POST-MARKET REPORT

The Indian benchmark indices bounced back on November 29 after witnessing a steep fall in the previous session, with Nifty starting the December F&O series above 24,100, led by buying in heavyweights and across sectors, barring realty and PSU banks.

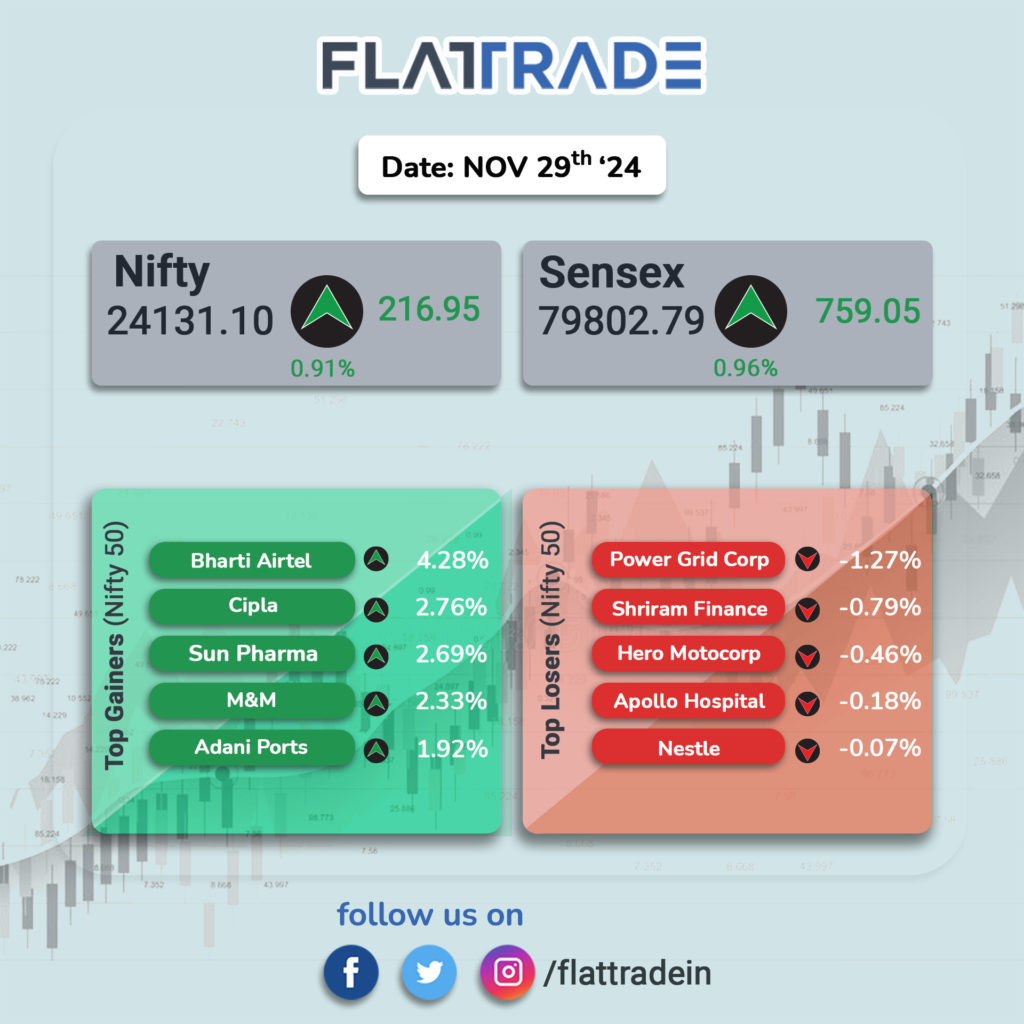

At close, the Sensex was up 759.05 points or 0.96 percent at 79,802.79, and the Nifty was up 216.90 points or 0.91 percent at 24,131.10.

In today’s gain, investors’ wealth increased by around Rs 3.49 lakh crore, as the market capitalization of BSE-listed companies jumped to Rs 446.47 lakh crore, from Rs 442.98 lakh crore in the previous session.

For the week, BSE Sensex and Nifty gained 1 percent each, while for November, Sensex added 0.5 percent, while Nifty slipped 0.30 percent.

Bharti Airtel, Cipla, Sun Pharma, M&M, and Adani Ports were among the major gainers on the Nifty, while losers were Power Grid Corp, Shriram Finance, Hero MotoCorp, Nestle, and Apollo Hospitals.

Except for realty and PSU Bank, all other sectoral indices ended in the green with auto, energy, pharma, and media up 1-2 percent.

The BSE Midcap index was up 0.3 percent and the Smallcap index rose 0.7 percent.

STOCKS TODAY

Zee Entertainment Enterprises: Shares rallied 5 percent, a day after the company informed the exchanges that its shareholders have rejected a proposal to reappoint Chief Executive Officer Punit Goenka as a Director at its annual general meeting (AGM).

Divi’s Laboratories: Shares gained 4 percent after international brokerage Citi reiterated its bullishness over the stock by naming it as its top pick in the Indian pharma sector, driven by the drugmaker’s expanding pipeline for its contrast media business. Accordingly, the brokerage held on to its ‘buy’ call on the stock, with a price target of Rs 6,850, which implies a potential upside of 15 percent from Thursday’s closing.

Sigachi Industries: Shares surged 6.5 percent following the company’s announcement regarding its submission of a Certificate of Suitability (CEP) filing for Propafenone Hydrochloride. Trimax Biosciences, a subsidiary of Sigachi, received communication from the European Directorate for the Quality of Medicines & Health Care (EDQM) on this filing.

Newgen Software Technologies: Shares surged 5 percent following an order from the Reserve Bank of India (RBI) to implement and maintain the Regulatory Application Management System (RAMS). The total value of the order stood at Rs 32.45 crore, inclusive of 18 percent GST.

CreditAccess Grameen: Shares fell 8.5 percent after international brokerage Goldman Sachs slashed its rating on the microfinance player as the earnings outlook remains clouded. The brokerage downgraded the NBFC’s rating to ‘Sell’ from ‘Buy’ and revised its target price to Rs 564, down from Rs 1,426 per share earlier. This indicates a 42 percent downside from the previous session’s close.