POST-MARKET REPORT

Indian benchmark indices, Sensex and Nifty, closed higher on January 22 after a volatile session, rebounding from seven-month lows, driven by strength in technology stocks.

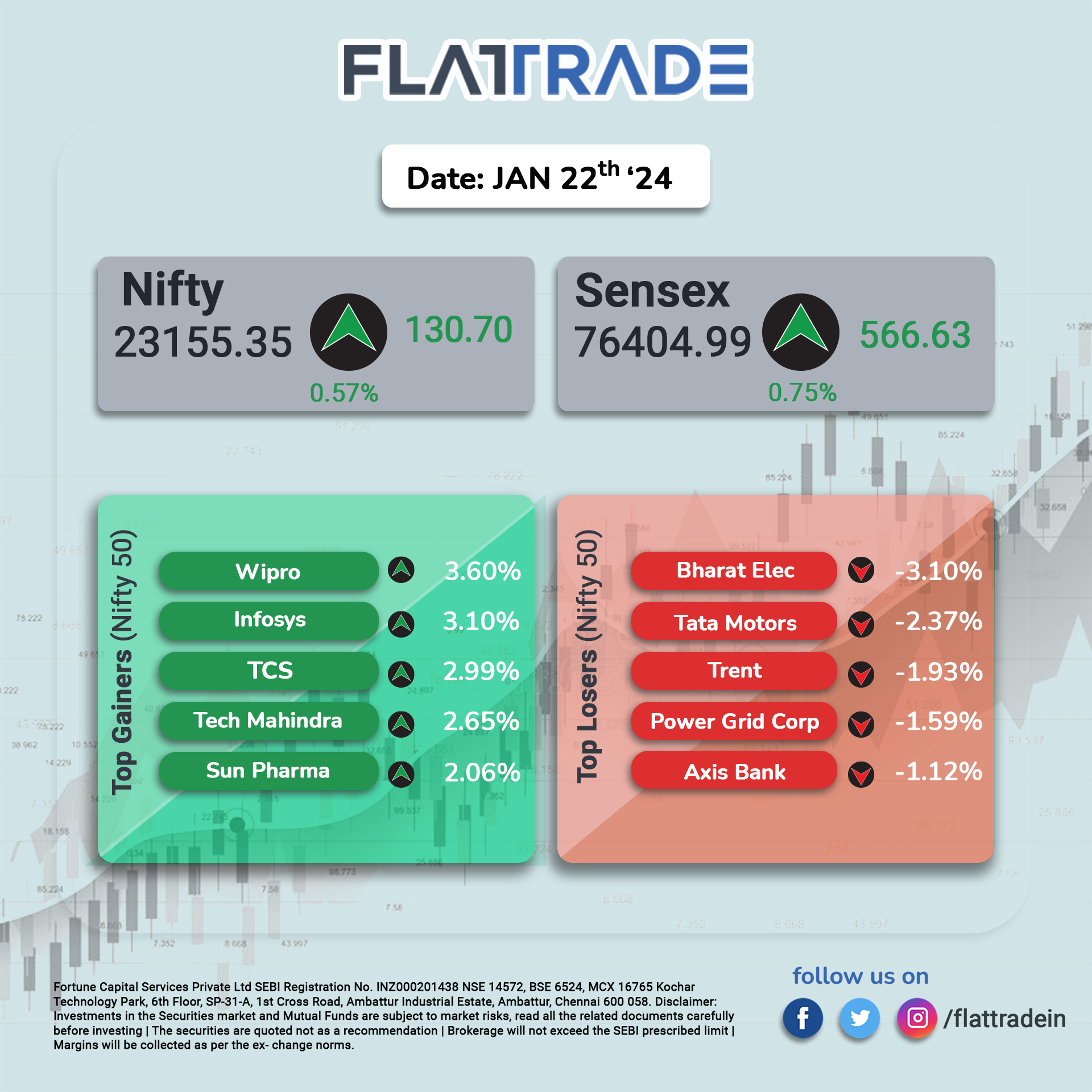

At the close, the Sensex rose 566 points (0.75 percent) to 76,404, while the Nifty gained 130 points (0.57 percent) to finish at 23,155. Market breadth remained weak, with 1,110 stocks advancing, 2,677 declining, and 107 remaining unchanged.

