POST-MARKET REPORT

Indian stocks struggled once again to gain momentum, as significant declines in FMCG and realty stocks dragged the frontline indices to a flat close.

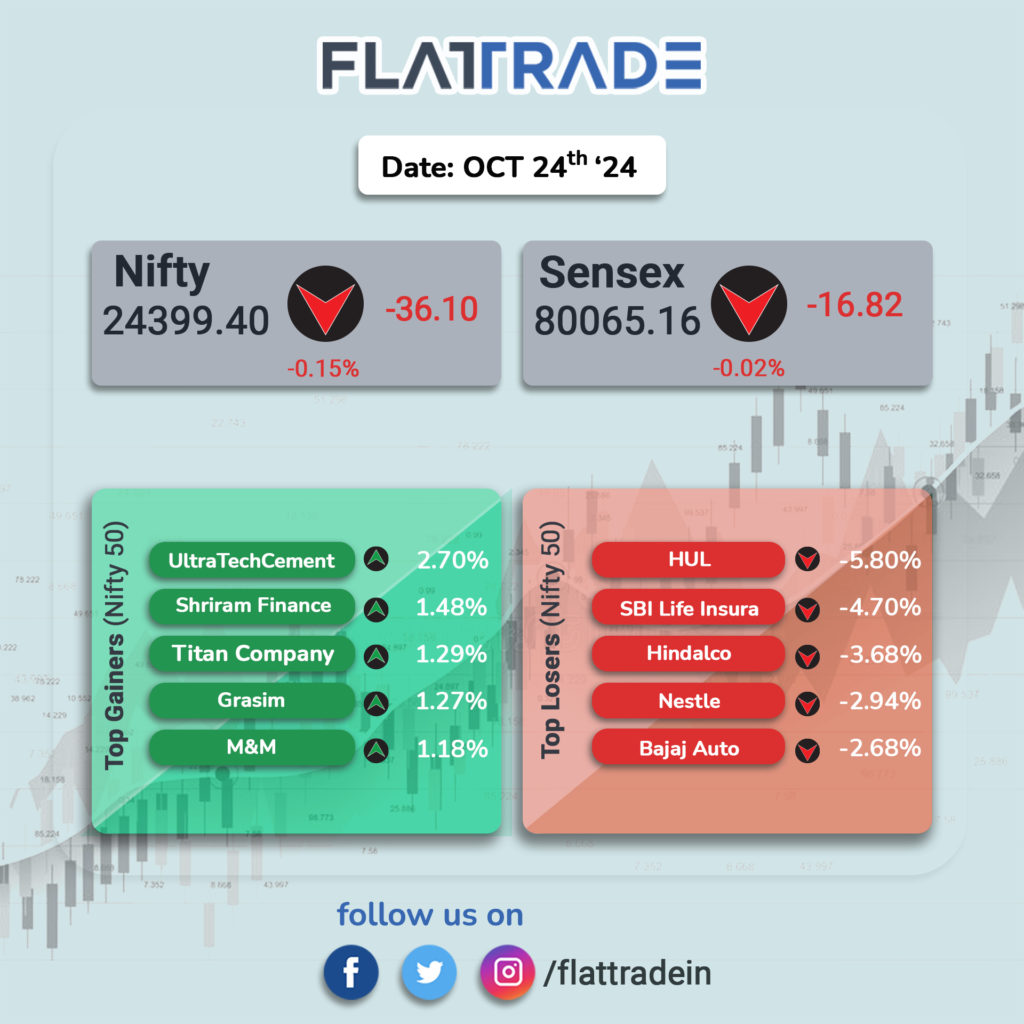

The Nifty 50 ended the session with a 0.15% drop at 24,399, while the Sensex ended trade with a cut of just 0.02% at 80,065.

Top losers led by HUL, which experienced a decline of nearly 6% and followed by SBI Life Insurance, Hindalco Industries, Nestle India, Bajaj Auto, Britannia Industries, ITC, Tata Consumer, Maruti Suzuki, and HDFC Life Insurance, all of which recorded losses exceeding 1%.

Among the sectoral indices, the FMCG was down by 2.83%, followed by the Nifty Realty index fell by 1.13%, while the Nifty Auto index continued its decline, dropping by 0.52%.

Considering broader market indices, both the Nifty Midcap 100 and Nifty Smallcap 100 indices closed lower, declining by 0.32% and 0.20%, respectively.

STOCKS TODAY

Piramal Pharma: Piramal Pharma shares climbed 18 percent a day after the drugmaker reported solid earnings for the July-September quarter, marked by a steep surge in its net profit. The drugmaker’s net profit zoomed 3.5 times year-on-year to Rs 22.59 crore in the September quarter, up from Rs 5.02 crore in Q2 FY24.

Tata Communications: Tata Communications’ share price rallied after the company unveiled AI infra with NVIDIA-accelerated computing. As part of the initiative, Tata Communications will integrate cutting-edge NVIDIA software solutions into its AI Cloud offerings.

Sona BLW: Sona BLW Precision stock rallied 13 percent after the company reported a robust set of numbers in the second quarter, and announced a signing pact with Escorts Kubota to acquire its railway equipment division. During the quarter, the auto components maker reported a 16 percent yon-year increase in profit after tax.

Aster DM: Shares of Aster DM Healthcare skyrocketed 14 percent after the company delivered a robust earnings performance for the July-September quarter. The hospital chain reported a net profit of Rs 97 crore in September, a stark turnaround from a net loss of Rs 31 crore in the same period last fiscal.

KPIT Technologies: KPIT Tech shares dropped by as much as 15 percent after JPMorgan lowered its target price to Rs 1,900 per share. This comes after the company revised its FY25 constant currency revenue growth outlook to the lower end of its 18-22 percent guidance range, mainly due to delays in deal ramp-ups and closures.

Dr Lal PathLabs: The pharma player’s share price slipped over 6 percent amid profit booking after the diagnostics firm said its consolidated profit after tax increased 18 percent on-year to Rs 131 crore for the second quarter ended September 30, 2024.