POST-MARKET REPORT

The benchmark indices, Sensex and Nifty 50, ended flat amid high volatility after Finance Minister Nirmala Sitharaman’s Budget speech.

Key sectors like insurance, FMCG, real estate, power, railways and defence were on investors’ radar amid the Budget impact on the share market.

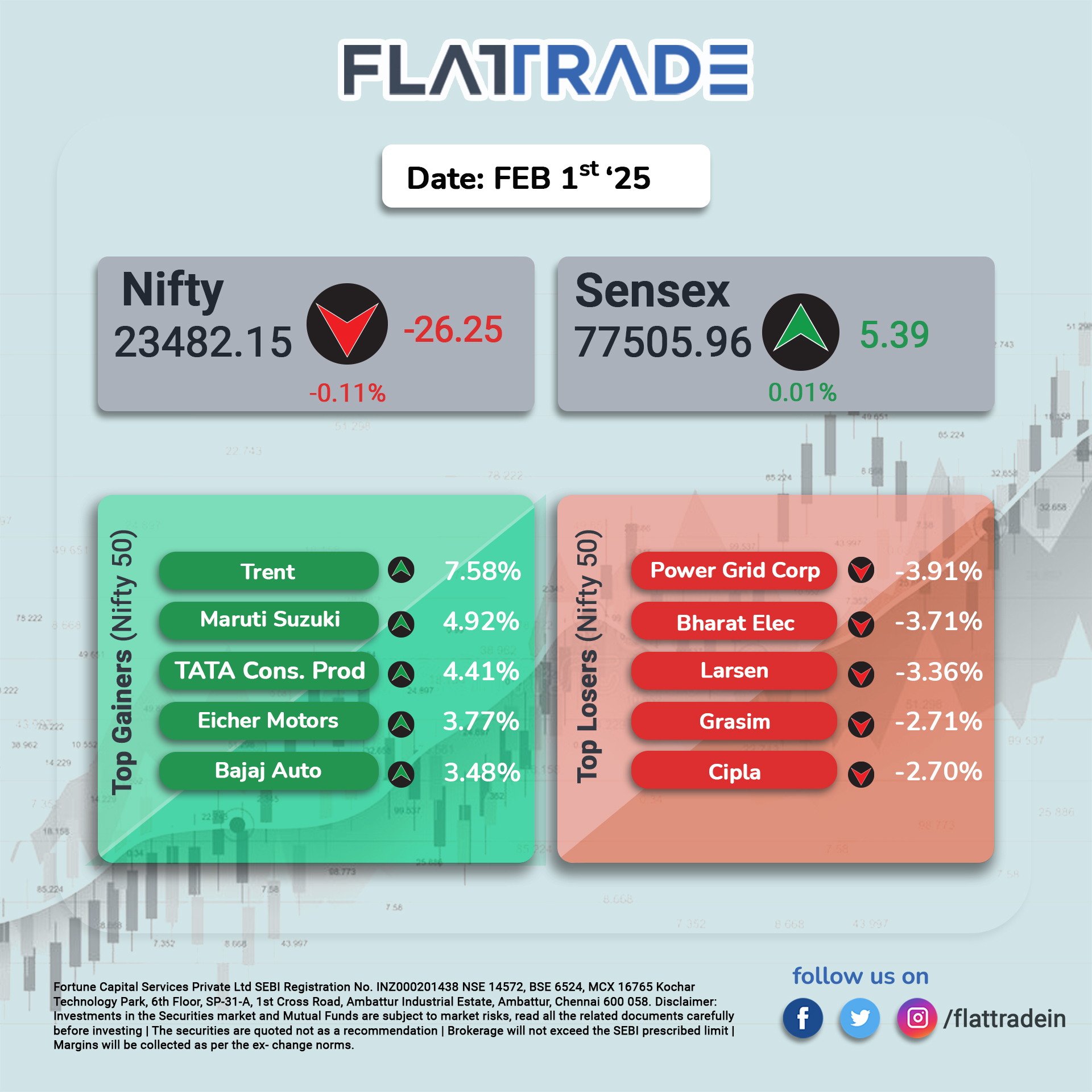

The Sensex closed 5.39 points, or 0.01%, higher at 77,505.96, while the Nifty 50 settled 26.25 points, or 0.11%, lower at 23,482.15, on Saturday after witnessing strong fluctuations during the session.

Trent, ITC Hotels, Maruti Suzuki India, Tata Consumer Products and Eicher Motors were the top gainers on Nifty 50, while Bharat Electronics, PowerGrid Corporation of India, Larsen & Toubro (L&T), Cipla and Grasim Industries were the top index losers.

Among sectoral indices, Nifty FMCG, Nifty Realty, Nifty Media, and Nifty Auto rallied the most, while Nifty PSU Bank, Nifty Metals, Nifty Pharma and Nifty Oil & Gas were the losers.

Broader markets ended mixed, as the Nifty Smallcap 100 index gained 0.41%, while the Nifty Midcap 100 index closed 0.42% lower. Bank Nifty index slipped 80.25 points, or 0.16%, to end at 49,506.95.

STOCKS TODAY

Avanti Feeds: The positive movement in shrimp stocks follows the government’s potential introduction of an enabling framework for the sustainable harnessing of fisheries in India’s Exclusive Economic Zone (EEZ), which includes the high seas, particularly focusing on the Andaman and Lakshadweep islands. This move is expected to enhance the sustainability and growth prospects of the fisheries sector.

Nuclear Energy stocks: Nuclear energy-focussed stocks gained as Finance Minister Nirmala Sitharaman announced a target to develop at least 100 GW of nuclear energy by 2047. In her budget speech, the Finance Minister noted that this development is essential for energy transition efforts. Additionally, for an active partnership with the private sector towards this goal, amendments to the Atomic Energy Act and the Civil Liability for Nuclear Damage Act will be taken up.

Realty stocks: Shares of real estate companies rallied after the government announced a major tax relief, exempting income up to Rs 12 lakh from taxation. Experts believe this move will provide a significant boost to the real estate sector, particularly benefiting homebuyers. Leading the gains, Prestige Estate surged 5 percent, Phoenix Mills jumped 4.7 percent, Macrotech Developers advanced 3 percent, Sobha gained 2.5 percent, Anant Raj rose 2.3 percent, and DLF climbed 1 percent.

Road construction: Shares of road construction companies fell after the government announced unchanged capital expenditure for highways in the first full budget. NCC fell 6 percent, IRB Infra lost 2 percent, PNC Infratech fell 3.7 percent, Dilip Buildcon declined 4 percent, and MEP Infrastructure dropped 2 percent.

Capital Goods: Capital goods stocks fell after the FY25 revised capex for FY2025 was reduced to Rs 10.18 lakh crore during the Union Budget 2025-26. Stocks of major capital goods stocks fell nearly 2 percent. The finance minister also announced the removal of 7 tariff rates in order to promote exports. After this there will be only 8 remaining tariff rates including zero rates. Additionally, investment index friendliness of states will be launched in 2025.