Sectoral performance was mostly negative, with only a few indices showing resilience. Nifty IT, Nifty Pharma, and Bank Nifty posted stable gains, while the Nifty Realty index emerged as the biggest laggard, falling by 4 percent.

The Nifty Midcap 100 index has tumbled 1.34% to 53,113, and the Nifty Smallcap 100 index experienced even more selling pressure as it ended with a cut of 1.63% at the 17,172 level.

Among individual stocks, HDFC Bank shares ended over 1 percent higher, buoyed by positive sentiment following its steady Q3FY25 results.

STOCKS TODAY

HUDCO: Housing & Urban Development Corporation Ltd (HUDCO) on January 22 reported a net profit of Rs 735 crore in the October-December quarter (Q3) of FY25. Its net profit stood at Rs 519.23 in the corresponding quarter of the previous financial year. The Navratna company also recorded a strong rise in revenue at Rs 2,760 crore in Q3. This marks a rise of nearly 37% from the Rs 2,013 crore revenue reported in the year-ago period. HUDCO also announced an interim dividend of Rs 2.05 per equity share for the current financial year 2025.

India Cements: Shares of India Cements plunged 13 percent weighed down by disappointing December quarter (Q3FY25) results. The cement manufacturer’s net loss ballooned multi-fold YoY to Rs 428 crore in Q3FY25, compared to a modest Rs 16 crore loss in the same quarter last year. Adding to the financial strain was an exceptional loss of Rs 190 crore in the quarter ended December 31, 2024. Revenue from operations also witnessed a steep 16.5 percent year-on-year decline, falling to Rs 903.2 crore from Rs 1,081.9 crore in Q3FY24, reflecting weaker demand and pricing pressures in a challenging macroeconomic environment.

Hindustan Unilever: The company reported a 19 percent year-on-year increase in net profit for the quarter ended December 2024 (Q3 FY25), driven by a one-time exceptional gain from the divestment of its Pureit business. The company’s standalone net profit stood at Rs 3,001 crore, significantly higher than the Rs 2,519 crore reported in the same quarter last year.

BPCL: Bharat Petroleum Corporation Limited (BPCL) on January 22 reported a 20% rise in consolidated net profit at Rs 3,806 crore for the quarter ended December 31, 2024. It reported a net profit of Rs 3,181 crore in the year-ago period. The state-run oil retailer’s revenue from operations decreased 2% to Rs 1.27 lakh crore in Q3FY25 as against Rs 1.3 lakh crore in the year-ago period.

Neuland Labs: Neuland Laboratories rose nearly 6 percent on January 22 after the company announced that its board of directors approved capital expenditures totaling Rs 342 crore for capacity expansion at its facilities in Telangana. The company plans to increase the capacity of its peptide synthesizers at its Unit 1 facility in Bonthapally Village, Gummadidala Mandal of Sangareddy District. The existing capacity of 0.5 KL, with a utilization rate of 30 percent, will be expanded by an additional 6.37 KL by FY27

Disclaimer: Investments in the Securities market and Mutual Funds are subject to market risks, read all the related documents carefully before investing | The securities are quoted not as a recommendation | Brokerage will not exceed the SEBI prescribed limit | Margins will be collected as per the ex- change norms. Fortune Capital Services Private Ltd SEBI Registration No. INZ000201438 NSE 14572, BSE 6524, MCX 16765 Kochar Technology Park, 6th Floor, SP-31-A, 1st Cross Road, Ambattur Industrial Estate, Ambattur, Chennai 600 058.