POST-MARKET REPORT

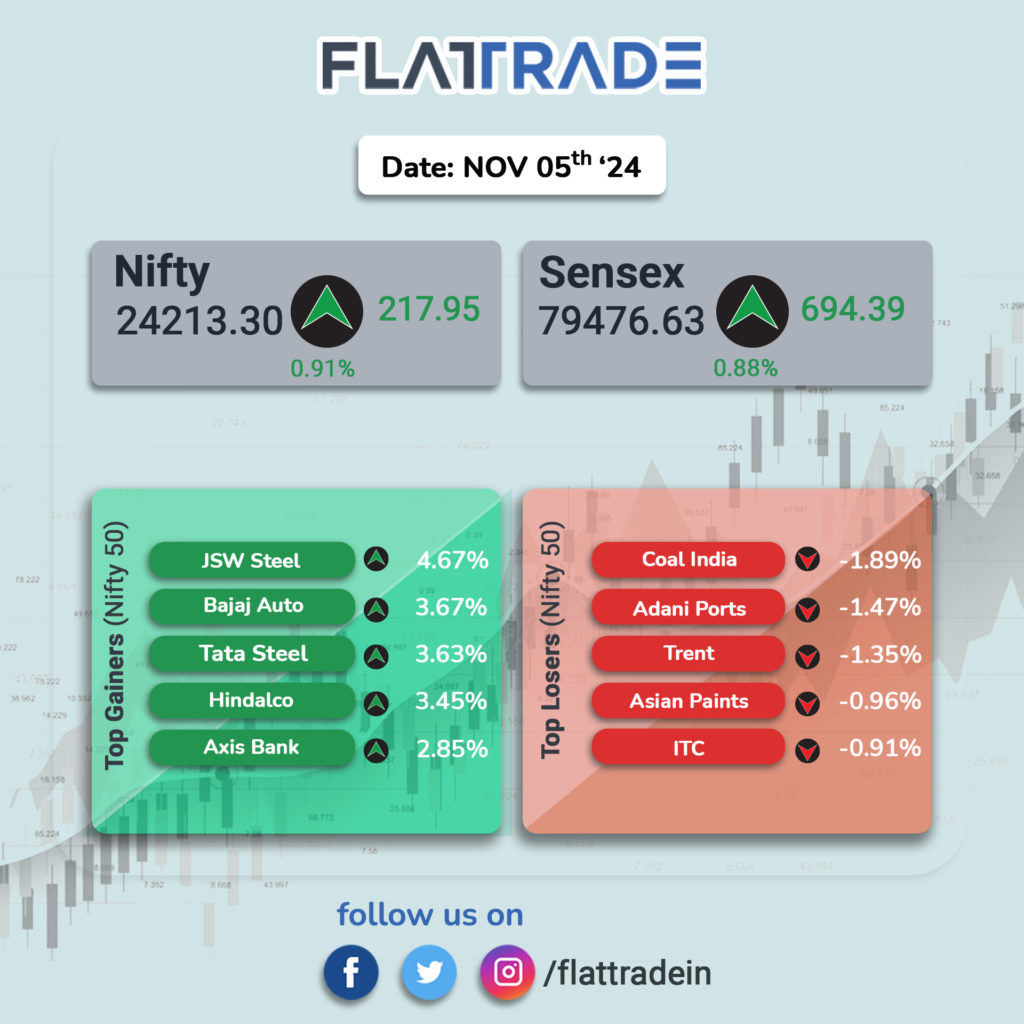

The domestic benchmark indices bounced back in the November 5 trade posting a sharp recovery after declining in the morning trade.

Nifty climbed above the 24,100 level, up 1.6 percent from the day’s low, and settled in green at 24,198.30, while the Sensex gained more than 1,100 points from the day’s low, backed by bank and metal stocks.

The recovery was primarily driven by gains in banking stocks, including HDFC Bank, ICICI Bank, Axis Bank, and State Bank of India, which collectively supported the market’s upward movement.

Among the sectoral indices, the Nifty Metals index recorded a sharp gain of 2.84%, followed by the Nifty Private Bank, Nifty PSU Bank, and Nifty Auto indices, each ending with gains of over 1%. Conversely, the Nifty FMCG and Nifty Media indices experienced modest losses, declining by more than 0.30%.

Mid and small-cap stocks also closed higher but lagged behind the benchmark indices. The Nifty Midcap 100 index recorded a gain of 0.59%, finishing at 56,115 points, while the Nifty Smallcap 100 index ended the session at 18,503 points, reflecting an increase of 0.43%.

STOCKS TODAY

KPR Mill: Shares fell 4 percent after the company posted a muted set of September quarter numbers. The company’s profit rose 1.6 percent year-on-year (Y-o-Y) to Rs 205 crore in Q2FY25) while the company’s revenue from operations dropped a little over 2 percent annually to Rs 1,480 crore.

Chemfab Alkalis: Shares of commodity chemicals company tanked 9 percent after reporting a net loss attributable to owners of Rs 0.53 crore in the second quarter of FY25, against a net profit of Rs 4.30 crore reported in the corresponding quarter of the previous fiscal year.

Amara Raja Energy & Mobility: Shares fell 4 percent and ranked among the top losers on the Nifty Smallcap index after the company reported its September quarter results that were a miss on expectations.

Gland Pharma: Shares soared over 13 percent following the company’s July-September earnings, which according to brokerages, hint that the worst for the drugmaker might be behind.

Saregama India: Shares fell 5 percent after the company reported its September quarter results where its net profit declined and margins too saw a significant compression compared to the same quarter last year.

Mazagon Dock Shipbuilders: Shares of the state-run defense company rose 4 percent after reporting its September quarter results which saw a sharp increase year-on-year, across all parameters. Net profit for the quarter increased by 76 percent year-on-year to Rs 585 crore, while revenue grew by 51 percent from the year-ago period to Rs 2,757 crore.