POST MARKET REPORT

Indian benchmark indices Nifty and Sensex extended their rally for the sixth consecutive session on April 22, albeit on a more muted note compared to the bumper gains recorded during this winning streak.

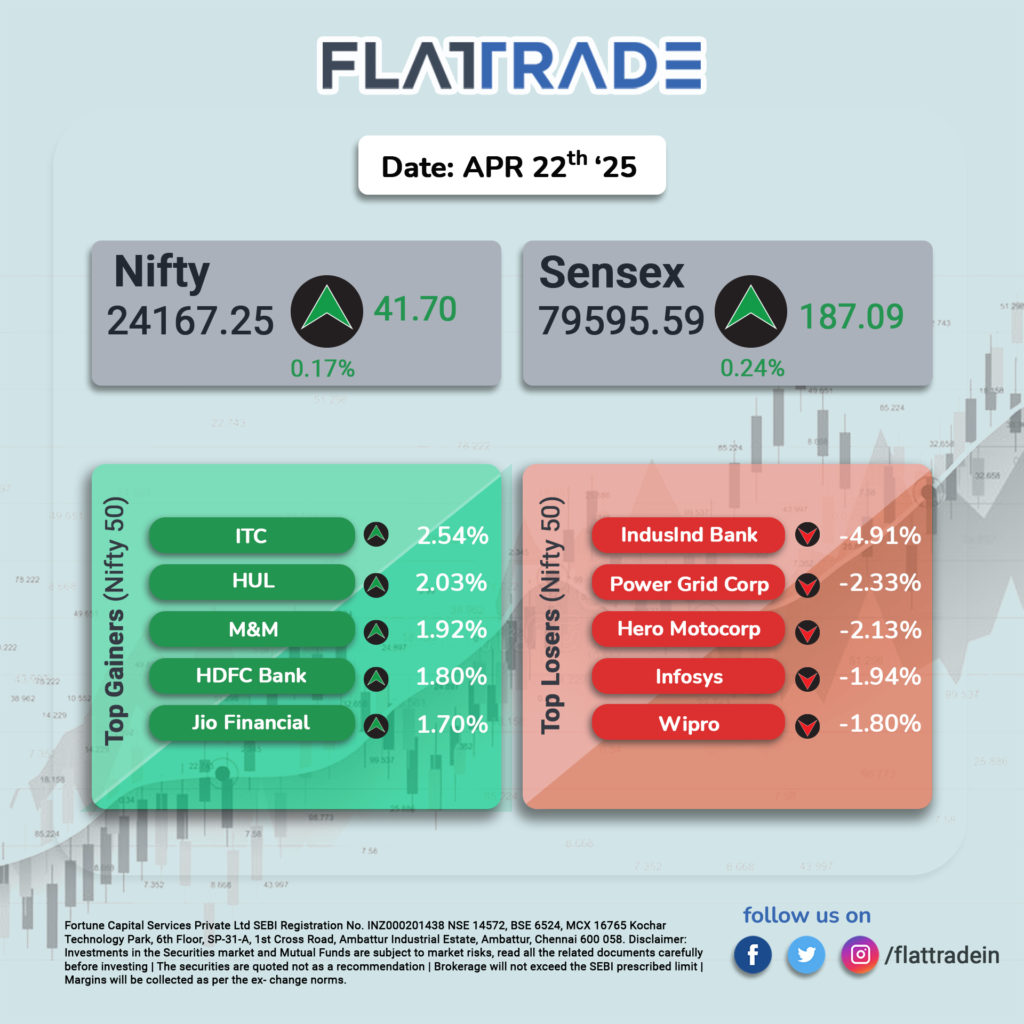

At close, the Sensex was up 187.09 points or 0.24 percent at 79,595.59, and the Nifty was up 41.70 points or 0.17 percent at 24,167.25. About 2389 shares advanced, 1453 shares declined, and 137 shares remained unchanged.

ITC, HUL, M&M, HDFC Bank, and Jio Financial were among the major gainers on the Nifty, while losers included IndusInd Bank, Hero Motocorp, Powergrid Corp, Infosys, Wipro, and Bharti Airtel

Among sectors, most of them ended in green with financial and metal stocks leading the market rally, while telecom, infrastructure, power, and IT ended in red.

The broader markets performed well, the Nifty Midcap 100 and Nifty Smallcap 100 indices gained 0.8 percent each, as investors continued to hunt for bargains among the beaten-down counters.

STOCKS TODAY

Waree Energies

The share price of the company has surged 7.56 percent to an intraday high of Rs 2,629 per share on the NSE. The counter opened gap-up with a gain of 3.1 percent in today’s trading session. It has been on an upward trend for the last 8 trading sessions and is up 25 percent in the period. This increase is due to the United States imposing substantial anti-dumping duties on solar imports from Southeast Asian countries.

Cholamandalam Investment & Finance

Hong Kong-based brokerage CLSA revised its rating from ‘buy’ to ‘hold’ on Cholamandalam Investment & Finance, citing inflated valuations. This has led to a 3 percent decrease in the share price.

Mahindra Logistics

Shares of the company are trading higher by 4 percent on April 22 on posting a narrower loss for the March quarter due to steady gains in its mainstay, the contract logistics business, and an improved performance from Rivigo, the express commerce unit. The company continues to face stiff competition in India’s $342 billion logistics sector, with rivals like Blue Dart and Delhivery aggressively investing to gain market share.

HDFC Bank

The shares of the company increased by around 2 percent on April 22, after the company achieved the Rs 15 lakh crore milestone, thus becoming the third Indian company to hit the level. Only Reliance Industries and Tata Consultancy Services have achieved this milestone before HDFC Bank.

Nestle

The largest FMCG, Nestle India will showcase its earnings report for the fourth quarter of the previous fiscal year on April 24, 2025. For the quarter gone by, margins are likely to be under stress from high coffee and cocoa prices. Weak operational performance is also expected to drag the company’s net profit. Due to such reasons profits are likely to sink upto 6 percent.

Source – Money Control

Disclaimer: Investments in the Securities market and Mutual Funds are subject to market risks. Read all the related documents carefully before investing | The securities are quoted as an example and not as a recommendation | Brokerage will not exceed the SEBI-prescribed limit | Margins will be collected as per the exchange norms.