POST MARKET REPORT

Indian benchmark indices Nifty and Sensex extended their winning streak to a fifth consecutive session on April 21, after strong Q4 earnings from major lenders like ICICI Bank and HDFC Bank gave investors a significant momentum boost. The rally has also been fuelled by sustained foreign inflows, with FIIs remaining net buyers for the past three trading sessions.

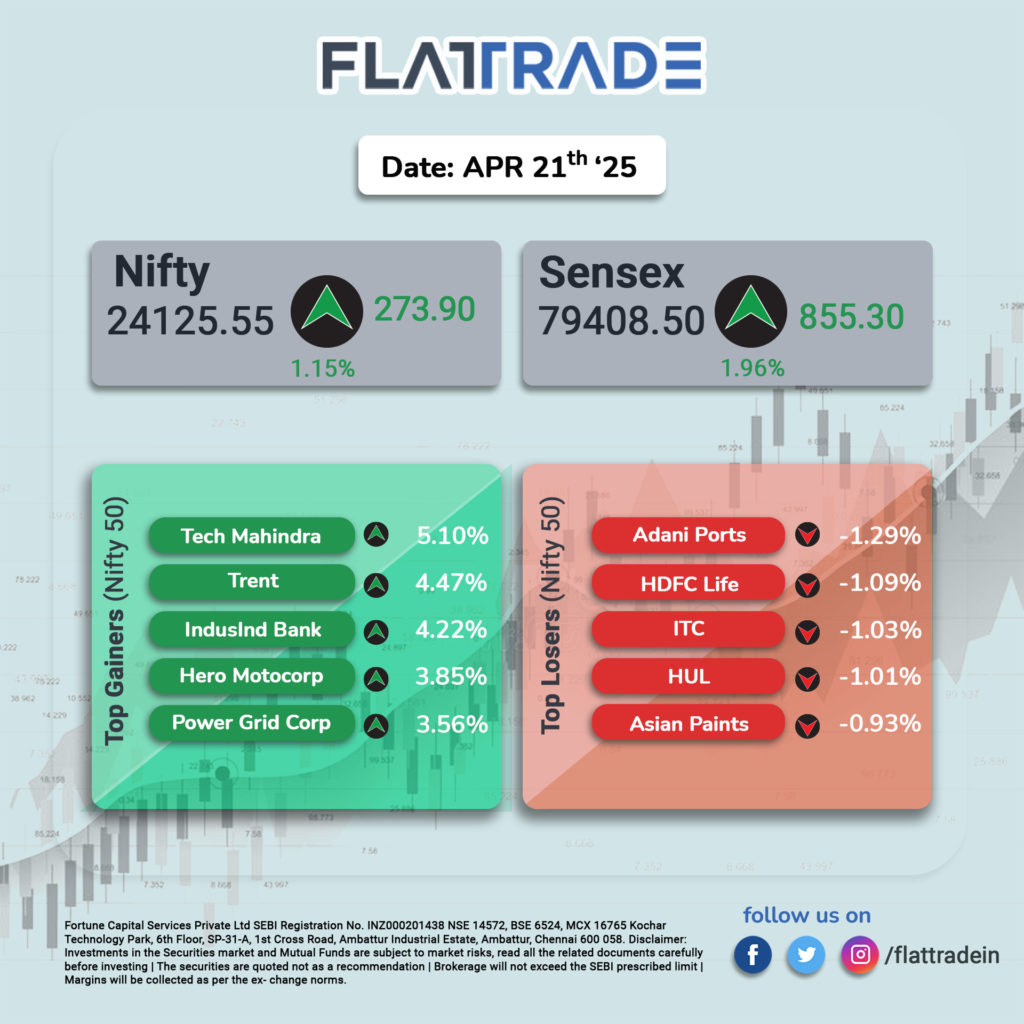

At close, the Sensex was up 855.30 points or 1.09 percent at 79,408.50, and the Nifty was up 273.90 points or 1.15 percent at 24,125.55. About 2829 shares advanced, 1093 shares declined, and 149 shares remained unchanged.

Tech Mahindra, Trent, IndusInd Bank, Hero Motocorp, and Powergrid Corp were among the major gainers on the Nifty, while losers included Adani Ports, HDFC Life, ITC, HUL, and Asian Paints.

On the sectoral front, Nifty Bank stole the spotlight, hitting a record high of 55,461 following robust results from ICICI Bank, HDFC Bank, and Yes Bank. Nifty IT, Nifty Auto, and Nifty Realty increased, whereas Nifty FMCG slipped nearly a percent.

Broader indices outperformed frontlined indices with Nifty Midcap 100 and Smallcap 100 rising 2.5 and 2.2 percent, respectively.

STOCKS TODAY

Just Dial

The company’s share price went up around 13 percent on April 21. This is after the company released its quarterly results on Friday after market hours, so after the market opened on Monday, the share price went up. The company reported a 61 percent year-on-year increase in net profit for FY25 to Rs 584.2 crore.

Yes Bank

Shares of the bank rose 5%, as the Mumbai-based private lender reported a 63% increase in net profit in the March quarter on lower provisions. The lender’s standalone net profit rose to Rs 738 crore for the financial year fourth quarter from Rs 452 crore in the same period a year earlier.

Eternal

Formerly known as Zomato, the company has proposed to implement a limit on total foreign ownership of 49.5 percent in the firm’s equity share capital. Over the past 12 months, shares of the company have given investors returns of around 11 percent.

Muthoot Finance

Shares of the NBFC increased over 4% on April 21 with Rs 2,206 per share, after the firm announced an interim dividend of Rs 26 per share for FY25. The 52-week high of the stock is Rs 2,435, and the 52-week low is Rs 1,509. The market capitalisation of the stock is Rs 88,560 crore. The firm’s board recommended raising borrowing power to up to Rs 2 lakh crore.

Adani Ports

APSEZ shares faced their most significant decline in two weeks, dropping 4.3% to ₹1,337.65 on April 21, 2025. This is after announcing that it will buy an Australian deep-water coal export facility for an enterprise value of about A$3.98 billion ($2.54 billion), as it aims to grow its global presence. The acquisition involves issuing 143.8 million shares to the Adani family’s Carmichael Rail and Port Singapore Holdings. Investors are cautious due to the deal’s size and related liabilities.

IGIL

International Gemmological Institute Limited (IGIL) shares increased 5 percent on Monday after the Blackstone-backed company posted a 12 percent jump in consolidated net profit at Rs 141 crore for the first quarter of the calendar year 2025, on the back of higher income and revenues. The company, in a statement, said it had clocked a net profit of Rs 126 crore in the year-ago period. The company reported a total revenue of Rs 305 crore for Q1 CY2025, a 10 percent jump from the previous year of Rs 278 crore.

Source – Money Control

Disclaimer: Investments in the Securities market and Mutual Funds are subject to market risks. Read all the related documents carefully before investing | The securities are quoted as an example and not as a recommendation | Brokerage will not exceed the SEBI-prescribed limit | Margins will be collected as per the exchange norms.