POST MARKET REPORT

The Indian benchmark indices, Sensex and Nifty, ended on a positive note with Nifty above 24,400. Despite the three-session gaining streak for the headline indices, market experts continue to advise caution.

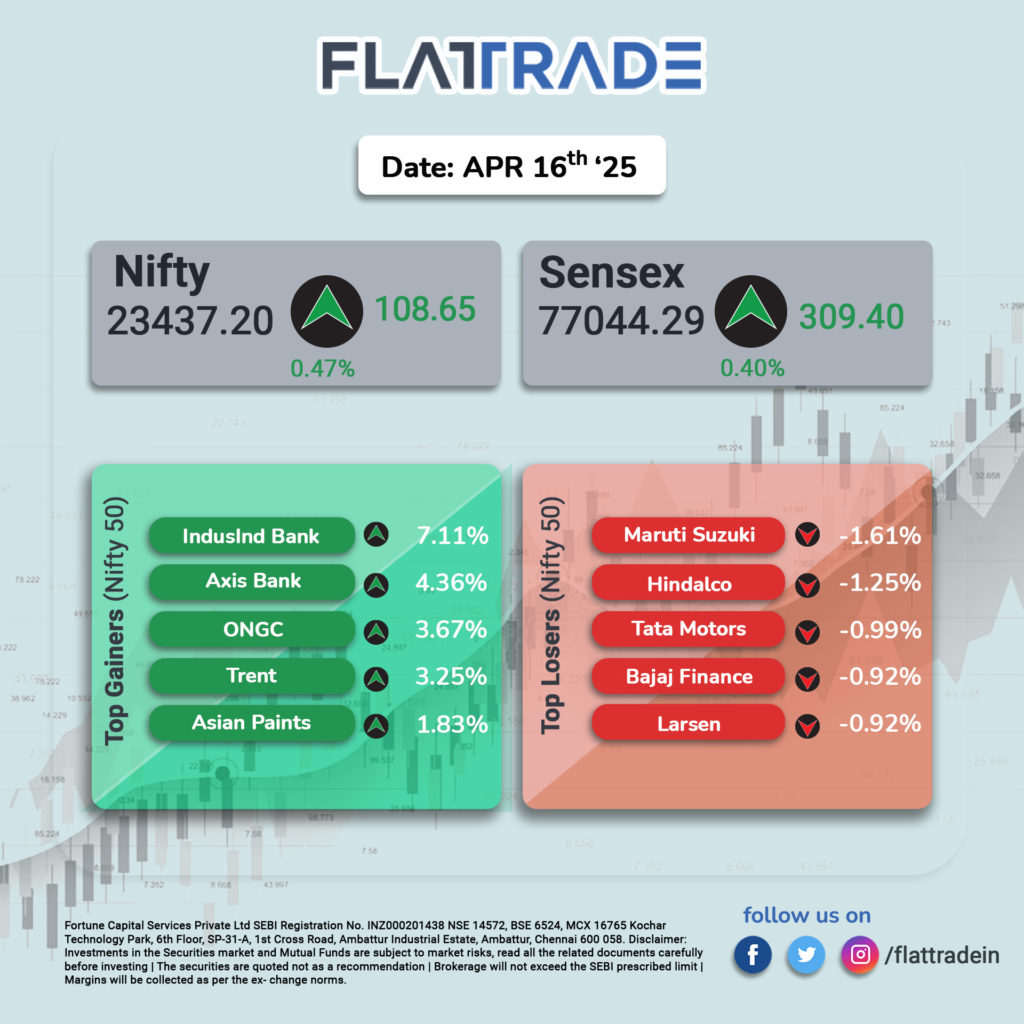

At close, the Sensex was up 309.40 points or 0.40 percent at 77,044.29, and the Nifty was up 108.65 points or 0.47 percent at 23,437.20. About 2561 shares advanced, 1244 shares declined, and 129 shares remained unchanged.

IndusInd Bank, Axis Bank, Trent, ONGC, and Asian Paints were among the major gainers on the Nifty, while losers were Maruti Suzuki, Hindalco, Bajaj Finance, L&T, and Tata Motors.

Among sectors, except auto, IT, pharma, all other indices ended in the green with media, PSU Bank, oil & gas up 1-2 percent.

Broader indices ended higher with the BSE Midcap index rising 0.5 percent and the smallcap index increasing nearly 1 percent.

STOCKS TODAY

ABB India

The shares of the company are up 3 percent today, after the domestic brokerage Motilal Oswal reiterated its ‘buy’ recommendation on the shares, with a target price of Rs 6,700 per share. The stock has recently experienced a correction, falling 38% over the past six months, reflecting this temporary period of weakness.

ICICI Bank

The bank’s shares traded flat on the April 16 trading session after the bank said it has cut its savings account deposit interest rate by 0.25 percent. The second largest private sector bank’s move comes days after larger rival HDFC Bank announced a similar move amid a spate of cuts in deposit offerings following RBI’s two back-to-back rate decreases.

ICICI Prudential

The asset management company’s shares increased by over 4 percent, following a mixed set of numbers by the life insurer in its March quarter results, extending the momentum seen in the previous trading session. Retail protection saw a sharp 25% jump, and key metrics like persistency, claim settlement, and solvency remained robust

Landmark cars

The shares of the company increased around three percent, after the firm shared a positive business update for the three months ended March, with revenue increasing over 21%. In the past 12 months, shares have dropped by 44 percent, whereas the benchmark Nifty 50 index has risen by approximately five percent over the same period.

IREDA

The shares of Indian Renewable Energy Development Agency (IREDA) increased by over 7 percent after reporting a robust set of numbers for the quarter ended March 2025. The state-run green energy financier posted a sharp 49 percent year-on-year jump in net profit for the March quarter of FY25. The PSU reported a profit of Rs 501.55 crore for the fourth quarter, up from Rs 337.39 crore a year ago, boosted by strong growth in its core lending operations.

Source – Money Control

Disclaimer: Investments in the Securities market and Mutual Funds are subject to market risks. Read all the related documents carefully before investing | The securities are quoted as an example and not as a recommendation | Brokerage will not exceed the SEBI-prescribed limit | Margins will be collected as per the exchange norms.