POST-MARKET REPORT

The benchmark indices ended with marginal losses on December 24, with the Nifty above 23,700 amid buying seen in the auto, oil & gas, and FMCG names.

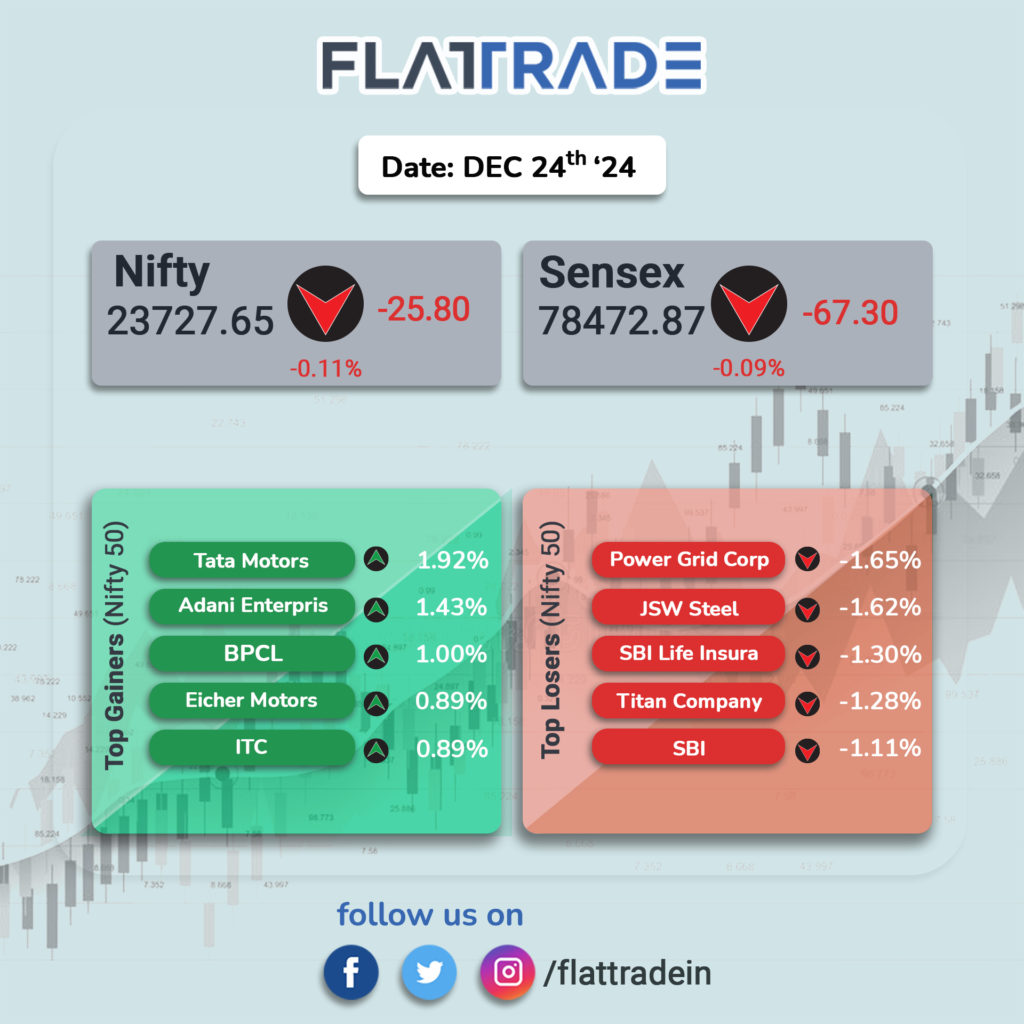

At close, the Sensex was down 67.30 points or 0.09 percent at 78,472.87, and the Nifty was down 25.80 points or 0.11 percent at 23,727.65.

Power Grid Corp, JSW Steel, SBI Life Insurance, Titan Company, and SBI were among the major losers on the Nifty, while gainers were Tata Motors, Adani Enterprises, Eicher Motors, BPCL, and ITC.

Among sectors, buying was seen in the auto, FMCG, oil & gas, while selling was seen in the IT, media, metal, PSU Bank. The BSE midcap index ended on a flat note, while smallcap index was up 0.3 percent.

The market will remain shut on Wednesday, December 25, on account of Christmas.

STOCKS TODAY

Interarch Building Products: Shares soared over 10 percent as investors rejoiced the management’s solid growth outlook. The management projected to deliver 50 percent growth in North India over FY25, with the majority of this growth coming from Uttar Pradesh. The North India region is expected to contribute 30 percent to the company’s overall business volume during this period.

Gulf Oil Lubricants: Shares rose 3 percent after the company announced it has entered into a partnership with Nayara Energy, India’s largest private fuel retailer, to make Gulf’s entire automotive product range available across Nayara’s network of over 6,500 fuel retail outlets nationwide. This strategic alliance is part of a 3-year contract leveraging Nayara Energy’s reach to further strengthen Gulf Oil’s brand presence and product availability to cater to the expanding automotive market, particularly along the country’s rapidly developing highway infrastructure in India.

Greaves Cotton: Shares skyrocketed nearly 8 percent after the company’s arm, Greaves Electric Mobility Limited (GEML) filed a draft red herring prospectus with the market regulator Securities and Exchanges Board of India (SEBI). Shares of Greaves Cotton have zoomed over 45 percent in the past month, largely driven by the board’s approval of the public offer for the subsidiary’s market listing. GEML’s IPO will include a fresh issue of equity shares along with an offer for sale by existing shareholders.

HG Infra Engineering: Shares for HG Infra gained over 2 percent following an announcement that the company’s subsidiary entered into a battery energy storage purchase agreement. According to an exchange filing, the purchase agreement with NTPC is for a long-term procurement of 185 MW.

Vedanta: Shares fell over 2 percent as the stock traded ex-dividend. The board had approved the fourth interim dividend for FY25 of Rs 8.50 per equity share, amounting to Rs 3,324 crore. Previously, Vedanta announced dividends in August, July, and May this year at Rs 20, Rs 4, and Rs 11 per share, respectively. With the latest announcement, the total dividend payout by Vedanta for FY2025 will be Rs 16,799 crore.