POST-MARKET REPORT

The Indian equity indices extended the fall on the sixth consecutive session on February 12 as the market failed to build on the mid-session sharp recovery from the day’s low, and ended marginally lower as investors remained worried over a global trade war and US inflation print later tonight.

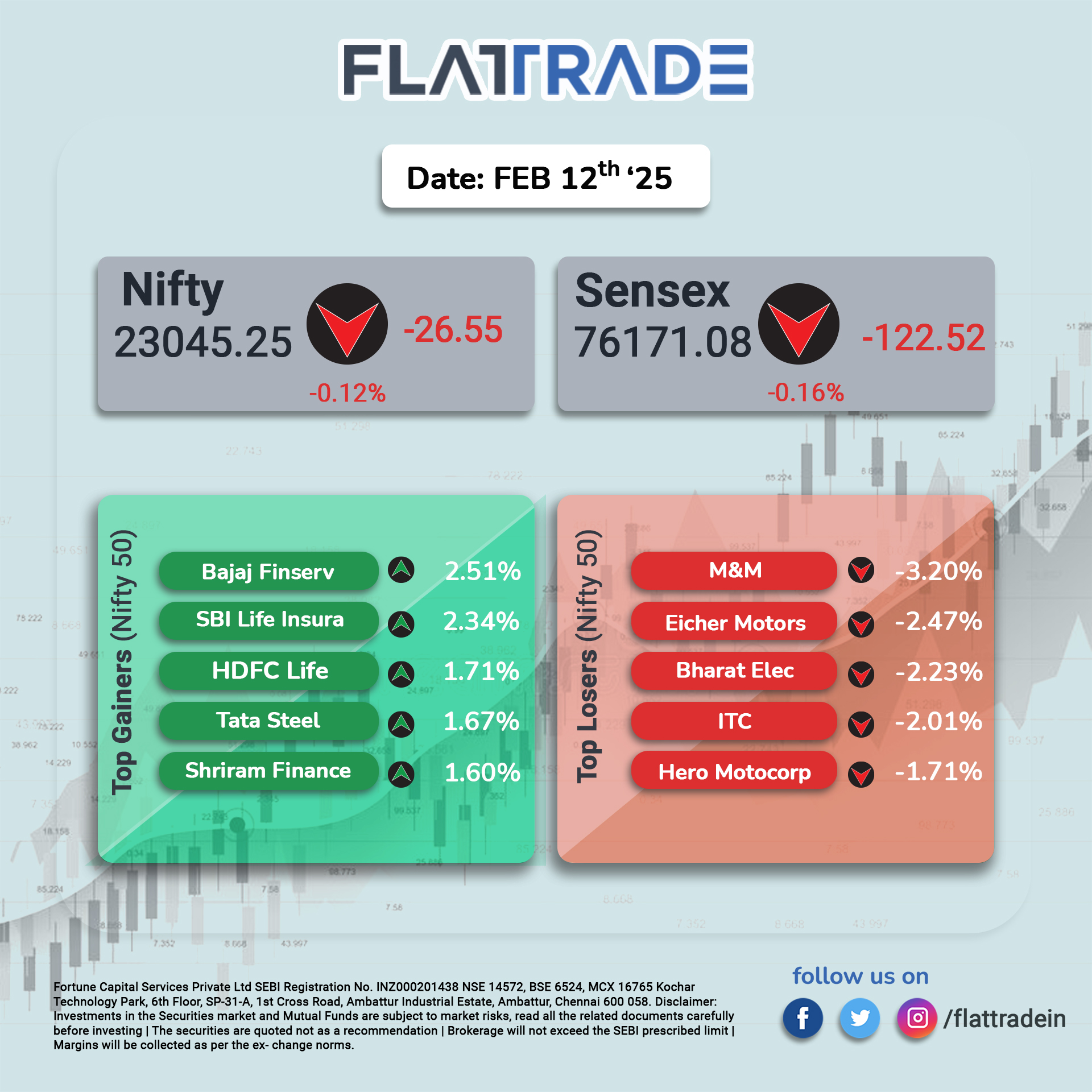

At close, the Sensex was down 122.52 points or 0.16 percent at 76,171.08, and the Nifty was down 26.55 points or 0.12 percent at 23,045.25.

M&M, Bharat Electronics, Eicher Motors, ITC, and Hero MotoCorp were among the major losers on the Nifty, while gainers were SBI Life Insurance, Bajaj Finserv, HDFC Life, Shriram Finance, and Tata Steel.

Among sectors, except PSU Bank and metal all other sectoral indices ended in the red with the realty index down nearly 3 percent.

Considering Broader markets, BSE Midcap and smallcap indices shed 0.5 percent each.

STOCKS TODAY

Graphite India: Shares of Graphite India tumbled as much as 13 percent to Rs 402 on February 12 after the company’s third-quarter earnings failed to meet investor expectations. The company reported a net loss of Rs 20 crore, a sharp reversal from the Rs 18 crore profit recorded in the same quarter last year, as revenue and profitability took a hit.

Gensol Engineering: Gensol Engineering reported a 6.1 percent decline in net profit for Q3, coming in at Rs 16.9 crore compared to Rs 18 crore in the same period last year. The drag on the bottom line was due to weakened operational performance as EBITDA margins contracted to 18.1 percent in Q3, down from 19.6 percent reported in the year-ago period. However, revenue saw a strong 30.5 percent growth, rising to Rs 344.5 crore from Rs 264 crore year-on-year.

Ashok Leyland: Ashok Leyland released its results for the third quarter (Q3) of the current financial year (FY25) on February 12. It reported revenue from operations at Rs 11,995 crore. This marks an increase of over 8 percent from the Rs 11,066 crore revenue from operations reported in the corresponding quarter of the previous financial year. The company shares jumped nearly 6 percent today.

Bajaj Healthcare: The pharmaceutical company recorded profits in Q3 FY25, reaching a figure of Rs 11.7 crore as compared to a net loss of Rs 2.2 crore in the corresponding quarter of last fiscal. Meanwhile, its revenue from operations rose to Rs 122.8 crore, marking a gain of 13.1 percent on a year-over-year basis. Last year, the third quarter saw the company’s revenue from operations at Rs 108.6 crore. The uptrend this quarter was said to be a result of higher demand for its active pharmaceutical ingredients (APIs) and bulk drugs.

Kirloskar Oil: Kirloskar Oil’s December quarter result showed a 21 percent decline in net profit at Rs 71.3 crore against Rs 89.82 crore in the previous year’s corresponding quarter. Q3FY25 revenue rose by 4.5 percent to Rs 1,453.7 crore over Rs 1,391.3 crore seen in the third quarter a year ago. Shares are down as much as 10 percent today