PRE-MARKET REPORT

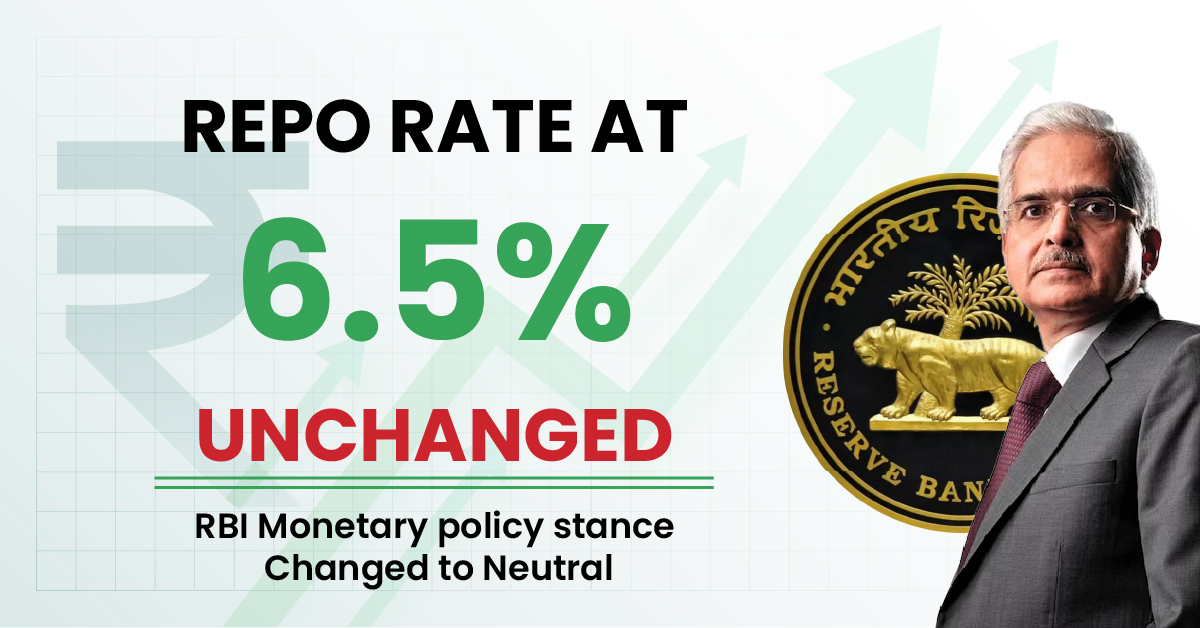

The domestic equity market indices, Sensex and Nifty 50, are likely to open higher on Wednesday, following gains in global markets and ahead of the announcement of the Reserve Bank of India’s monetary policy.

Gift Nifty was trading around 25,160 level, a premium of nearly 28 points from the Nifty futures’ previous close, indicating a mildly positive start for the Indian stock market indices.

US stock market indices ended higher on Tuesday led by buying in technology stocks. The Dow Jones Industrial Average rose 126.13 points, or 0.30%, to 42,080.37, while the S&P 500 gained 55.19 points, or 0.97%, to 5,751.13 points. The Nasdaq Composite ended 259.01 points, or 1.45%, higher at 18,182.92.

Asian markets traded higher following the overnight rally on Wall Street. Japan’s Nikkei 225 gained 1%, while the Topix rose 0.5%. Hong Kong’s Hang Seng index futures indicated a higher opening. South Korea’s markets are closed for a public holiday.

STOCKS TODAY

Phoenix Mills: The company recorded retailer consumption of Rs 3,289 crore in the quarter ended September 2024, marking a 25% growth compared to the year-ago period. Gross retail collections stood at Rs 812 crore in Q2FY25, representing a 27% YoY increase.

Signature Global: The real estate developer reported an 184% YoY growth in pre-sales, amounting to Rs 2,780 crore. However, pre-sales declined by 11% sequentially in Q2FY25. The company sold 2.38 million square feet in the second quarter, up 143% YoY and 27% QoQ. Collections during the September 2024 quarter grew by 28% YoY to Rs 920 crore, though they were down 24% QoQ.

Torrent Power: The Torrent Group company has received a letter of award from the Maharashtra State Electricity Distribution Company (MSEDCL) for the long-term supply of 2,000 megawatts (MW) of energy storage capacity from its InSTS-connected pumped hydro storage plant. This 2,000 MW capacity includes 1,500 MW for which MSEDCL already issued a Letter of Intent in September. The company has now received the allotment of an additional 500 MW capacity under the tender, bringing the total capacity allocated to 2,000 MW.

Infosys: The digital services and consulting company announced a strategic expansion collaboration with Nasdaq-listed Old National Bank. Old National will leverage Infosys’ services, solutions, and platforms for operations transformation and process digitization powered by automation and generative AI (GenAI).

Dr Reddy’s Laboratories: The company’s subsidiary, Aurigene Oncology, has announced the Phase 1 results for Ribrecabtagene autoleucel (DRL-1801) from the SWASTH study. The Drugs Controller General of India has approved the commencement of Phase 2 of the trial. The SWASTH study is India’s first trial for a novel autologous BCMA-directed CAR-T cell therapy in patients with relapsed/refractory multiple myeloma.

Nuvama Wealth Management: SEBI has issued an administrative warning following an inspection of the company’s merchant banking activities. Nuvama Wealth stated that there is no material impact on the financials, operations, or other activities of the company.