POST-MARKET REPORT

The Indian market ended lower during a highly volatile session on January 10 with Nifty falling below 23,350, led by selling across the sectors, barring IT stocks, which rallied post TCS’ estimated Q3 numbers.

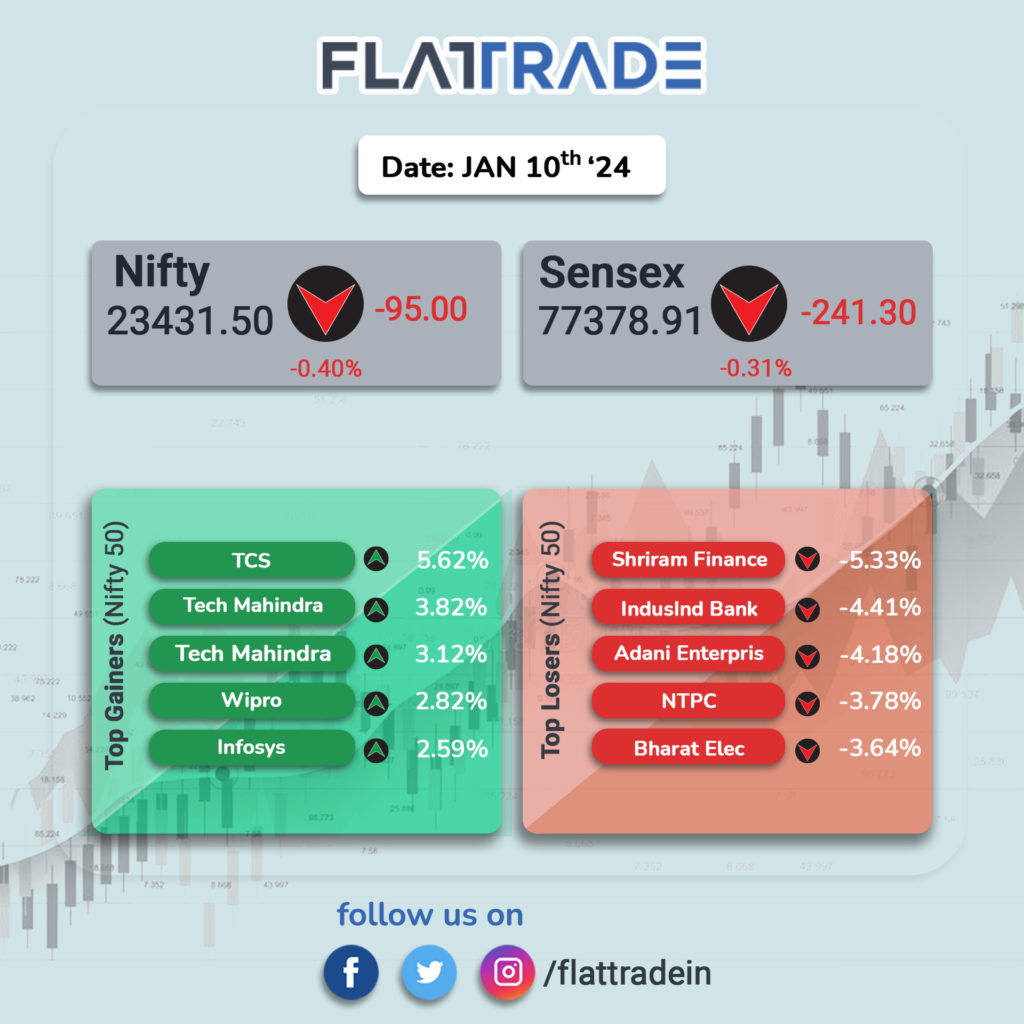

At close, the Sensex was down 241.30 points or 0.31 percent at 77,378.91, and the Nifty was down 95 points or 0.40 percent at 23,431.50.

TCS, Tech Mahindra, Wipro, Infosys, and HCL Technologies were among the major gainers on the Nifty, while losers were Shriram Finance, IndusInd Bank, Adani Enterprises, NTPC and Bharat Electronics.

Except IT, all other sectoral indices ended in the red with power, PSU, realty, healthcare, and PSU Bank down 2 percent each.

BSE midcap index shed 1.2 percent and smallcap index slipped 2.4 percent.

For the week, BSE Sensex and Nifty fell more than 2 percent.

STOCKS TODAY

IRCTC: Shares gained above 2 percent, snapping their two-day losing streak on the bourses, after international brokerage Macquarie initiated coverage with an ‘outperform’ rating and assigned a target price of Rs 900. Macquarie said that IRCTC’s unparalleled monopoly in Indian Railways’ e-ticketing and catering services remains its standout strength, positioning it as a leader of the country’s railway modernization journey.

Delta Corp: Shares gained 4.37 percent as the Supreme Court on January 10 stayed GST show cause notices to the tune of Rs 1.12 lakh crore to online gaming companies. Supreme Court stayed all further proceedings for all show cause notices until the final disposal of the case. The Supreme Court’s decision will come as a relief to gaming companies and could potentially stabilize their financial outlook.

Adani Wilmar: Shares slipped to their 10 percent lower circuit as promoter Adani Commodities launched a two-day offer-for-sale (OFS) for non-retail investors. The sale for retail investors is set to begin on January 13. Adani Commodities plans to sell 17 crore shares in Adani Wilmar, which accounts for 13.5 percent of the company’s total issued and paid-up equity share capital.

GTPL Hathaway: Shares tanked 11.60 percent on January 10 after the digital cable TV and broadband services provider reported a sharp decline in net profit for the third quarter, leaving investors unimpressed. According to a regulatory filing, the company reported a 57.2 percent year-on-year drop in net profit for the third quarter ending December 31, 2024. The company posted a net profit of Rs 10.1 crore, down from Rs 23.6 crore in the same period last year.

IndusInd Bank: Shares dropped 4.29 percent after Goldman Sachs downgraded the stock to ‘neutral’ from its earlier ‘buy’ call. The international brokerage reduced its target price for the shares of the private lender to Rs 1,090 from Rs 1,318. This, however, suggests a potential upside of 11% from the stock’s previous closing level. Goldman cited rising defaults in IndusInd Bank’s commercial retail portfolio, slower revenue growth, and growing earnings pressure as reasons for the revised outlook on the stock.