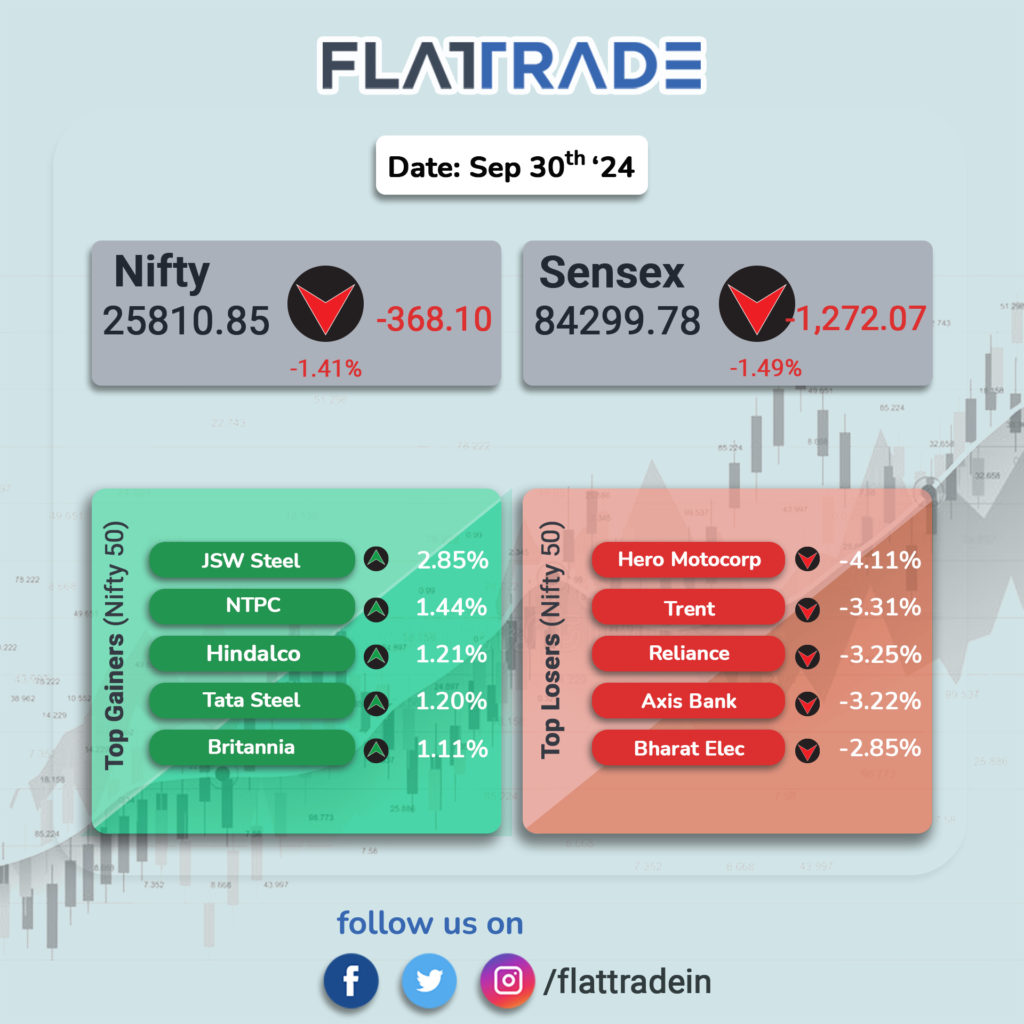

At close, the Sensex was down 1,272.07 points or 1.49 percent at 84,299.78, and the Nifty was down 368.20 points or 1.41 percent at 25,810.80.

Hero MotoCorp, Trent, Axis Bank, Reliance Industries, and Bharat Electronics were among the top losers on the Nifty, while gainers were JSW Steel, Hindalco Industries, NTPC, Tata Steel, and Britannia Industries.

Except for metal and media (up 1 percent each), all other sectoral indices ended in the red with auto, bank, IT, telecom, pharma, and realty down 1-2 percent.

The BSE midcap index ended with marginal losses, while the smallcap index ended flat.

STOCKS TODAY

Bharat Electronics: Shares of state-owned Bharat Electronics, the newest entrant to the Nifty 50, slipped into the red on its debut trading day after joining the benchmark index. Bharat Electronics, along with retail major Trent, replaced Divis Laboratories and LTIMindtree in the benchmark Nifty 50 on September 27. The stock fell over 3 percent.

Ola Electric Mobility: Ola Electric Mobility tanked more than 2 percent in trade on September 30, which also took the stock below the Rs 100 mark for the first time since its market listing. Moreover, the stock has also been in the red for 12 out of the last 14 sessions. In a recent note, brokerage firm HSBC reported that it visited several Ola service stations and observed that many were overwhelmed with service requests.

Avantel: Small-cap defense electronics manufacturer Avantel’s stock price surged over 7 percent on bagging an order from infrastructure major Larsen & Toubro. The order, worth Rs 44.5 crore, is for the supply of satcom systems and is expected to be executed by March 2025.

Hero MotoCorp: Hero MotoCorp was the worst performer on the Nifty Auto index after UBS retained its ‘sell’ call on the counter suggesting that the company is conceding market share to rivals. This decline pushed Hero to the second position in the domestic two-wheeler market, with a 23.2 percent share. Dragged by this, the stock slipped nearly 4 percent.

Max Estates: Max Estates gained over one percent following the announcement of strong pre-sales for its Gurugram project, Estate 360. The real estate developer recorded a pre-sales booking value of approximately Rs 4,100 crore, surpassing its FY25 guidance of Rs 4,000 crore.

JM Financial: Shares soared 6 percent after its subsidiary, JM Financial Products approved the direct assignment, or sale, of its MSME loan portfolio. In a meeting on September 27, JM Financial Products’ board of directors approved the direct assignment of its MSME loan portfolio for Rs 1,000 crore to one or more parties.