POST-MARKET REPORT

A sharp rebound in the second half on January 8 amid buying in heavyweights and IT, oil & gas, and FMCG stocks, helped the Indian benchmark indices to erase most of the intraday losses to end nearly flat.

Despite weak global markets, Indian equity indices opened higher but failed to build the gains and traded lower for most of the session. However, last-hour buying helped to wipe out all the intraday losses.

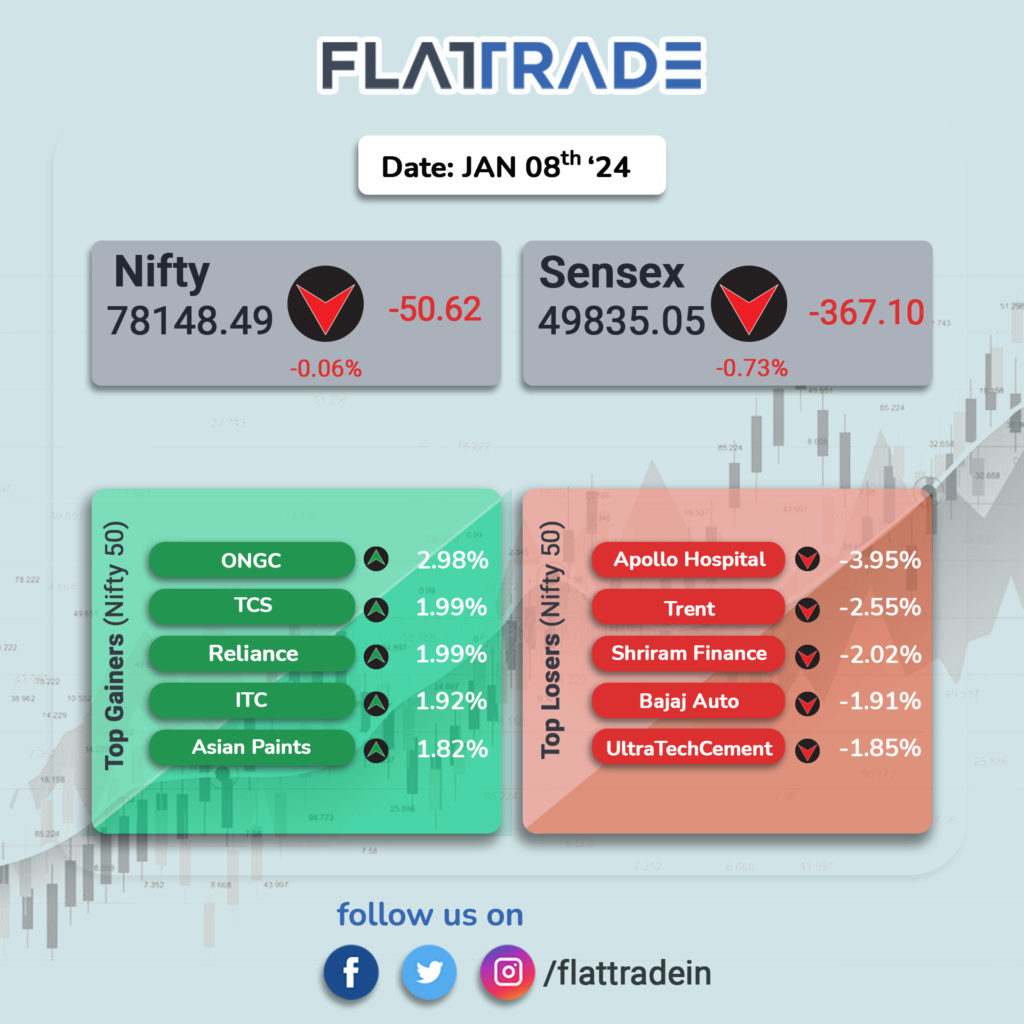

At close, the Sensex was down 50.62 points or 0.06 percent at 78,148.49, and the Nifty was down 18.95 points or 0.08 percent at 23,688.95.

ONGC, ITC, Reliance Industries, TCS, and Asian Paints were among the top gainers on the Nifty, while losers were Apollo Hospitals, Trent, Bajaj Auto, Adani Ports, and Shriram Finance.

On the sectoral front, FMCG, oil & gas, and IT rose 0.3-1.5 percent, while PSU bank, pharma, metal, media, media, bank, and auto shed 0.4-1 percent.

BSE Midcap and Smallcap indices shed 1 percent each.

STOCKS TODAY

Reliance Industries: International brokerages Jefferies and Bernstein reiterated their bullishness on chemicals-to-retail conglomerate Reliance Industries Ltd, leading to a 2 percent bump in its share price. Reliance Industries’ stock price has seen a 22 percent correction from its 52-week high. As a result, RIL’s valuations have become the cheapest since the COVID-19 shock seen in March 2020, making for a great buying opportunity as the risk-reward ratio turns attractive.

Borosil Renewables: Shares of Borosil Renewables were locked in the 5 percent upper circuit for a second consecutive session after the company’s promoter recently increased their holding. Promoter increasing stake in a company is generally seen as a positive sign, reflecting confidence over its growth prospects.

Spandana Sphoorty Financial: Shares of Spandana Sphoorty Financial skyrocketed 15 percent to a 10-week high driven by an influx of heavy trading volumes in the counter. As many as 55 lakh shares changed hands on the exchanges so far, already exceeding the one-month daily average of seven lakh shares.

ONGC: ONGC shares extended gains for a second session in a row after the oil marketing major bagged an upgrade from Hong Kong-based brokerage CLSA. The brokerage upgraded this stock to ‘High Conviction Outperform’ from ‘Outperform’ earlier.