POST-MARKET REPORT

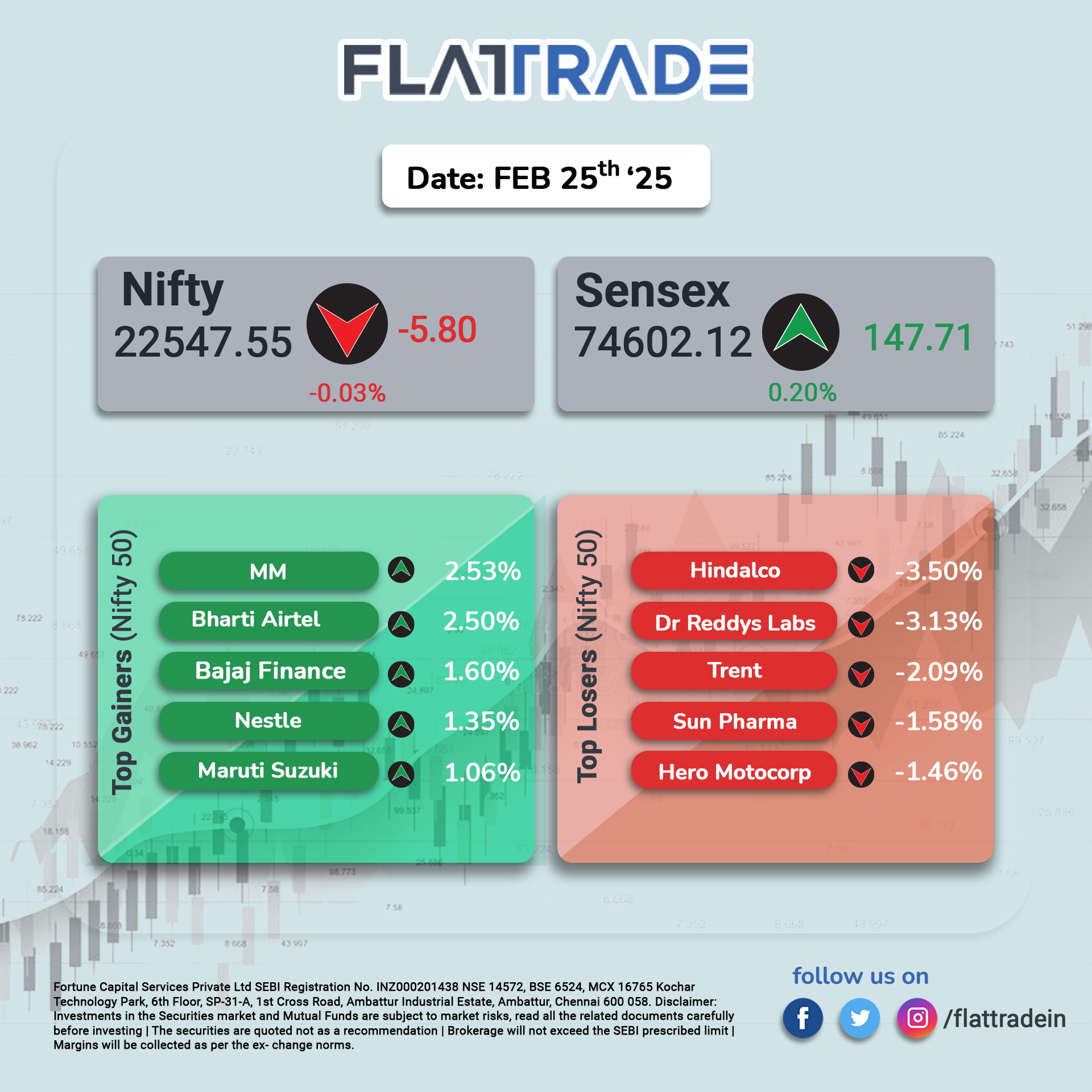

Benchmark indices ended off highs after the selloff extended in late trade, to end little changed on February 25 during a volatile session. At close, Sensex was up 147.71 points or 0.20 percent at 74,602.12. After the fall, Nifty 50 has closed lower for the sixth session in a row.

M&M, Bharti Airtel, Bajaj Finance, Maruti Suzuki, and Nestle were among the major gainers on the Nifty, while losers included Hindalco, Dr Reddy’s Labs, Sun Pharma, Hero MotoCorp, and Trent.

On the sectoral front, IT, metal, oil & gas, energy, capital goods, PSU bank, and realty shed 0.5-1 percent, while auto, consumer durables, FMCG, and telecom rose 0.5 percent each.

Considering Broader market indices, the BSE Mid and the Smallcap indices fell 0.5 percent each.

STOCKS TODAY

Nestle India: Shares of Nestle India gained over a percent in early trading on February 25 after Suresh Narayanan, the managing director said that the company will consider raising prices by a small margin to offset costlier coffee, cocoa, and edible oil prices. “Price increases are not the salvation for the industry because it impacts volume growth,” Nestle India MD said.

Bharti Airtel: The company shares snapped their six-day losing streak to gain 3 percent in the February 25 trading session on partnership with Ericsson to drive the company’s 5G transition. Bharti Airtel informed the shareholders through an exchange filing on its new collaboration to deploy Ericsson’s 5G Core solutions to support Airtel’s transition to 5G Standalone.

Thangamayil Jewellery: The company shares hit the upper circuit limit in the February 25 trade, tracking optimism over the company’s business growth after it informed the exchanges of earning Rs 16 crore opening-day sales at its news Chennai showroom. The gold jewellery store chain posted standalone net sales of Rs 1132.46 crore for the December quarter, higher by 26 percent on the year.

Adani Wilmar: Adani Wilmar secured a majority approval from its shareholders to change the name of the company to AWL Agri Business Limited. “Since 99.99% of the total votes polled are in favour of the above-mentioned resolution, the said resolution is duly passed as a Special Resolution as mentioned in the notice dated 15th January 2025 with requisite majority,” billionaire Gautam Adani’s group said in an exchange filing on February 25.

Shriram Finance: Shares of Shriram Finance gained about a percent on February 25 after Jefferies recommended a ‘Buy’ on the shares with a target price of Rs 710/share. The company has seen a 20 percent fall in its stock performance from the recent peak on concerns over sluggish commercial vehicle (CV) sales and rising asset quality risks. The increase in freight rates since December has provided some support for the business.