POST-MARKET REPORT

The Benchmark indices erased all the previous session losses with a gain of 0.5 percent led by financial, power, and telecom names.

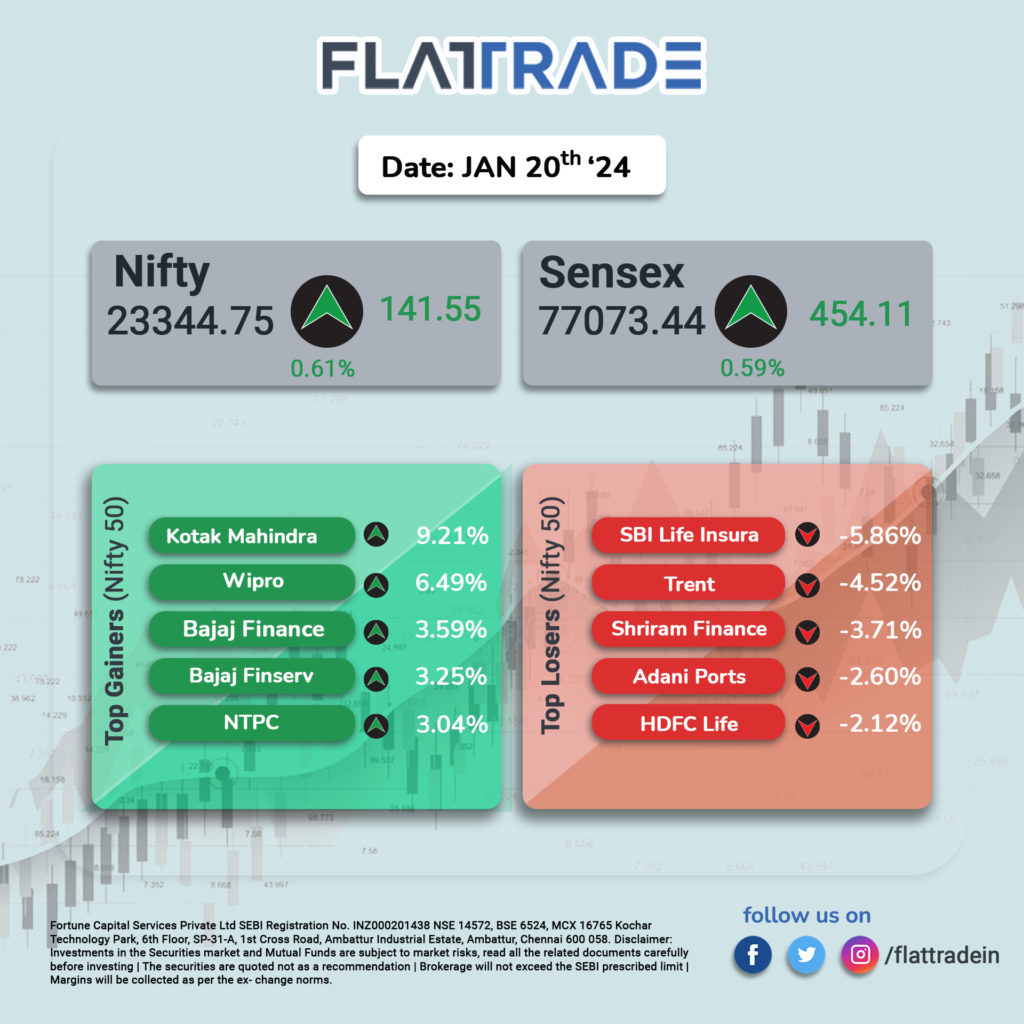

At close, the Sensex was up 454.11 points or 0.59 percent at 77,073.44, and the Nifty was up 141.55 points or 0.61 percent at 23,344.75.

Kotak Mahindra Bank, Wipro, Bajaj Finance, NTPC, and Bajaj Finserv were among the major gainers on the Nifty, while losers were SBI Life Insurance, Shriram Finance, Trent, HDFC Life, and Adani Ports.

Among sectors, except auto and FMCG, all other indices ended in the green with bank, media, metal, capital goods, PSU, telecom, power, and PSU bank up 1-2 percent.

BSE midcap index was up 0.66 percent and smallcap index rose nearly 1 percent.

STOCKS TODAY

Zomato: Blinkit, the quick commerce arm of Zomato, posted adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) loss of Rs 103 crore in Q3FY25, a 16 percent increase year-on-year (YoY) from a loss of Rs 89 crore incurred during the same period last year. “The losses in our quick commerce business this quarter are largely on account of pulling forward the growth investments in the business that we would have otherwise made in a staggered manner over the next few quarters”, Deepinder Goyal, co-founder, and group CEO, of Zomato said.

Supreme Industries: Shares of Supreme Industries fell over 4 percent on January 20 after the company reported a year-on-year decline in net profit, EBITDA, and EBITDA margins for the third quarter. For Q3FY25, Supreme Industries reported a consolidated Profit After Tax (PAT) of Rs 187 crore, down 27 percent year-on-year. Revenue from operations rose marginally by over 2 percent to Rs 2,510 crore.

Bharat Dynamics: Shares of Bharat Dynamics climbed 5 percent to Rs 1,345 on January 20, marking a 1-month high and extending their winning streak to three sessions. The stock has surged 18 percent over the past three days, driven by strong order momentum. The company recently signed a Rs 2,960 crore contract with the Defence Ministry to supply Medium-Range Surface-to-Air Missiles (MRSAM) for the Indian Navy. The MRSAM system is a standard feature on multiple Indian Naval Ships and is planned to be installed on most future platforms.

Waaree Renewable: Shares of Waaree Renewable Technologies jumped up 7 percent to Rs 1,118 apiece on January 20 after the company received a letter of intent (LOI) from a prominent wind energy company. Over the past 3 months, shares of Waaree Renewable Technologies tumbled over 36 percent, underperforming a 6 percent decline in the benchmark Nifty 50 index. Earlier, Waaree Renewable shares had hit a 52-week low of Rs 530 per share on January 19, 2024.

Havells India: shares rose on January 20 even as the firm’s net profit fell marginally in the December quarter. The home appliances maker’s profit fell to Rs 283 crore in the three months ended December 31 from Rs 288 crore a year earlier. Havells’ revenue from operations rose nearly 11% to Rs 4,883 crore, while total expenses climbed 12.3% to Rs 4,564 crore.