The lot sizes for index derivatives, such as Nifty and Bank Nifty, are often reviewed and revised by exchanges periodically. As the effective date for the revised lot sizes for index derivatives is set for November 20, 2024

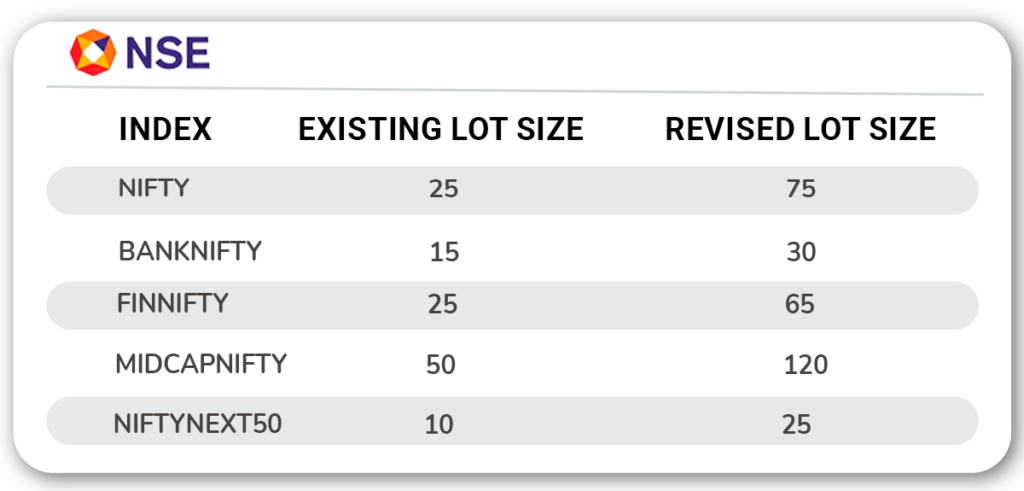

Revised Lot size for NSE indices

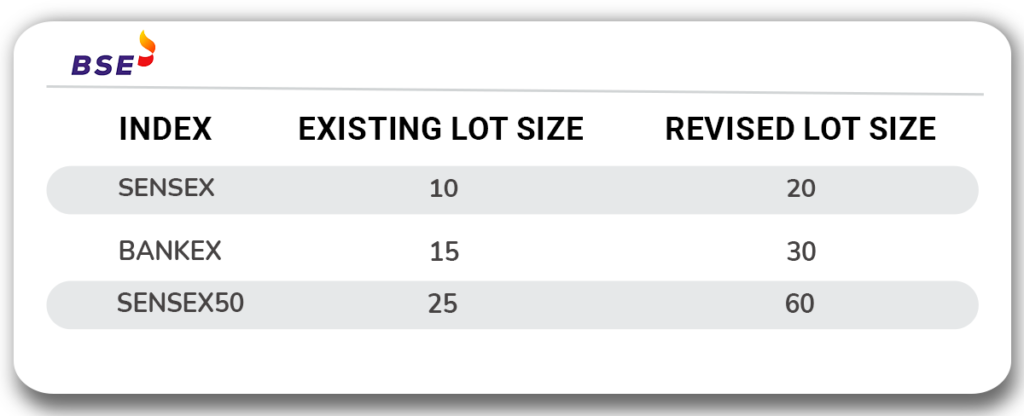

Revised Lot size for BSE indices

For quarterly and half-yearly contracts:

- The lot size will change on December 26, 2024, end of the day for Nifty.

- The lot size will change on December 24, 2024, end of the day for Bank Nifty.

- The Lot size will change on December 27, 2024, end of the day for Sensex.

