POST-MARKET REPORT

Indian markets experienced a sharp decline on February 10, shedding over 0.7 percent, in line with losses across most Asian markets. Investor sentiment remained cautious following US President Donald Trump’s commitment to imposing tariffs on imports.

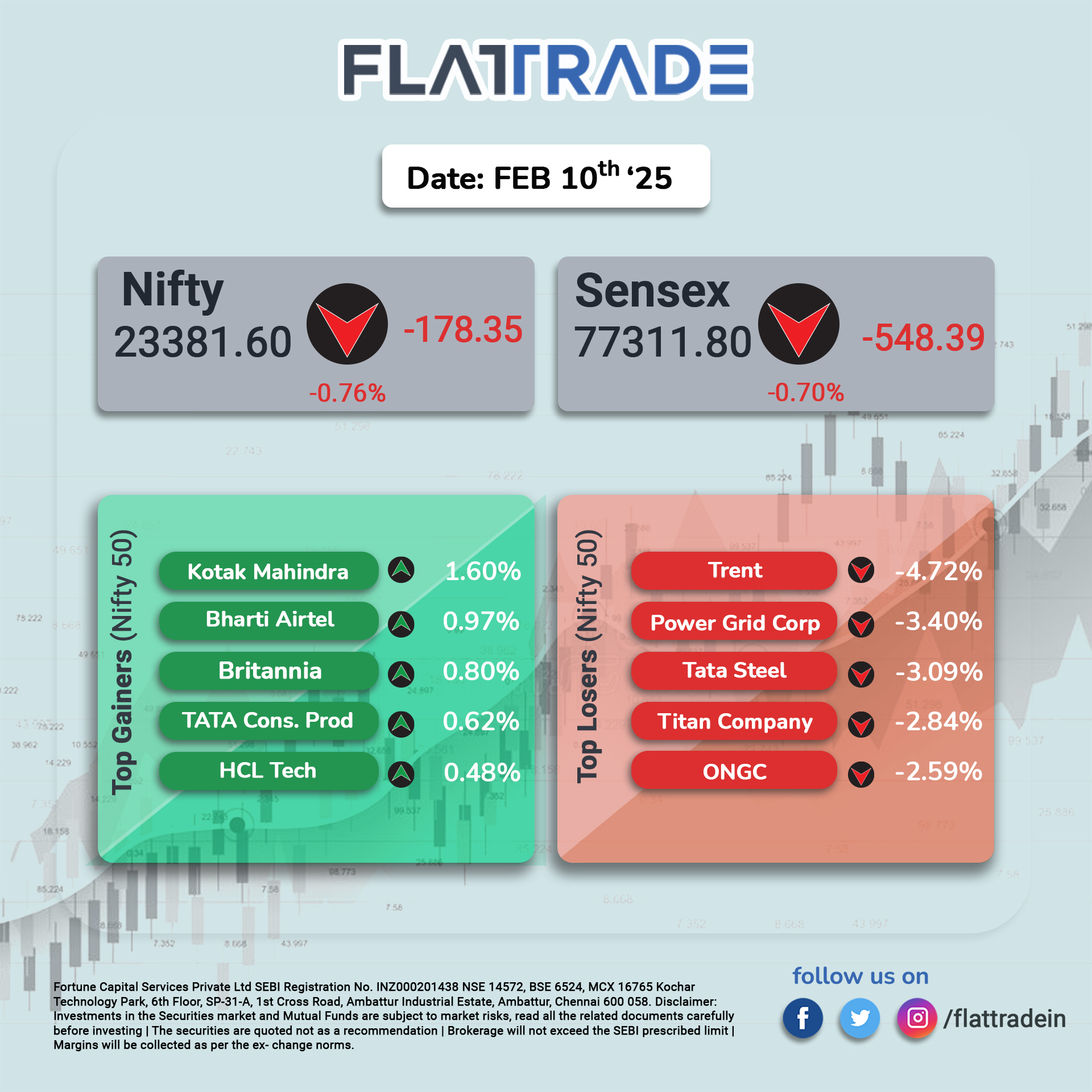

At closing, the benchmark Sensex dropped 0.7 percent, or 548 points, settling at 77,311.80, while the Nifty50 index declined by 0.76 percent, or 178.35 points, to 23,381.60.

The day’s top gainers in the Nifty index included Kotak Mahindra Bank (up 1.60%), Bharti Airtel (up 0.97%), Britannia Industries (up 0.80%), Tata Consumer (up 0.62%), and HCL Technologies (up 0.48%).

The top losers were Trent (down 4.72%), Power Grid Corporation of India (down 3.40%), Tata Steel (down 3.09%), Titan Company (down 2.84%), and Oil & Natural Gas Corporation (down 2.59%).

All the sectoral indices ended in the red with metal, media, pharma, consumer durables, energy, and realty down 2 percent each.

Considering the Broader indices, Nifty Midcap 50 closed down by 2.26%. Similarly, small-cap stocks also lagged, as the Nifty Small Cap 100 ended at 17,006.85, down by 358.15 points, reflecting a decrease of 2.11%.

The Rupee settles flat at 87.50 against the USD after inching close to the 88-level in the intra-day trade.

STOCKS TODAY

Mazagon Dock Shipbuilders: shares rose 9.4 percent to Rs 2,440 on February 10, for the second consecutive trading session following the company’s strong third-quarter earnings. It recorded a 29 percent rise in consolidated net profit at Rs 807 crore, up from Rs 627 crore in the same quarter last year.

Bharat Electronics Ltd. (BEL): shares reflected gains close to a percent on February 10 after bagging various orders. The orders are worth Rs 962 crore, including a Rs 610 crore contract to supply an Electro-Optic Fire Control System (EOFCS) to the Indian Navy.

Mahanagar Telephone Nigam Limited (MTNL): The company gained 9 percent to Rs 57.50 in morning trade on February 10. This comes after reports of the Union Cabinet having approved a Rs 6,000 crore financial package to fast-track the 4G network expansion of Bharat Sanchar Nigam Limited (BSNL) and its subsidiary, MTNL.

Mahindra & Mahindra: shares gained about 2 percent, trading at Rs 3,244.10 on the NSE. It delivered strong Q3 earnings that stood as the primary reason behind the share gains. The company also affirmed a robust demand for its sport utility vehicles and tractors which continues to drive positive investor sentiment.

Tilaknagar Industries: shares plunged 20 percent, hitting the lower circuit at Rs 293.40 apiece on February 10. This was mostly triggered by the Bombay High Court’s dismissal of the company’s plea against other firms using its trademark brand names ‘Mansion House’ and ‘Savoy Club’ on their product, on February 7.

Sun TV Network: shares fell beyond 7 percent on February 10, mostly due to the company’s disappointing quarterly earnings reflecting margin pressure and lower advertising revenue. The South India-based broadcaster reported a 20 percent on-year decline in net profit at Rs 363 crore while revenue from operations also fell 10.4 percent to Rs 827.6 crore.