POST-MARKET REPORT

Indian markets extended the fall for a fifth consecutive session on October 25, with the Nifty breaking 24,100 intraday, amid selling across the sectors barring FMCG.

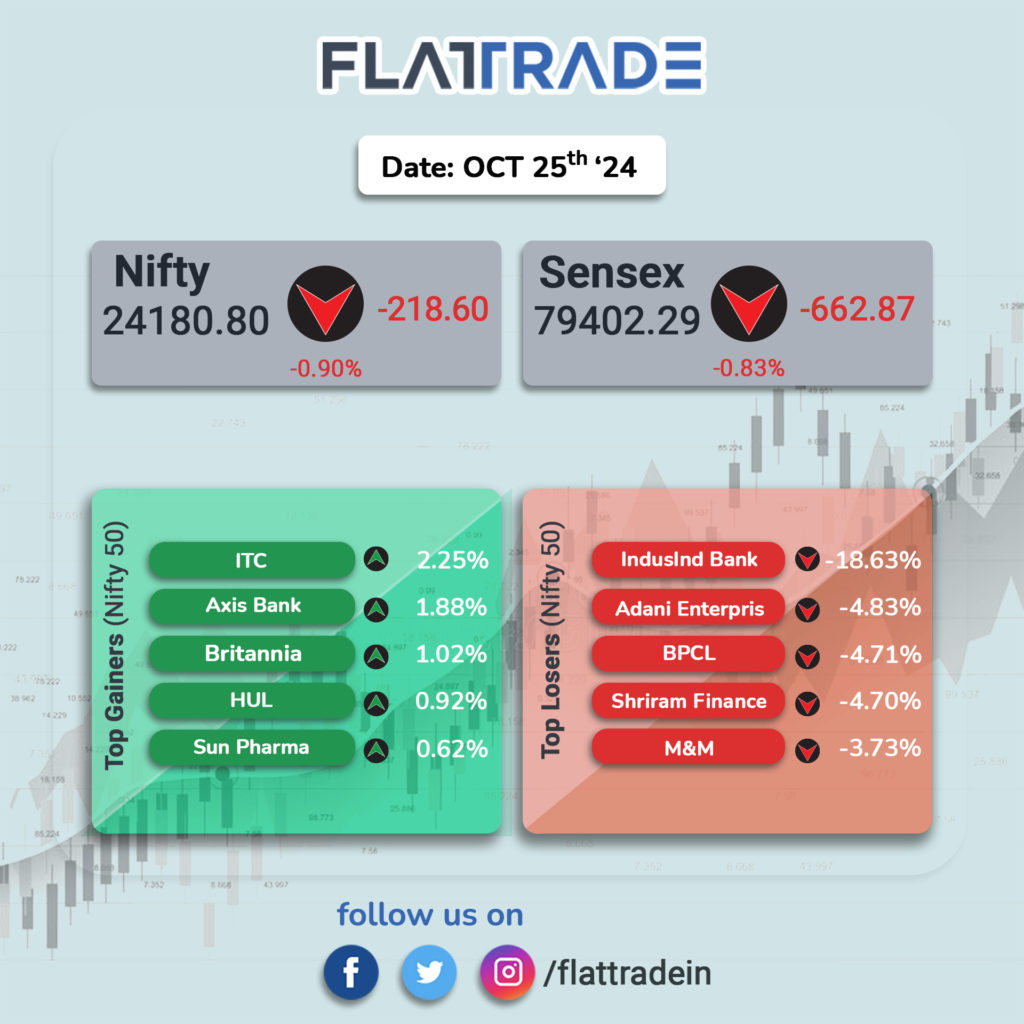

At close, the Sensex was down 662.87 points or 0.83 percent at 79,402.29, and the Nifty was down 218.60 points or 0.90 percent at 24,180.80.

IndusInd Bank, BPCL, Adani Enterprises, Shriram Finance, and M&M were among the top losers on the Nifty, while gainers were ITC, Sun Pharma, Britannia Industries, HUL and Axis Bank.

Among sectors, except FMCG (up 0.5 percent) all other indices ended in the red with auto, capital goods, metal, oil & gas, power, telecom, and media down 1-2 percent.

For the week, BSE Sensex and Nifty50 lost more than 2 percent each, and considering the broader market indices, the BSE Midcap index shed 1.5 percent, and the smallcap index fell 2.4 percent.

STOCKS TODAY

STOCKS TODAY

Bikaji Foods: Shares of Bikaji Foods surged over 10 percent after the company reported robust second-quarter earnings. The snack maker reported a 15% year-on-year rise in net profit to Rs 69 crore. Meanwhile, the company’s revenue surged by 19% to Rs 721 crore.

Godrej Consumer Products: Godrej Consumer Products rose as much as 6% after a host of brokerages issued bullish calls on the counter following the company’s second-quarter earnings. The company reported a 13% year-on-year rise in net profit to Rs 491 crore while its revenue rose 2 percent to Rs 3,666 crore.

DCB Bank: DCB Bank shares touched an intraday high of 10% after it reported a 23% year-on-year rise in net profit to Rs 155 crore for the second quarter. This growth was driven by a higher net interest income, which stood at Rs 519 crore, and a sharp rise in non-interest income of Rs 205 crore.

ITC: ITC shares saw an uptick after the company delivered a standout earnings report in the second quarter. With an impressive performance in key segments such as cigarette volumes and the hotel business, a host of analysts issued bullish calls on the stock.

IndusInd Bank: IndusInd Bank shares tanked nearly 20% after it reported a significant 39% drop in its consolidated net profit for the second quarter to Rs 1,331 crore. The bank’s net interest margin (NIM), a key indicator of profitability also fell, indicating some pressure on margins.

Dixon Technologies (India): Dixon Tech shares tanked as much as 12% despite delivering a robust performance in the second quarter. Even as the weak sentiment persisted today, a host of brokerages dished out bullish calls, suggesting that the mobile segment will be the biggest growth driver alongside IT hardware and backward integration.