POST-MARKET REPORT

Indian equity market cheered Donald Trump’s victory in the US presidential election and extended the winning streak for the second straight session on November 6, with Nifty rising above 24,500, amid buying across sectors, especially in IT, realty, oil & gas, and power names.

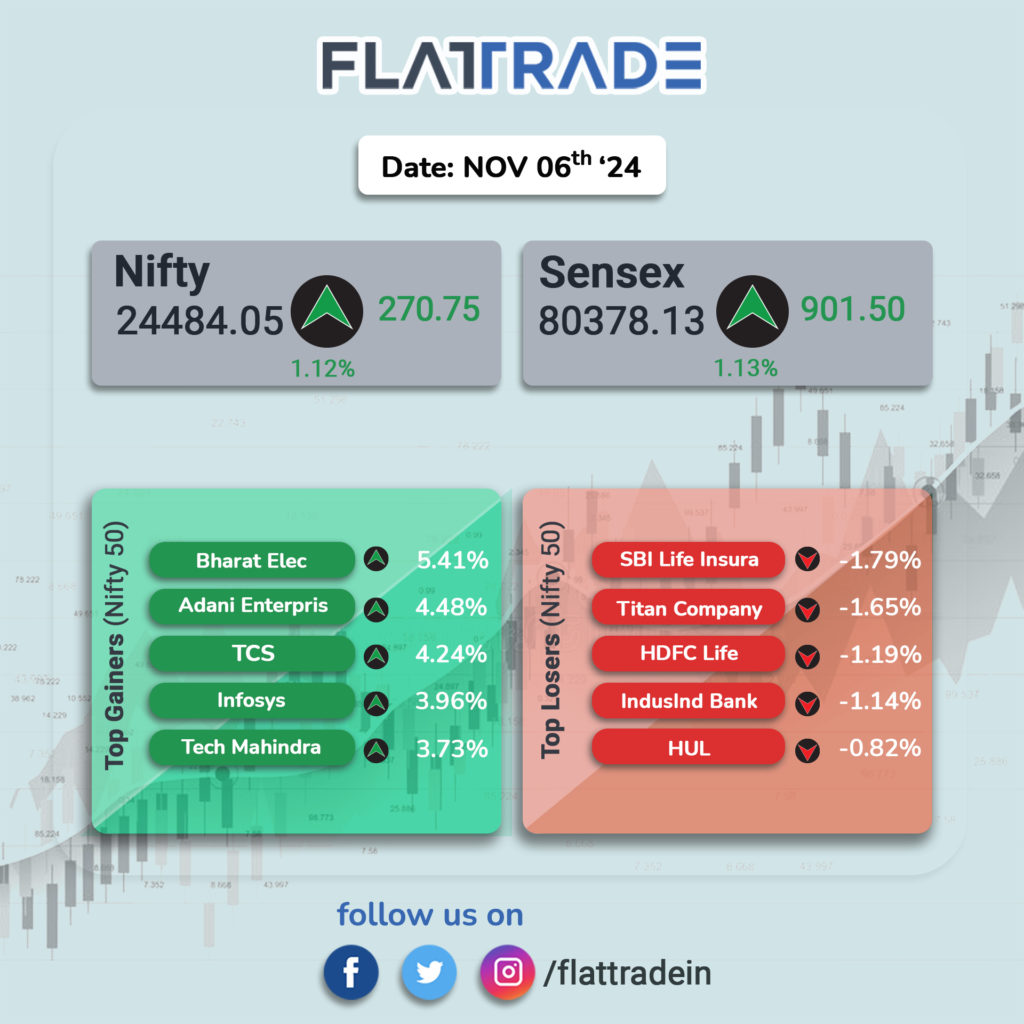

At close, the Sensex was up 901.50 points or 1.13 percent at 80,378.13, and the Nifty was up 270.75 points or 1.12 percent at 24,484.

The biggest gainers on the Nifty were Bharat Electronics, Adani Enterprises, TCS, Tech Mahindra, and Infosys, while losers included SBI Life Insurance, Titan Company, IndusInd Bank, HDFC Life, and HUL.

All the sectoral indices ended in the green with the IT index rising 4 percent, oil & gas, power, capital goods, and realty up 2 percent each.

BSE Midcap index is up more than 2 percent and Smallcap index is up nearly 2 percent.

STOCKS TODAY

eClerx Services: Shares surged over 7 percent after the company’s upbeat quarterly earnings bolstered sentiment. For the July-September quarter, eClerx reported a 5.9 percent sequential growth in revenue in dollar terms at $98.8 million, while the growth in constant currency terms stood at 5.7 percent. Net profit for the September quarter also grew to Rs 139.5 crore, up from Rs 112 crore in the previous quarter and Rs 135.1 crore in the same period last fiscal.

Dr Reddy’s Labs: Shares rose over 2 percent after the company posted decent quarterly earnings. Dr Reddy’s revenue surged by 17 percent to an all-time high of Rs 8,016 crore, with strong sales growth in North America primarily driven by volume increases, albeit partially offset by price erosion. Despite this, it reported a 15 percent-on-year drop in its net profit for Q2 at Rs 1,255 crore, impacted by acquisition costs for the Nicotinell portfolio, government land tax, minority interest in Nestle, and impairment charges.

Oil India: Shares surged around 6 percent following a robust earnings report. The state-owned firm reported a substantial net profit increase to Rs 2,069 crore, up from Rs 640 crore in the same quarter last year—an impressive 464 percent growth. However, revenue for the quarter fell 8 percent year-on-year to Rs 8,136 crore.

GAIL India: Shares surged over 6 percent after the company reported positive earnings for the quarter ended September 30, 2024. Morgan Stanley and Jefferies have both issued positive outlooks on the stock, highlighting its potential for growth and re-rating. Morgan Stanley maintained an ‘Overweight’ rating with a target price of Rs 258 per share, noting the company’s 19 percent integrated return on equity (RoE) for its gas pipeline business. They pointed to the ongoing volume growth and increasing domestic gas penetration as multiple catalysts for future stock gains, and valued GAIL at 1.2x its FY26 estimated price-to-book ratio.

Hindustan Zinc: Shares took a beating and plummeted 8 percent as the government announced offloading a 2.5 percent stake in the company through an offer-for-sale. The government’s long-awaited plan for an OFS to pare stake in Hind Zinc will be executed at a floor price of Rs 505, marking a sharp discount of nearly 10 percent from the previous closing level. Under the OFS, which opened today, the government will divest 1.25 percent equity or 5.28 crore shares, with a greenshoe option to increase the offer size by another 1.25 percent.

Mazagon Dock Shipbuilders: Share price rose 2 percent after the state-run company reported strong September quarter results. The defence company reported a rise of 76 percent in its net profit on-year to Rs 585 crore in the second quarter of the current fiscal. The revenue of the company grew 51 percent in the quarter under review to Rs 2,757 crore from a year-ago period.