These changes will come into effect from the following expires:

| Index | Expiry | Expiry Date | Effective change |

| Nifty 50 | Weekly | December 19, 2024 | Last weekly expiry with existing lot size |

| Weekly | January 02, 2025 | First weekly expiry with revised lot size | |

| Monthly | January 30, 2025 | Last monthly expiry with existing lot size | |

| Monthly | February 27, 2025 | First monthly expiry with revised lot size | |

| Quarterly & half yearly | March 27, 2025 | Will be revised from December 26, 2024, end of the day | |

| Nifty Bank | Monthly | January 29, 2025 | Last monthly expiry with existing lot size |

| Monthly | February 26, 2025 | First monthly expiry with revised lot size | |

| Quarterly | March 26, 2025 | Will be revised from December 24, 2024, end of the day | |

| Nifty Financial Services | Monthly | January 28, 2025 | Last monthly expiry with existing lot size |

| Monthly | February 25, 2025 | First monthly expiry with revised lot size | |

| Nifty Midcap Select | Monthly | January 27, 2025 | Last monthly expiry with existing lot size |

| Monthly | February 24, 2025 | First monthly expiry with revised lot size | |

| Nifty Next 50 | Monthly | January 31, 2025 | Last monthly expiry with existing lot size |

| Monthly | February 28, 2025 | First monthly expiry with revised lot size | |

| Sensex | Weekly | January 03, 2025 | Last weekly expiry with existing lot size |

| Weekly | January 10, 2025 | First weekly expiry with revised lot size | |

| Monthly | January 31, 2025 | Last monthly expiry with existing lot size | |

| Monthly | February 28, 2025 | First monthly expiry with revised lot size | |

| Quarterly & half yearly | March 28, 2025 | Will be revised from December 27, 2024, end of the day | |

| BSE Bankex | Monthly | January 27, 2025 | Last monthly expiry with existing lot size |

| Monthly | February 24, 2025 | First monthly expiry with revised lot size | |

| BSE Sensex 50 | Monthly | January 30, 2025 | Last monthly expiry with existing lot size |

| Monthly | February 27, 2025 | First monthly expiry with revised lot size |

Revisions in the lot sizes for index derivatives can have a significant impact on traders in the following ways:

Changes in Capital Requirements: With an Increase in Lot Size, traders will need more capital to initiate positions. This could make it difficult for small traders or those with limited funds to participate in the market.

Liquidity and Volatility: An increase lot size will impact market liquidity. larger lot sizes might limit trading to larger, institutional players, which could impact liquidity and increase market volatility.

Scalping and Intraday Trading: Changes in lot size may alter the risk-reward ratio for strategies like scalping. A larger lot size could increase potential profits but also magnify losses.

Additional Margins on Expiry Day: Starting November 20, 2024, an Extreme Loss Margin (ELM) of 2% will be applied to short positions on expiry day to mitigate potential volatility risks.

Example: If you hold a short position in a Nifty 25,000 call option expiring on October 30 with a margin requirement of Rs. 1 lakh, you will need an additional margin of Rs. 37,500 on the expiry day. The calculation is based on the contract value: [Strike price (25000)* Lot size(75) * 2%/100).

No Calendar Spread Benefits on Expiry Day: Currently, traders holding positions across different expiries (calendar spreads) receive margin benefits, reducing the margin requirement. However, from February 1, 2025, these margin benefits will no longer be available on the expiry day of contracts.

Example:

Suppose you have a short option expiring on January 31 with a margin requirement of Rs. 1 lakh, hedged with a long option expiring on February 28, reducing the required margin to Rs. 50,000. On January 31 (expiry day), you will need to maintain the full Rs. 1 lakh margin as the benefit will be removed.

Intraday Monitoring of Position Limits: From April 1, 2025, SEBI and exchanges will begin intraday monitoring of position limits. Currently, these limits are reviewed at the end of each trading day

Client Limit – 5% of all derivative contracts of the same underlying.

Broker Limit – 15% of all derivative contracts.

Implementation Dates for SEBI’s New Regulations:

- Increase in Contract Size: Effective from November 20, 2024

- Limiting Weekly Expiry Contracts: Effective from November 20, 2024

- Additional Margins on Expiry Day: Effective from November 20, 2024

- No Calendar Spread Benefits on Expiry Day: Effective from February 1, 2025

- Upfront Collection of Premium While Buying Options: Effective from February 1, 2025

- Intraday Monitoring of Position Limits: Effective from April 1, 2025

For further details regarding the existing contracts refer the circular below.

To read NSE circular, click here

To read BSE circular, click here

We encourage you to review these changes and consider their impact on your trading strategy.